Prime Tales of The Week

Dealer who made $190M shorting crash additionally apparently wager on CZ’s pardon

The nameless crypto dealer who supposedly made thousands and thousands shorting the crypto market earlier than US President Donald Trump’s tariff announcement seems to have profited once more by betting that Trump would pardon the founding father of Binance.

Onchain sleuth Euan pointed to Etherscan information to make the connection between the dealer and the Polymarket account. The crypto pockets reportedly made $56,522 on Polymarket by betting that Trump would pardon Changpeng “CZ” Zhao someday in 2025.

The crypto dealer had already been suspected in crypto circles of accessing insider information after their tightly timed Bitcoin and Ethereum shorts, simply hours earlier than Trump’s tariff announcement despatched costs falling.

Rumble companions with Tether so as to add Bitcoin suggestions for content material creators

Video-sharing platform Rumble is getting ready to roll out Bitcoin tipping for its greater than 51 million month-to-month lively customers, the corporate’s CEO Chris Pavlovski introduced on Friday.

Rumble has teamed up with stablecoin issuer Tether to allow Bitcoin tipping, Pavlovski mentioned onstage on the Plan ₿ Discussion board in Lugano, Switzerland.

“Proper now, we’re within the testing section [but] we’re going to begin rolling that out alongside Tether right here within the coming weeks,” he added.

Additionally onstage was Tether CEO Paolo Ardoino, who expects a full rollout by early to mid-December as soon as small bugs are fastened and the UX is finessed.

‘Loopy stuff’ wanted for Bitcoin to succeed in $250K this yr: Novogratz

Planets would nearly have to align for Bitcoin to succeed in $250,000 by the top of the yr, in accordance with Galaxy Digital CEO Mike Novogratz.

A number of crypto executives have not too long ago doubled down on their $250,000 Bitcoin predictions by year-end.

“The tip of the yr is just two and a half months away,” Novogratz mentioned throughout an interview with CNBC on Wednesday, including: “There must be a heck of a whole lot of loopy stuff to actually get that sort of momentum.”

Arthur Hayes requires $1M Bitcoin as new Japan PM orders financial stimulus

Japan’s new Prime Minister, Sanae Takaichi, introduced a bundle of financial stimulus measures on Tuesday to ease the impression of inflation on households. The transfer, some crypto observers mentioned, might drive extra capital into Bitcoin.

The stimulus measures embody subsidies for electrical energy and fuel expenses, in addition to regional grants to ease worth stress and encourage small to medium-sized companies to boost wages.

BitMEX co-founder Arthur Hayes considered the event as a precursor to extra fiat cash printing by Japan’s central financial institution, which can catalyze Bitcoin’s rise to $1 million.

“Translation: let’s print cash at hand out to of us to assist with meals and power prices,” mentioned Hayes in a Tuesday X put up, including that this dynamic may even see Bitcoin rise to $1 million, whereas triggering an increase within the Japanese yen.

Prediction markets hit new excessive as Polymarket enters Sam Altman’s World

World co-founder and OpenAI CEO Sam Altman’s digital identification venture, previously generally known as Worldcoin, is increasing into prediction markets by integrating Polymarket.

World App, a cellular utility that mixes a digital pockets with World’s decentralized identification device, World ID, has built-in the Polymarket App, the corporate introduced on Tuesday.

“World App customers can obtain and entry the brand new Mini App as we speak in nations the place Polymarket’s companies are permitted,” the announcement mentioned.

