A latest JPMorgan report signifies that Coinbase would possibly unlock $34 billion by way of its Layer 2 community, Base, pushed by steady person progress and upcoming token initiatives because it advances towards extra on-chain monetization.

The report was launched on Friday, simply over a month after Base’s creator, Jesse Pollak, said that the staff is “starting to discover” launching a local token, albeit noting that there are “no definitive plans.”

Whereas the implications of such a transfer are nonetheless unsure, JPMorgan’s Base token valuation underscores simply how robust Wall Avenue’s confidence in Coinbase’s on-chain technique has turn into.

Moreover, it highlights the numerous potential for different cryptocurrencies to determine substantial valuations as market liquidity grows. So, with that in thoughts, what are the most effective altcoins to purchase now?

Base Token to $34 Billion, Says JPMorgan

JPMorgan analysts famous that the Base token might assist Coinbase seize worth from the expansion of the Layer 2 community. The Wall Avenue financial institution estimates that Base might attain a market capitalization between $12 billion and $34 billion, with the venture’s staff prone to management round 40% of the tokens.

This implies Coinbase might maintain roughly between $3 billion and $11 billion in tokens, creating a robust incentive to launch. However extra importantly, it suggests there might be as much as $23 billion in new liquidity for Base customers, assuming remaining tokens are airdropped to community contributors.

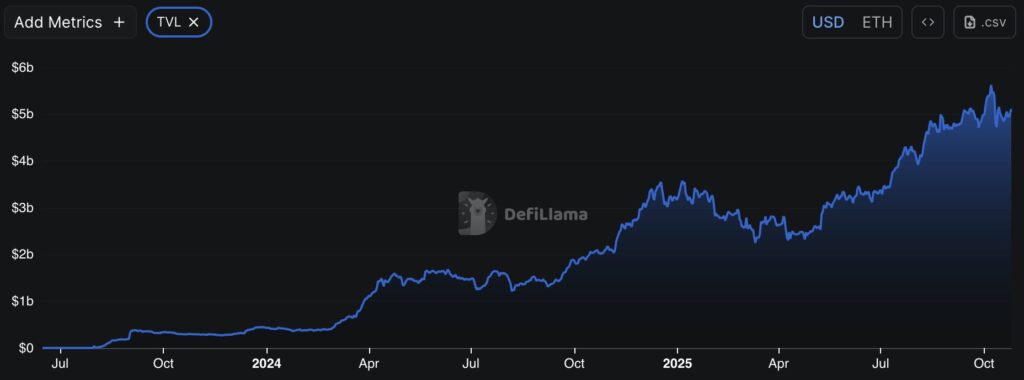

JPMorgan means that this initiative would possibly improve improvement, enhance neighborhood involvement, and foster long-term infrastructure growth. This comes after a gradual rise in Base’s on-chain exercise, with DeFiLlama information exhibiting over a 2x improve in its DeFi TVL over the previous 12 months.

Moreover, the agency upgraded Coinbase’s ranking and elevated its December 2026 share value goal to $404, highlighting “rising monetization alternatives and lowering dangers” as the corporate advances extra into its Layer 2 ecosystem and stablecoin methods.

In the end, nevertheless, the 2 key takeaways from JPMorgan’s report are:

- On-chain Base customers might doubtlessly see a multi-billion-dollar airdrop.

- The financial institution believes blockchain infrastructure tokens maintain vital worth.

With this in thoughts, let’s discover some altcoins which may profit from this information.

Bitcoin Hyper

JPMorgan’s prediction is a major bullish indicator for Bitcoin Hyper, the world’s first ZK-rollup-powered Bitcoin Layer 2 blockchain. The venture is constructed on the Solana Digital Machine (SVM), inheriting Solana-grade speeds, charges, and sensible contract assist.

Its utilization of ZK-rollups means it bundles transactions and periodically studies its state again to the Bitcoin L1, thereby inheriting Bitcoin-level safety.

