- Chainlink’s worth has fallen 35% since August however accumulation and fundamentals stay sturdy.

- Whale shopping for, ecosystem partnerships, and a bullish chart sample trace at a doable rebound.

- Strategic reserves exceed $10M and will develop previous $100M within the subsequent 12 months.

Chainlink hasn’t escaped the broader crypto market crash, tumbling over 35% from its August peak. As of October 24, LINK trades round $17.76, however apparently, a number of components level towards a doable rebound within the coming weeks. The venture appears to be quietly setting itself up for a comeback—by means of accumulation, technical setups, and ecosystem progress that might shock the market quickly.

Strategic LINK Reserves Climb Previous $10 Million

One of many strongest bullish drivers proper now’s Chainlink’s new Strategic LINK Reserves, launched in early August. The thought’s easy however highly effective: use all on-chain and off-chain income to steadily purchase and maintain LINK over time. Basically, the community is betting on itself—locking away tokens to enhance its tokenomics whereas making ready for future rallies.

In accordance with knowledge from Chainlink’s web site, builders purchased 63,480 LINK this week alone, bringing whole reserves to 585,641 LINK. At present costs, that’s roughly $10.4 million value. If this development continues, the community might simply surpass $100 million in LINK reserves over the following 12 months, relying in fact on market efficiency. It’s a gradual accumulation technique that indicators long-term confidence quite than short-term hypothesis.

Bullish Chart Patterns Kind Amid Downtrend

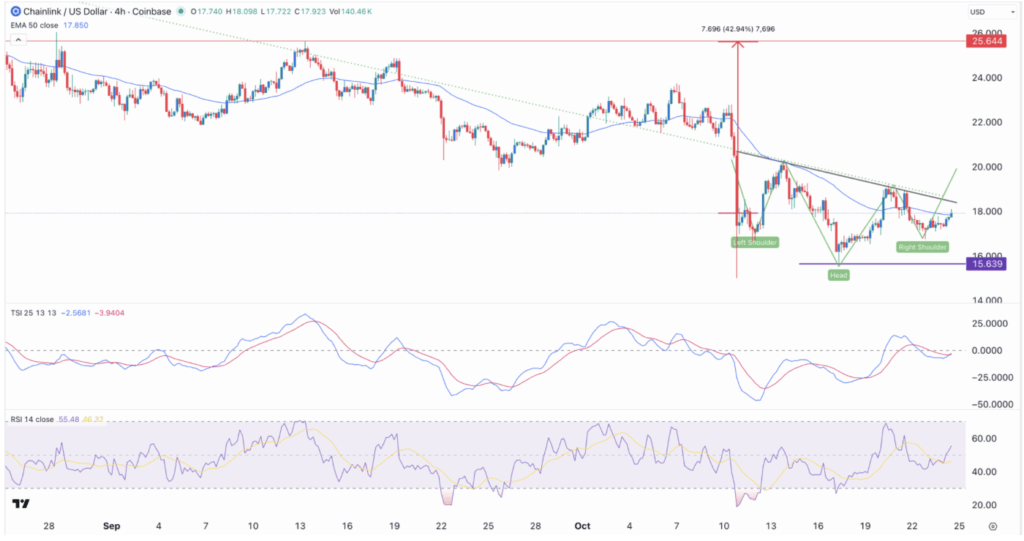

Technically talking, Chainlink’s chart may be hinting at a turnaround. On the 4-hour timeframe, LINK has shaped an inverse head-and-shoulders sample—one that always precedes a powerful upward breakout. The “head” rests round $15.63, whereas the neckline slopes upward by means of current swing highs from October 13 and 20.

On high of that, momentum indicators are beginning to lean bullish. The True Energy Index (TSI) climbed from -46 on October 11 again to impartial territory, whereas RSI has edged above 50. LINK has additionally managed to maneuver above its 25-period EMA, one other constructive signal. If bulls maintain momentum, a push towards $25—about 42% above present costs—might be on the horizon. Nonetheless, the bullish thesis would weaken if LINK falls under the $16 zone, which marks the precise shoulder of the sample.

Whale Exercise and Falling Change Reserves

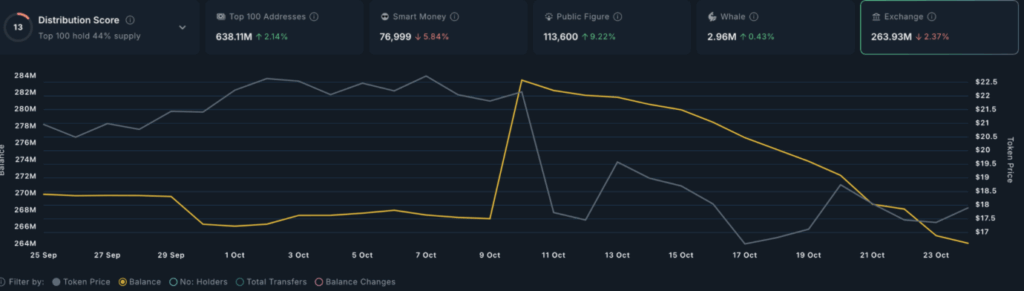

Whales appear to be making quiet strikes too. Knowledge from Nansen reveals that giant holders have been actively shopping for LINK all through October. Collectively, they now management over 2.96 million LINK, value about $52 million. Traditionally, this sort of accumulation from massive wallets typically indicators that good cash sees worth earlier than a wider rally.

This shopping for spree has additionally drained trade reserves. Complete LINK on exchanges has dropped from 284 million in September to 263 million—that means roughly 21 million tokens (round $357 million) have been withdrawn. When fewer tokens sit on exchanges, it normally factors to investor confidence and a decrease chance of mass promoting stress.

Ecosystem Development and ETF Hypothesis

Chainlink’s increasing partnerships add one other layer to the bullish narrative. The community was lately chosen by the US authorities because the oracle answer for shifting knowledge on-chain. It’s additionally collaborating with heavyweights like S&P World, which plans to make use of Chainlink tech for its Stablecoin Stability Assessments, in addition to established gamers comparable to Swift, JPMorgan, and Coinbase.

In the meantime, the SEC is reviewing proposals for each Grayscale and Bitwise LINK ETFs. If authorised, these funds might unlock institutional demand and produce recent liquidity into the market. Mixed with rising reserves and whale exercise, Chainlink’s setup seems like a sluggish burn—one that might flip explosive if sentiment flips.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.