Winners and Losers

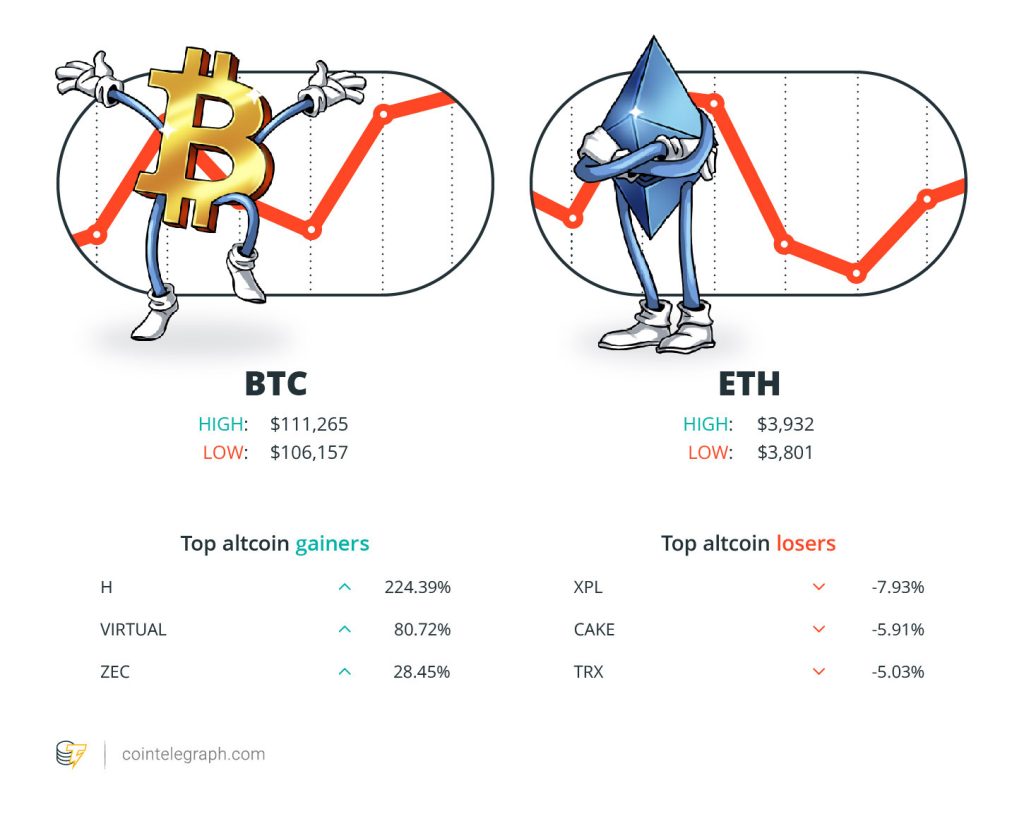

On the finish of the week, Bitcoin (BTC) is at $111,265 Ether (ETH) at $3,932 and XRP at $2.60. The full market cap is at $3.61 trillion, in accordance with CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Humanity Protocol (H) at 224.39%, Virtuals Protocol (VIRTUAL) at 80.72% and ZCash (ZEC) at 28.45%.

The highest three altcoin losers of the week are Plasma (XPL) at 7.93%, PancakeSwap (CAKE) at 5.91% and TRON (TRX) at 5.03%.

For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“If Congress doesn’t cease this type of corruption, it owns it.”

Elizabeth Warren, US senator

“So the almost certainly outlook is we’re rangy between 100 and 120 or 125, until we take out the highest aspect.”

Mike Novogratz, CEO of Galaxy Digital

“Bitcoin is forming a uncommon broadening high on the charts. This sample is known for tops.”

Peter Brandt, veteran dealer

“Generally we’re actually promoting 50 million an hour or 100 million an hour and shopping for the $100 million of Bitcoin the identical hour.”

Michael Saylor, government chairman of Technique

“So what occurs there may be the AI analyzes the place you’re, seems to be on the geography of what retailer [is nearby] and determines that that’s the one, after which makes use of a blockchain to really do a digital fee system for the tall low-fat latte.”

Kevin O’Leary, multimillionaire

“I’ve been saying for the previous two years that the affect of @paradigm inside Ethereum might turn out to be a related tail threat for the ecosystem. I imagine this can turn out to be more and more clear to everybody within the months forward.”

