- Analyst Lingrid warns that XRP may drop to $2.10 if the present descending channel holds.

- A breakout above $2.45–$2.50 may invalidate the bearish setup and spark a rebound towards $2.83.

- Different analysts notice indicators of a attainable short-term bounce, with market sentiment and Bitcoin’s motion prone to affect XRP’s subsequent transfer.

Crypto market analyst Lingrid believes XRP is likely to be on the verge of hitting a contemporary yearly low — however she’s additionally pinpointed the precise value zone that might flip the development round. In her newest market breakdown, she famous that whereas the short-term construction nonetheless appears bearish, there’s a slender window the place bulls may regain management.

XRP Struggles to Regain Power

On the time of her evaluation, XRP was buying and selling close to $2.44, down roughly 14% for the month. The token’s weak restoration after the October 10 market-wide crash hasn’t been sufficient to reverse the broader downtrend. Regardless of temporary aid rallies, XRP retains lagging behind different main cryptos when it comes to energy.

Lingrid’s earlier forecast, posted on October 18 when XRP hovered round $2.33, outlined a descending channel sample on the 4-hour chart — one which’s been guiding value motion since late August. Every try to interrupt increased has met resistance, retaining the asset trapped on this falling construction.

Bears in Management: A Transfer Towards $2.10?

Her chart evaluation confirmed a blue descending trendline slicing by means of the center of the channel — appearing as a form of dividing line between weak recoveries and deeper drops. Each time XRP approached that inside resistance, sellers took over.

Earlier in October, the coin even managed a short breakout above it, reaching $3.10, however the transfer shortly unraveled as sellers slammed it again under. The October 10 crash deepened the autumn, sending XRP underneath $2.70. Even after a rebound try and $2.63 on October 13, the token failed to shut above resistance.

Lingrid highlighted that XRP continues to kind decrease highs and decrease lows, the textbook definition of a downtrend. If that sample stays intact, she expects a slide towards $2.10, which she marked because the backside of the descending channel— and probably the subsequent sturdy demand zone.

The Key to a Reversal

Nonetheless, it’s not all doom and gloom. Lingrid identified the precise ranges that might invalidate the bearish case. A decisive breakout above $2.45, she mentioned, could possibly be the primary signal of energy. If bulls handle to push previous $2.50 and maintain, that might affirm a short-term reversal, probably driving XRP towards $2.83 within the coming periods.

She additionally talked about that broader market sentiment may shift issues. If Bitcoin turns bullish, altcoins like XRP typically observe. On a macro stage, she referenced JPMorgan’s current feedback suggesting that the U.S. Federal Reserve would possibly quickly finish its quantitative tightening section — a transfer that might loosen liquidity and inject optimism throughout threat markets, together with crypto.

Analysts Divided as Sentiment Wavers

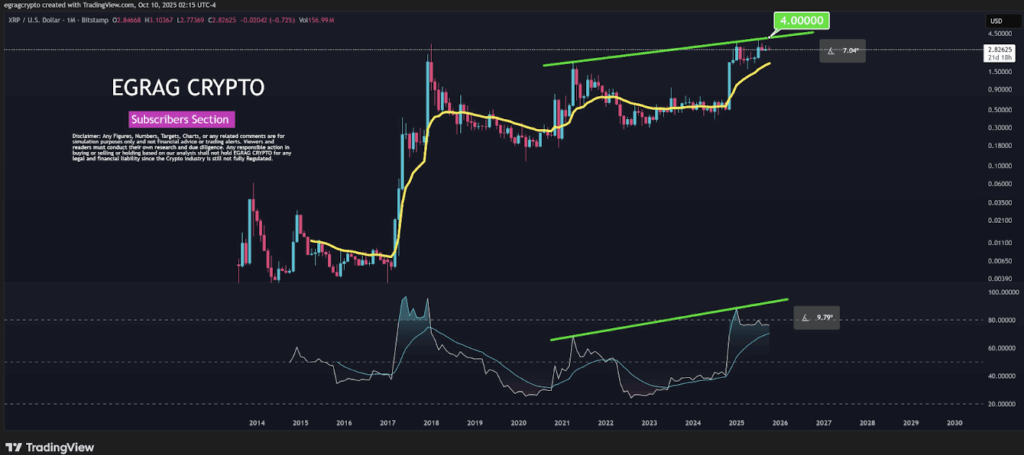

Lingrid’s view leans cautious, however not everybody agrees. Fellow analyst EGRAG Crypto argues that XRP’s month-to-month chart nonetheless exhibits structural energy, noting that no main assist has been decisively damaged but. In the meantime, Ali Martinez pointed to a TD Sequential purchase sign on the 4-hour chart, hinting {that a} short-term bounce would possibly already be in movement.

At this stage, XRP’s route will depend on the way it handles the $2.45–$2.50 area. A break above that vary may flip sentiment bullish once more. But when the rejection continues, a retest of the $2.10 zone appears an increasing number of doubtless — a stage that might outline whether or not this correction ends… or deepens.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.