- Analysts warn Solana might drop to $160 as whales cut back holdings and momentum cools.

- Technicals present key assist at $160 close to the 200-day EMA.

- Regardless of near-term weak spot, analysts stay optimistic.

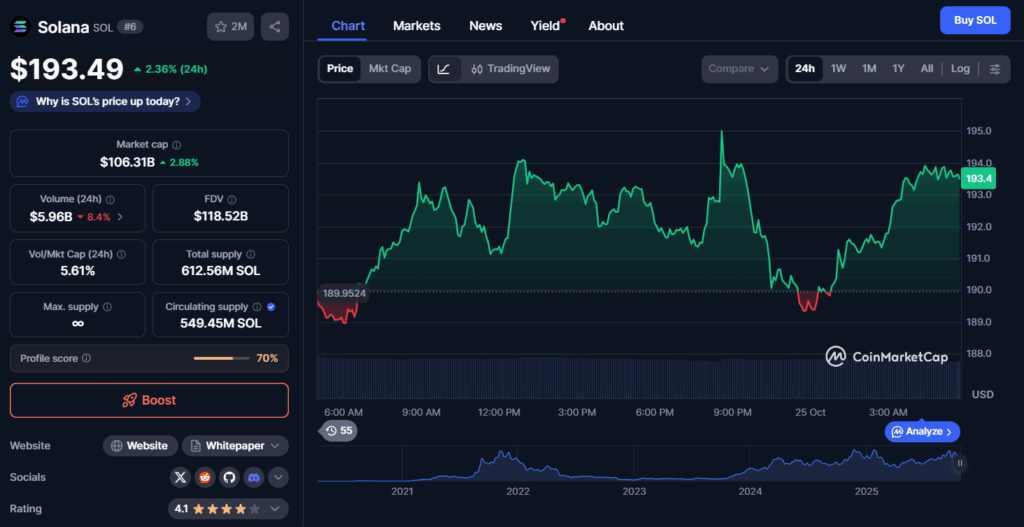

Solana’s current worth motion has merchants treading rigorously once more. After rebounding barely from $175, analysts now warn the community’s native token, SOL, might be headed for a retest of $160. On-chain metrics present massive holders are beginning to take earnings, with whale accumulation dropping off over the previous week. This sort of repositioning usually indicators a cooling pattern in bullish momentum, particularly when mixed with impartial readings throughout RSI and MACD indicators.

Key Assist Ranges and Technical Outlook

The $160 stage is now rising as a significant line within the sand for Solana’s short-term stability. It aligns intently with the token’s 200-day exponential shifting common (EMA), a zone that beforehand acted as a powerful bounce level throughout earlier corrections. If SOL loses grip on the $175 space, merchants warn a clear breakdown might set off one other leg all the way down to $160. For now, consumers seem hesitant, with institutional inflows slowing as funds diversify throughout different high-utility belongings.

Lengthy-Time period Outlook Nonetheless Intact

Regardless of near-term weak spot, analysts stay optimistic about Solana’s broader trajectory. The ecosystem continues to develop, and upcoming ETF-related developments might reignite investor curiosity. Most see this pullback as a pure breather after an prolonged rally slightly than a structural breakdown. If Solana manages to carry above $160, it might reestablish its bullish footing heading into the subsequent cycle of institutional accumulation.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.