Federico Carrone, Ethereum developer

Prime Prediction of The Week

XRP worth eyes rally to $3.45 after Ripple CEO tells traders to ‘lock in’

XRP flashes indicators of a possible 35% breakout as bullish technicals align with recent fundamentals, together with Ripple CEO Brad Garlinghouse’s renewed push for the blockchain firm’s “web of worth” imaginative and prescient.

Learn additionally

Options

3 individuals who unexpectedly turned crypto millionaires… and one who didn’t

Options

North American crypto miners put together to problem China’s dominance

XRP’s worth chart technicals point out that it has bounced from the decrease trendline of its prevailing ascending triangle sample. That help has traditionally marked the beginning of highly effective rebound strikes, together with 70-80% jumps earlier in 2025.

Prime FUD of The Week

Spot Ether ETFs see outflows for second consecutive week amid ‘cooling demand’

Spot Ethereum exchange-traded funds (ETFs) have logged two straight weeks of outflows amid cooling investor sentiment after months of sturdy inflows.

In keeping with information from SoSoValue, Ether merchandise collectively posted $243.9 million in internet redemptions for the week ending on Friday, following the earlier week’s $311 million outflow.

The newest information brings cumulative inflows throughout all Ether spot ETFs to $14.35 billion, with whole internet belongings standing at $26.39 billion, representing about 5.55% of Ethereum’s market cap.

On Friday, the funds additionally $93.6 million in outflows. BlackRock’s ETHA ETF led withdrawals with $100.99 million in outflows, whereas Grayscale’s ETHE and Bitwise’s ETHW posted minor inflows.

Younger Australians’ greatest monetary remorse: Ignoring Bitcoin at $400

Over 40% of Australian Gen Z and Millennials say they remorse not investing in cryptocurrency a decade in the past, with a brand new survey from Australian crypto dealer Swyftx suggesting they see it as one of many greatest missed alternatives of the final 10 years.

Learn additionally

Columns

We tracked down the unique Bitcoin Lambo man

Options

Memecoin degeneracy is funding groundbreaking anti-aging analysis

The research, performed by YouGov and launched on Thursday, surveyed 3,009 individuals, discovering that nearly half of the under-35s surveyed remorse lacking the crypto boat.

This was adopted by remorse for not shopping for property and never shopping for shares in massive expertise corporations resembling Apple and Amazon.

A part of the FOMO is probably going due to the structural shopping for of Bitcoin and Ether by firms, sovereigns and US pension funds, in accordance with Swyftx.

Bitcoin chart is echoing the Nineteen Seventies soybean bubble: Peter Brandt

Bitcoin’s worth chart has began to indicate similarities to the soybean market round 50 years in the past, which noticed costs high earlier than plummeting 50% as international provide started to outweigh demand, warns veteran dealer Peter Brandt.

Nevertheless, different Bitcoin analysts are assured that the charts are signaling additional upside forward.

“Bitcoin is forming a uncommon broadening high on the charts. This sample is known for tops,” Brandt advised Cointelegraph. “Within the Nineteen Seventies, Soybeans fashioned such a high, then declined 50% in worth.”

Prime Journal Tales of The Week

Mysterious Mr Nakamoto writer: Discovering Satoshi would damage Bitcoin

The Mysterious Mr Nakamoto writer chased suspects throughout the globe. He’s now open to the thought Satoshi is perhaps an ex-cypherpunk working for the NSA.

Most rich Hong Kong traders plan to purchase crypto, Japan’s Bitcoin plan: Asia Categorical

Hong Kong’s wealthy traders are planning to enter crypto this yr, South Korea to ban stablecoin yields, and extra.

Cliff purchased 2 properties with Bitcoin mortgages: Intelligent… or insane?

Purchase a home on credit score and hold your Bitcoin — Bitcoin-backed mortgages sound nice, however what are the drawbacks?

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.