The ultimate piece of the puzzle is Bitcoin Hyper’s Trustless canonical bridge, which permits customers to seamlessly and securely switch BTC to and from the L2. This paves the best way for BTC liquidity flows, doubtlessly serving to gasoline community progress.

Bitcoin is price 4.6 occasions greater than Ethereum, indicating vital potential for a venture like Bitcoin Hyper, which successfully performs what Base is doing, however on Bitcoin.

At present, Bitcoin Hyper is in a presale, having raised $24.7 million to date, clearly exhibiting that whales are betting huge, whereas additionally leaving large upside potential given the $34 billion forecast for the Base token. Go to Bitcoin Hyper.

Toshi

Assuming the Base token is airdropped to community customers, this could mark a major wealth-creation occasion for the neighborhood, seemingly triggering an on-chain ‘Base Season.’ On this state of affairs, many airdrop winners would rotate their Base tokens into smaller-cap Base tasks in pursuit of bigger features.

As this happens and costs start to climb, it might appeal to extra consideration to the ecosystem and in the end draw in additional liquidity. So, what crypto might carry out finest on this state of affairs?

One potential choice is Toshi, a meme coin that just lately overtook Brett to turn into the main token on the Base community. Not like Brett, Toshi is listed on Coinbase, which supplies a serious benefit.

Toshi is a cat-themed meme coin that manufacturers itself as “the face of Base.” It introduces varied ecosystem options, together with NFTs, merchandise, and neighborhood artwork. Moreover, its value has demonstrated notable energy at present, rising 5%, which reaffirms neighborhood curiosity.

Maxi Doge

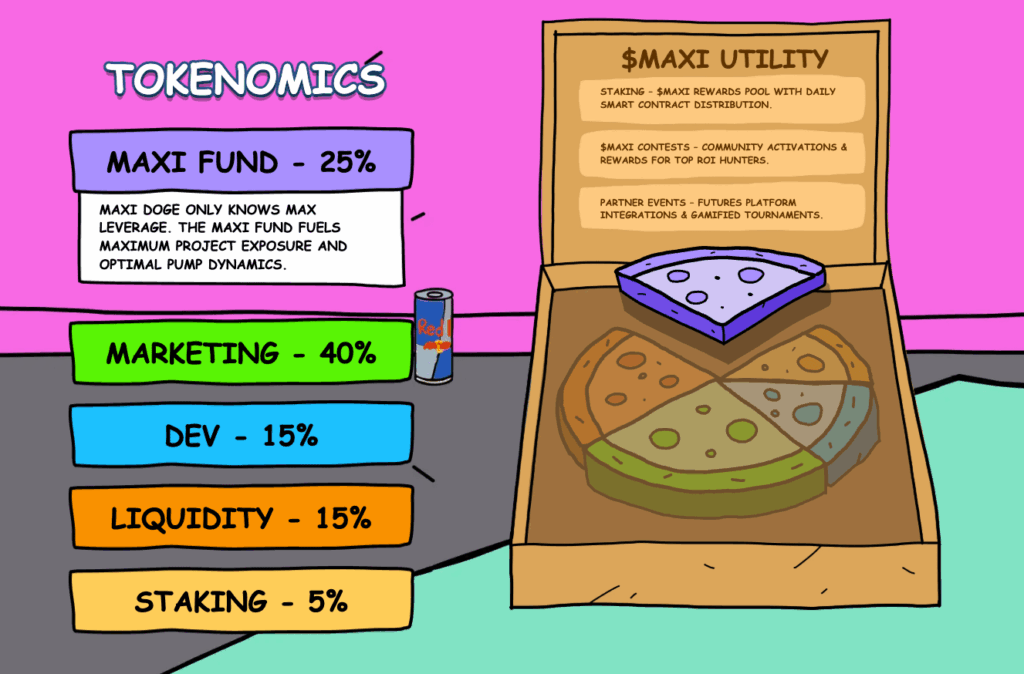

Maxi Doge is a Dogecoin-themed meme coin with futures buying and selling utility. The venture is constructed on the Ethereum community, indicating it’ll trip the rising tide of Base and the broader Ethereum ecosystem.

