A yr after Bitcoin’s 2024 halving, the mining panorama seems far much less predictable.

As soon as dominated by a handful of giants, the trade is now seeing a wave of bold mid-tier corporations closing in on the leaders – a shift that displays how evenly the sphere has begun to stability.

Information cited by The Miner Magazine signifies that companies comparable to Cipher Mining, Bitdeer, and HIVE Digital have expanded their operations aggressively, changing years of infrastructure funding into tangible onchain outcomes. Their realized hashrate – a metric that measures precise mining output moderately than theoretical capability – has climbed quick sufficient to problem the dominance of MARA Holdings, CleanSpark, and Cango.

The mixed realized hashrate of the biggest publicly traded miners hit roughly 326 EH/s in September, greater than twice the extent recorded a yr in the past. That collective energy now accounts for near one-third of Bitcoin’s whole community energy, an indication that industrial-scale mining has by no means been extra concentrated – or aggressive.

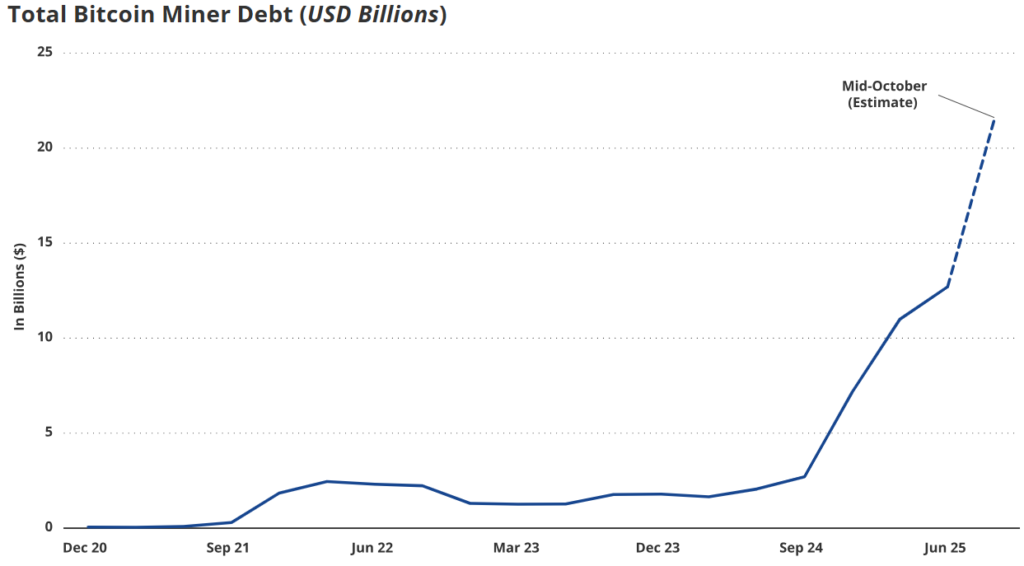

But the race to scale isn’t with out value. Analysis from VanEck reveals that public miners have collectively taken on practically $13 billion in debt, a sixfold enhance since final yr. A lot of that borrowing is being funneled into new mining rigs, renewable energy sources, and synthetic intelligence {hardware}, as corporations seek for contemporary income past Bitcoin itself.

Following the halving that diminished rewards to three.125 BTC per block, the strain to innovate has intensified. Some miners are experimenting with high-performance computing and AI internet hosting to counter slimmer margins, signaling that the mining enterprise is evolving into one thing broader than pure crypto extraction.

The post-halving period has turned mining right into a take a look at of technique moderately than sheer scale – and the hole between the outdated guard and the brand new challengers is narrowing sooner than anybody anticipated.