- Cardano whales added 50M ADA price $32.5M in simply two days.

- Dormancy is rising, signaling fewer cash shifting and early indicators of accumulation.

- A breakout above $0.66 may ship ADA towards $0.79, whereas failure may drag it again to $0.50.

Cardano has been shifting quietly beneath the radar these days, however the calm won’t final for much longer. On-chain information and value charts are starting to indicate the primary sparkles of life, hinting that one thing might be brewing. Massive ADA holders are regularly stacking up once more, and some key technical alerts counsel {that a} breakout may be nearer than most count on. With the worth hovering close to a serious resistance zone, the following few buying and selling classes may make or break ADA’s short-term trajectory.

Whales Slowly Return to the Recreation

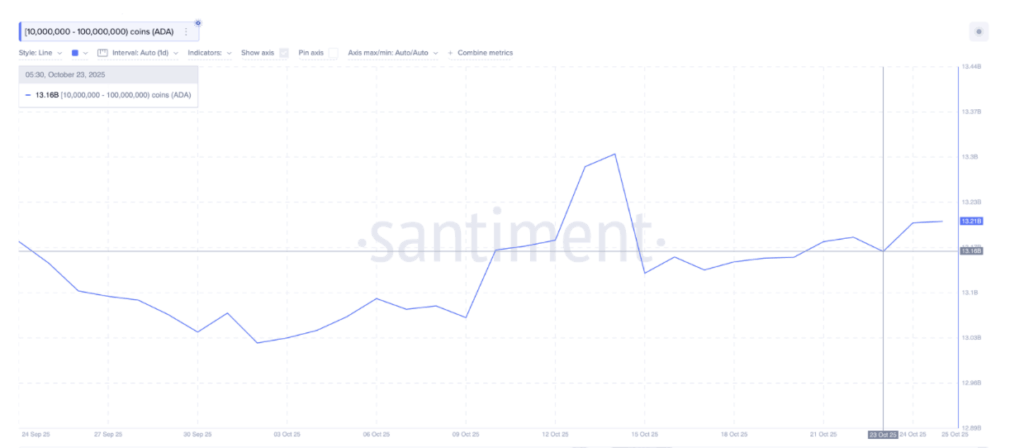

Information from Santiment exhibits that wallets holding between 10 million and 100 million ADA have been on a light accumulation streak. In simply two days, this group added roughly 50 million ADA, bumping their complete holdings from 13.16 billion to 13.21 billion. That’s round $32.5 million price of ADA at present costs — not a small wager.

Whereas the transfer isn’t explosive, it’s a transparent shift in sentiment. Whales are inclined to act early, and once they begin accumulating once more, it usually alerts that they’re positioning for one thing down the road. Nonetheless, analysts warn {that a} stronger affirmation would come provided that the development continues with increased quantity over a number of classes. For now, the shopping for appears to be like cautious however deliberate.

