The Zcash (ZEC) worth has surged by greater than 750% prior to now three months, with token holders gaining over 20% within the final 24 hours.

The dormant privateness coin from crypto’s early years began stealing the highlight in October, after practically 9 years of relative dormancy following its launch in 2016.

Sponsored

Sponsored

Arthur Hayes Reawakens a Zcash Value Rally

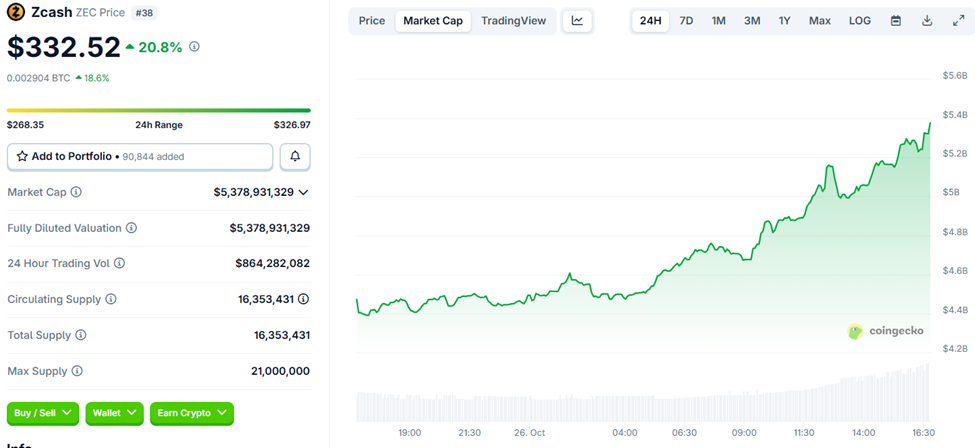

CoinGecko information exhibits ZEC is up by 20.8% to commerce for $332.52 as of this writing. It follows a current put up from Arthur Hayes, after the BitMEX co-founder and former CEO referred to as a $10,000 worth goal for ZEC, the powering token for the Zcash ecosystem.

The put up from Hayes, identified for his contrarian macro views and market-moving feedback, reinvigorated curiosity within the altcoin after the Black Friday crash did not cease ZEC.

“…after a protracted interval of silence, it [ZEC] was all of a sudden endorsed by a legendary Silicon Valley investor, driving everybody to observe the pattern and take part, subsequently triggering a full month’s FOMO market frenzy,” stated analyst AB Kuai Dong.

Zcash has seen periodic spikes through the years however has largely light into obscurity amid tighter regulation and waning developer exercise.

Over the previous few weeks, it has been again on merchants’ radars, and never only for nostalgia. In opposition to this backdrop, the analyst likened the ZEC worth rally to the early Bitcoin and Ethereum mania, with a number of structural catalysts now aligning.

Sponsored

Sponsored

“ZEC completely blew my thoughts. Value pumped +755% in 3 months, testing the $305 “ATH” resistance. Greyscale launched a Zcash belief this month, a Hyperliquid itemizing, an upcoming halving, and the “BTC vs. Zcash” dialogue triggered explosive momentum,” stated crypto analyst Lennaert Snyder.

In the identical tone, technical analyst Clifton FX highlighted an ascending triangle sample for the ZEC worth on the 8-hour chart, suggesting potential for an additional 100–150% upside on breakout.

Nonetheless, not everyone seems to be satisfied. Ignas DeFi, a well-liked DeFi analyst, referred to as Zcash the proper case research for a way narratives emerge and go viral. The analyst warned that many might turn out to be exit liquidity for coordinated pumps.

Additional, Ignas DeFi described a reflexive loop wherein merchants see ZEC content material on X (Twitter) and purchase in to keep away from lacking out. The FOMO amplifies the hype as neighborhood members interact with extra ZEC posts, feeding the cycle additional.

Mert Helius, CEO of Helius Labs, expressed skepticism, referencing ZEC’s valuation relative to larger-cap altcoins.

Sponsored

Sponsored

Zcash Value Outlook: Why ZEC Holders Ought to Watch $281.35

With the ZEC worth buying and selling for $333.77 as of this writing, curiosity attracts to the $281.35 help stage, the provision zone’s imply threshold (midline) between $270.95 and $292.22.

In hindsight, each time the worth examined this order block, it met intense sell-pressure that halted the upside, not less than earlier than the current breakout.

From a technical standpoint, the ZEC worth is buying and selling inside an ascending parallel channel. For so long as an asset’s worth stays inside the confines of this technical formation, it’s primed for extra beneficial properties.

Sponsored

Sponsored

With the RSI (Relative Energy Index) nonetheless climbing, momentum continues to rise and, with it, the Zcash worth may see additional upside, doubtlessly reaching $360. Such a transfer would represent a 6% climb above present ranges.

Conversely, if the higher boundary of the ascending channel holds as a resistance stage, the ZEC worth may drop. A slip beneath the channel’s midline at $298.35 would exacerbate the correction, with the help as a result of 9-day SMA (Easy Shifting Common) more likely to break as a help stage.

Nevertheless, solely a decisive candlestick shut beneath the imply threshold of $281.35 would verify the correction, with promoting stress more likely to prolong. Slipping beneath this stage would toss the ZEC worth into bearish palms able to promote.

Promoting stress may trigger the Zcash worth to spiral to $240, successfully breaking out of the bullish technical formation.

In a dire case, the ZEC worth may drop beneath the $200 psychological stage, with prospects for extra losses.

The RSI’s place at 79 additionally raises considerations, suggesting that the ZEC token is already massively overbought and will quickly endure a correction as a consequence of purchaser exhaustion.