- Stellar is up 2.8% this week however stays down practically 30% over three months.

- RSI exhibits a hidden bearish divergence regardless of rising social buzz and rising RWA worth.

- Key resistance lies at $0.38 and $0.41; failure to carry $0.30 may drag XLM towards $0.23.

Stellar’s worth is exhibiting a little bit of life once more—up round 2.8% over the previous week—however the larger image nonetheless leans bearish. During the last three months, XLM has fallen practically 29%, struggling to search out lasting momentum even after a number of short-lived bounces. Merchants are actually zeroed in on one essential stage that might resolve whether or not this rebound turns into an precise restoration or simply fizzles out into one other leg decrease.

Bearish Divergence Creeps In as Social Buzz Spikes

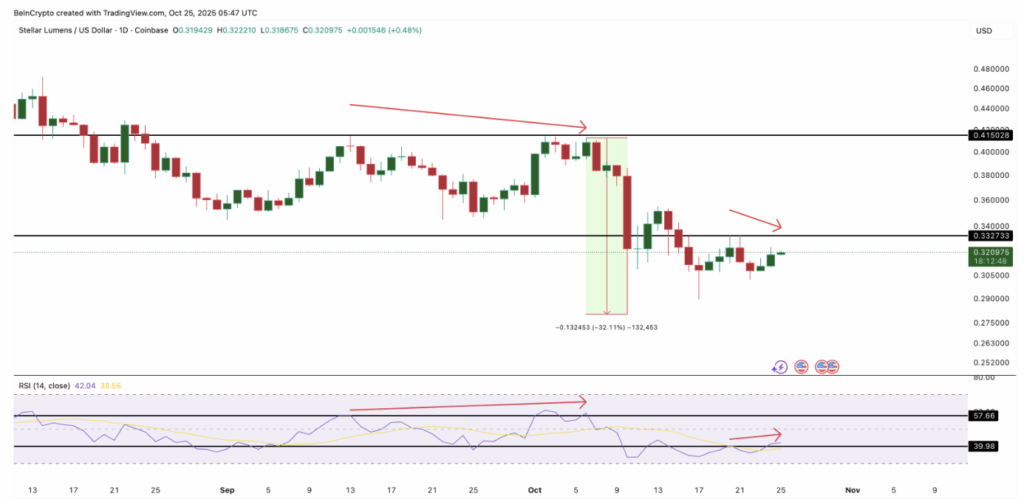

Right here’s the factor: even with robust on-chain progress and a flood of chatter throughout social media, the chart isn’t wanting all that wholesome. The Relative Power Index (RSI), which tracks shopping for versus promoting stress, is exhibiting a hidden bearish divergence—principally, an indication that momentum is fading although the worth seems to be pushing greater.

Between October 20 and 25, Stellar made a decrease excessive whereas the RSI made the next one. That mismatch typically hints that consumers are shedding energy. An almost equivalent setup appeared from mid-September to early October, and that was adopted by a steep 32% correction. So yeah, merchants are on alert once more, watching for one more potential dip if the identical sample repeats.

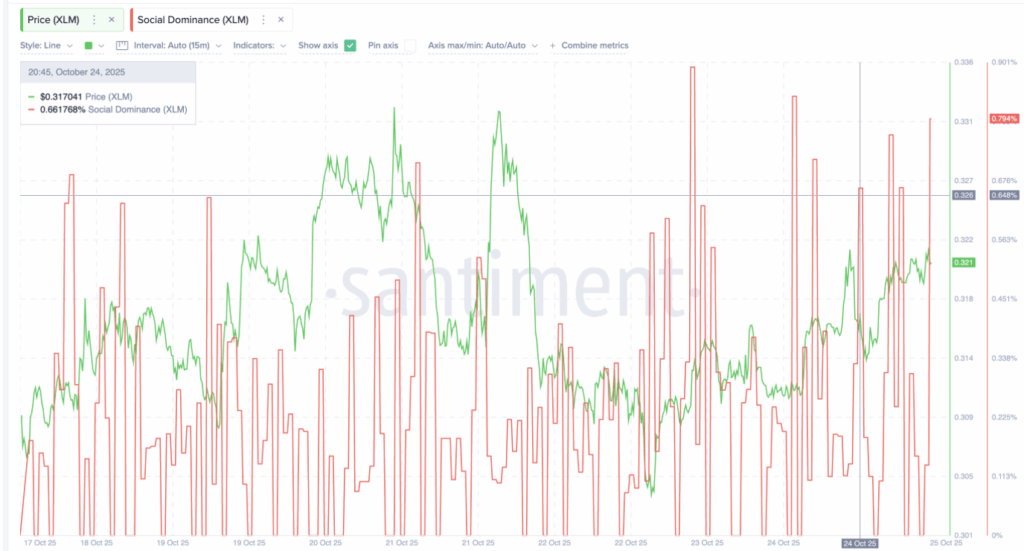

In the meantime, exterior the charts, issues look surprisingly upbeat. Stellar’s tokenized real-world asset (RWA) worth has climbed over 26% within the final 30 days, now sitting round $638.8 million. The challenge’s social dominance can be on the rise, leaping from 0.648% to 0.794% in simply someday. However extra discuss doesn’t all the time imply extra shopping for—and that’s precisely what the info exhibits. There’s a transparent disconnect between hype and precise worth motion proper now.

XLM Caught Under Resistance at $0.38

Wanting on the day by day chart, Stellar stays trapped inside a descending channel. Each time the worth tries to maneuver greater, promoting stress shortly kicks again in. The construction remains to be bearish, exhibiting that the market hasn’t flipped but. For XLM to begin exhibiting actual energy, it might want to interrupt cleanly above $0.38—the highest of that channel. Doing so would mark a 20% rise from present ranges and will lastly shift short-term sentiment from bearish to impartial, possibly even bullish if momentum holds.

Nonetheless, the important thing stage to look at is $0.41, a resistance zone that’s rejected a number of rally makes an attempt since September. Clearing that might verify a bigger pattern reversal. Then again, if XLM can’t defend $0.30, it dangers sliding again down towards $0.23, which marks the following main demand zone. For now, it’s a ready recreation between cautious optimism and the acquainted weight of promoting stress that’s haunted Stellar for months.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.