- Over 50% of all Litecoin is now held by retail traders, signaling sturdy neighborhood possession.

- Community hash fee, MWEB utilization, and Layer 2 developments are driving development in 2025.

- Institutional curiosity from Luxxfolio, MEI Pharma, and T. Rowe Worth reinforces Litecoin’s standing as a secure long-term asset.

Litecoin is quietly changing into one in every of 2025’s most adopted cryptocurrencies, gaining traction amongst each informal customers and main establishments. Its attraction lies in its simplicity—quick transactions, low charges, and a decade-long fame for reliability. Because the market shifts towards real-world utility, Litecoin is displaying that endurance nonetheless issues.

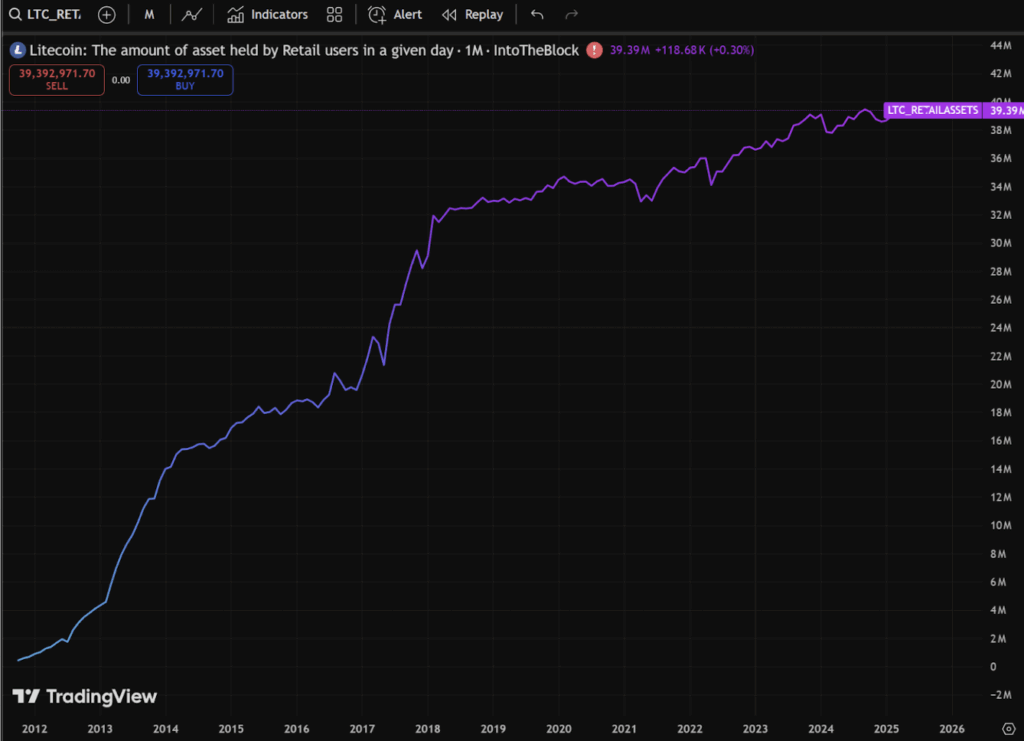

Retail Holders Dominate the Provide

Retail traders now management greater than half of all Litecoin in circulation, a outstanding present of decentralization at a time when many different crypto networks are dominated by whales and funds. Whilst institutional gamers have been rising their publicity, the vast majority of LTC stays within the fingers of on a regular basis customers.

Litecoin’s circulating provide sits round 76.44 million cash, buying and selling at roughly $95.45—a modest 1.9% acquire within the final day. What’s extra spectacular is the 8.7 million energetic retail customers, not simply pockets addresses. This regular development reveals Litecoin’s increasing world base of individuals truly holding and utilizing it, not simply speculating.

Community Energy and New Tech Developments

2025 has been a powerhouse yr for the Litecoin community. The hash fee has reached new all-time highs, reflecting stronger community safety and miner confidence. Curiously, miners have been holding onto extra of their cash as an alternative of promoting, which frequently alerts long-term optimism.