The venture’s mascot is portrayed as Dogecoin’s youthful cousin – a bodybuilding crypto bro who trades with 1000x leverage and no cease loss. It goals to seize the degen spirit that has more and more permeated meme tradition lately – and it doesn’t cease with simply branding.

Maxi Doge plans to combine the MAXI token into futures buying and selling platforms, permitting customers to commerce it with as much as 1000x leverage. It is going to additionally run weekly commerce competitions with USDT and MAXI rewards up for grabs.

These futures utilities supply a brand new perspective past the standard meme coin playbook, and that is attracting investor consideration. That’s evident in its presale success, with over $3.7 million raised to date.

Nonetheless, this presale nonetheless leaves vital room for progress, as many meme cash are price lots of of hundreds of thousands, if not billions of {dollars}. Go to Maxi Doge.

OriginTrail

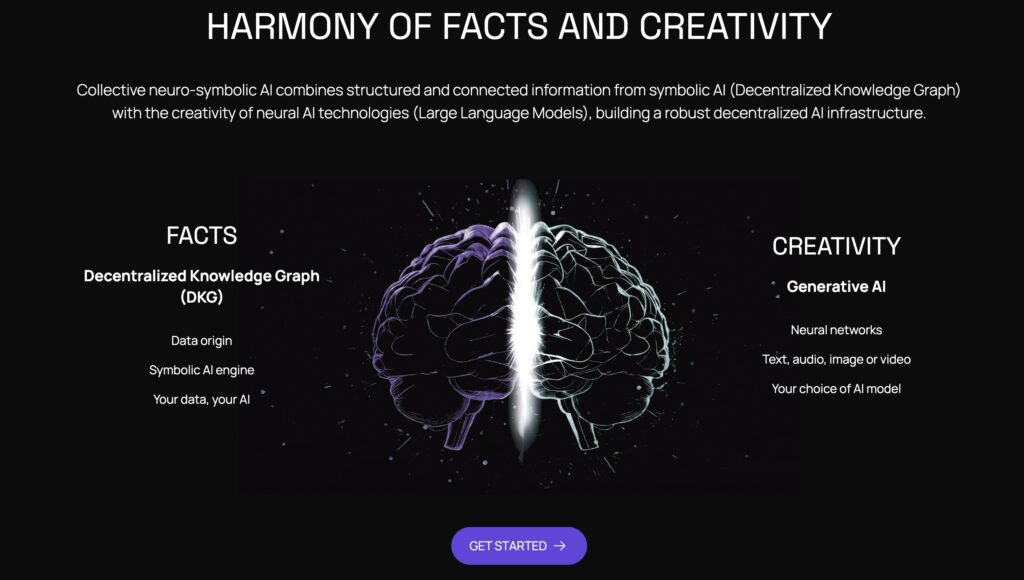

OriginTrail reveals precisely why the Base community is fashionable – actual innovation colliding with scalable infrastructure. The venture is constructing a decentralized AI infrastructure that goals to seek out “the reality in data.”

AI isn’t going wherever – annually, language fashions get extra superior, and new kinds of generative AI seem. However the primary problem with generative AI is the place it will get its information and whether or not that information is dependable and truthful. For instance, how does AI decide the relative authority of conflicting data sources, and may we belief its judgment?

OriginTrail makes use of decentralized data graphs (DKGs) to construct a clear belief layer for AI, the place data will be verified, traced, and shared overtly throughout networks. It’s fixing one of many largest issues inside one of many hottest know-how fields – and it’s doing it on Base.

The venture’s native token TRAC has been on hearth recently, rising 8% at present, 30% this week, and 149% this month. This energy, forward of a possible $34 billion liquidity boon to the Base ecosystem, signifies vital potential for TRAC.