- Ethereum is testing a serious resistance zone round $4,000–$4,100 after bouncing from $3,800 assist.

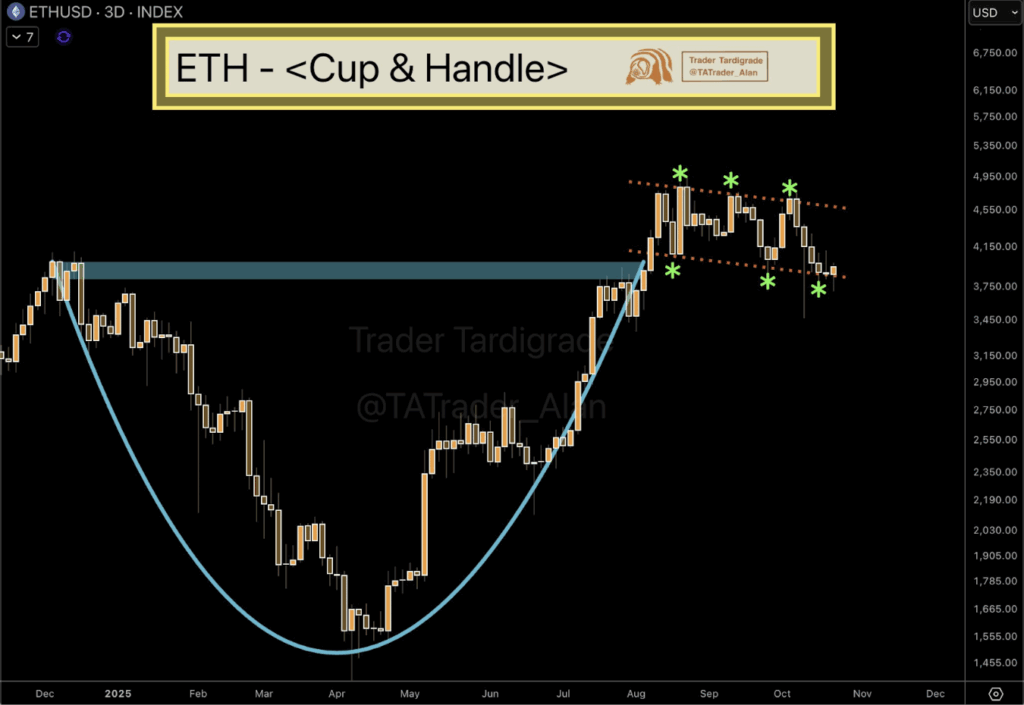

- Analysts spotlight a possible cup-and-handle sample, suggesting a breakout if ETH closes above $4,100 on quantity.

- Upcoming CPI information and the Fed assembly may act as catalysts for Ethereum’s subsequent transfer, both towards $4,250 or again to $3,800.

Ethereum’s holding regular close to $4,000, just below an important resistance zone that might resolve its subsequent huge transfer. After defending the $3,800 assist, the market’s now asking the identical query — will ETH lastly punch by means of overhead strain, or is one other rejection ready across the nook?

ETH Holds Floor Round $3,800

Ethereum has managed to claw its manner again from latest lows, presently hovering near the $4,000 mark. The token discovered sturdy footing between $3,790 and $3,815, a zone that’s acted like a springboard a number of instances this month. Beneath that, there’s one other sturdy base forming between $3,550 and $3,670, giving patrons some respiratory room if issues dip once more.

Analyst Ted famous that ETH has as soon as extra bounced cleanly from $3,800 and is now testing that robust $4,000–$4,100 resistance band. Traditionally, sellers have crowded this space, forcing costs again down. But when bulls handle to interrupt above it — and maintain — the subsequent logical goal sits close to $4,236–$4,265, a zone that’s flipped between assist and resistance greater than as soon as.

Proper now, ETH is just about range-bound. The path it takes from right here will rely on how the market reacts to this resistance ceiling. A robust push by means of may get up the bulls, whereas one other rejection would possibly drag the value proper again towards assist.

Technical Setup Suggests a Breakout Brewing

On the 3-day chart, Ethereum’s worth motion appears to be shaping right into a basic cup-and-handle sample — a formation that always hints at a much bigger breakout down the street. The “cup” developed slowly between January and August, marking an extended restoration part after final 12 months’s correction. Now, the “deal with” seems as a downward-sloping channel, tightening momentum earlier than a possible transfer.

Analyst Dealer Tardigrade identified that ETH has made three touches on each the higher and decrease bounds of this channel, forming what he calls a “managed construction.” If the token breaks out above the highest boundary on sturdy buying and selling quantity, it may verify a bullish continuation.

One other analyst, Joe Swanson, talked about a attainable triple backside close to $3,750, describing it as a launchpad setup that might result in a 10% rally towards $4,280 if $4,000 offers manner. In the meantime, EtherWizz sees the market in a Wyckoff-style reaccumulation part, with a daring projection — a path to $7,000 if Ethereum can reclaim the $4,200 stage convincingly.

Macro Occasions May Steer the Subsequent Transfer

There’s additionally the macro angle. The upcoming CPI information and the Federal Reserve’s assembly subsequent week may rattle markets a bit, including extra volatility into the combo. Ted talked about, “These occasions may convey some purchase strain in Ethereum and possibly set off a brief squeeze,” hinting that exterior catalysts would possibly resolve whether or not ETH can maintain momentum.

For now, most merchants are staying cautious. Analyst Lennaert Snyder stated he’s watching the $4,050 mark intently — probably shorting if resistance holds or leaping in lengthy if Ethereum pushes by means of decisively.

To this point, ETH’s taking part in a ready sport. The $4,000–$4,100 space is the battleground to observe. A breakout may mild the fuse towards increased ranges, however a rejection would possibly ship the token again down for yet one more retest of assist. Both manner, the subsequent few periods may resolve whether or not Ethereum’s subsequent chapter begins with fireworks — or frustration.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.