On the tech facet, privacy-focused MWEB (MimbleWimble Extension Block) addresses have practically tripled in adoption, displaying that Litecoin’s privateness layer is gaining critical traction. There’s ongoing growth round Layer 2 scaling options utilizing ZK Proofs, too. In the meantime, main cost processors and firms proceed to undertake Litecoin for day-to-day transactions, with ETF and ETP approvals nonetheless pending however anticipated so as to add additional legitimacy.

Institutional Accumulation and Company Treasuries

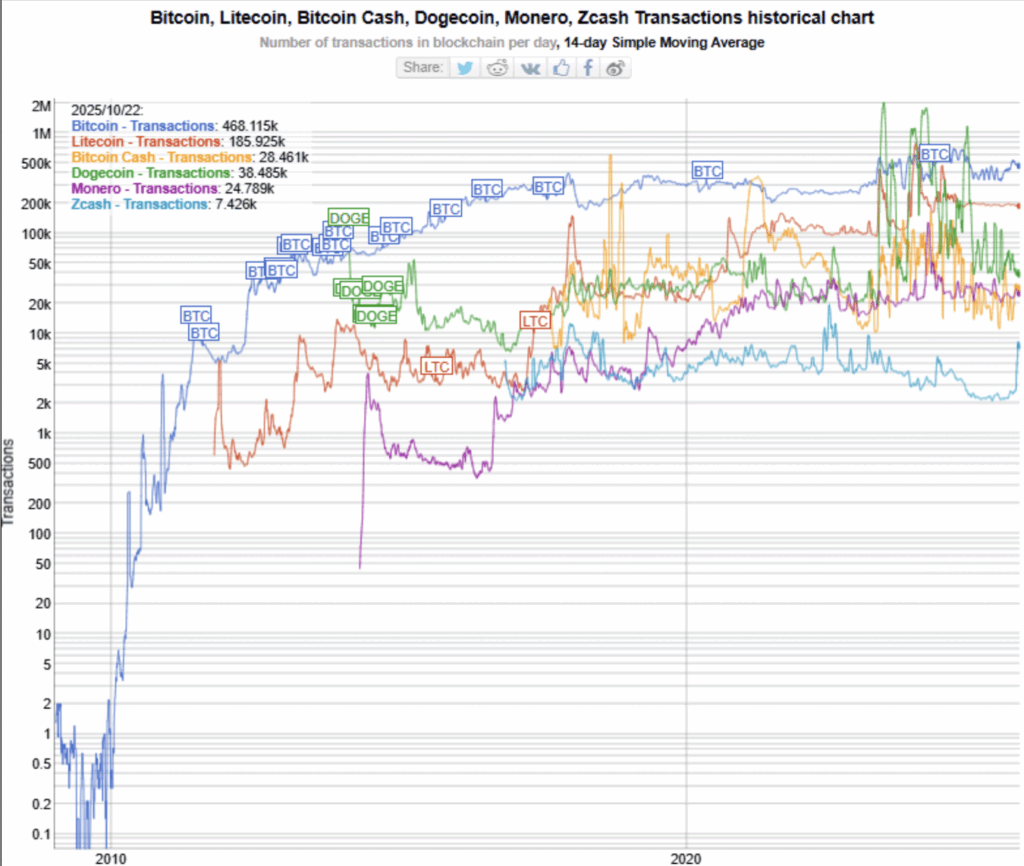

Institutional adoption is choosing up momentum. Luxxfolio Holdings, which manages Litecoin reserves, has famous persistently excessive transaction exercise, with Litecoin sustaining round 30–40% of Bitcoin’s day by day transaction quantity for 4 straight years. That’s no small feat.

Luxxfolio just lately filed to boost $73 million, concentrating on the acquisition of as much as 1 million LTC by 2026. In one other huge transfer, MEI Pharma bought 929,548 Litecoin—valued at over $110 million—cementing a considerable company treasury place. And asset administration agency T. Rowe Worth has jumped in too, submitting for a crypto ETF that can maintain between 5–15 digital property, together with Litecoin alongside Bitcoin and Ethereum.

All this implies a turning tide. With on a regular basis customers proudly owning the bulk, establishments stacking up reserves, and ongoing technical enlargement, Litecoin is shaping up as one in every of 2025’s quiet energy gamers in crypto. It’s not flashy, nevertheless it’s stable—and on this market, that may simply be what wins long run.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.