Dormancy Suggests Traders Are Holding Tight

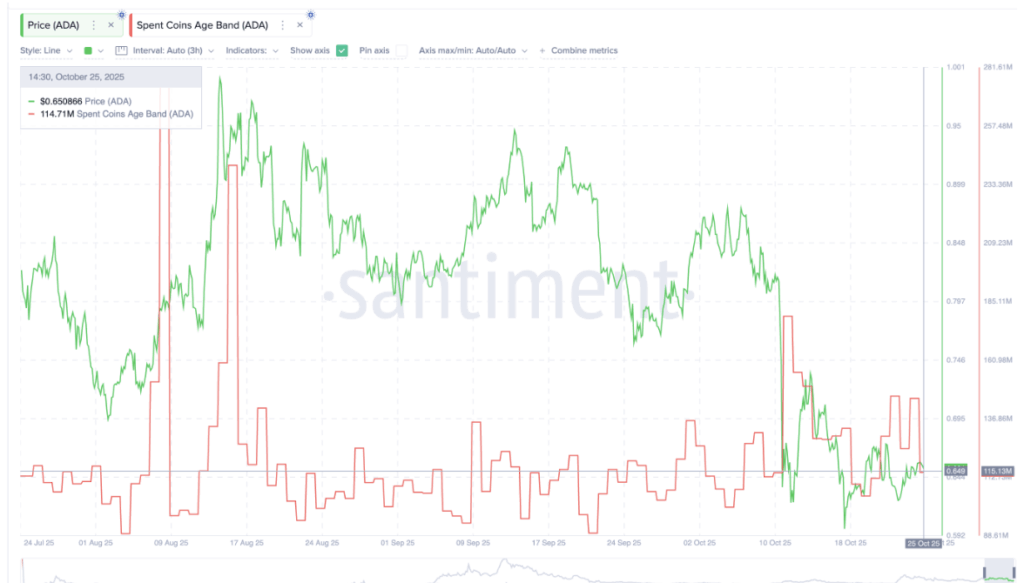

One other attention-grabbing element comes from ADA’s dormancy metrics. The Spent Cash Age Band — which tracks how previous cash transfer — has dropped by about 36% since mid-October, from 179 million ADA to round 114 million. In easy phrases, fewer cash are shifting round, that means extra holders are sitting tight as a substitute of promoting.

That stated, dormancy ranges are nonetheless a bit increased than the deep lows seen earlier than main rallies. On September 22, dormancy fell to round 89 million ADA, proper earlier than a small value bump. For now, we’re not fairly at that degree, however we’re getting nearer. If dormancy retains falling towards or under 90 million, it may mark stronger conviction amongst long-term holders — a basic signal of quiet accumulation earlier than greater strikes.

Chart Patterns Level to Bullish Potential

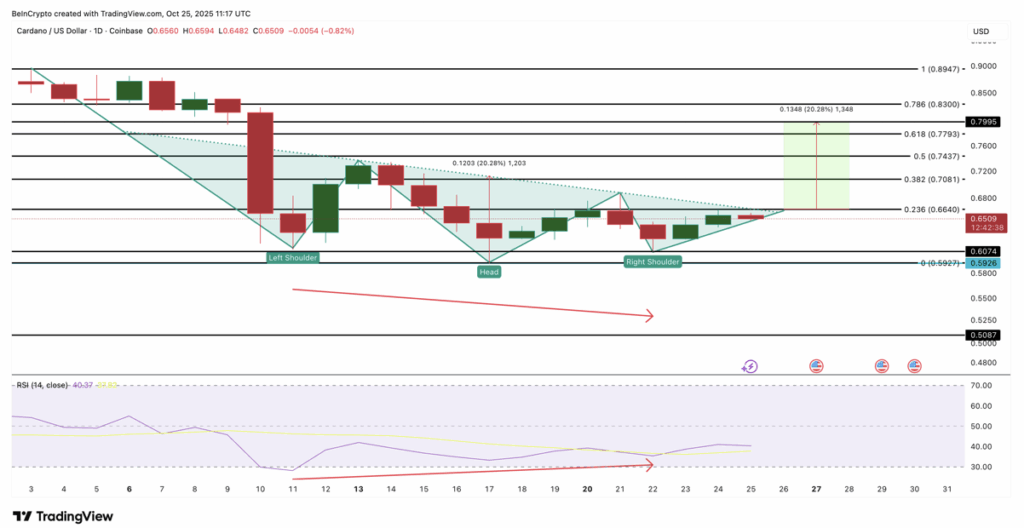

Cardano’s each day chart has began to sketch what appears to be like like an inverse head-and-shoulders sample — a formation that always exhibits up earlier than bullish reversals. ADA is at present hovering close to $0.66, which traces up with the 0.236 Fibonacci retracement zone. A clear breakout and each day shut above this resistance may open the door to $0.79, with additional potential as much as $0.83 and $0.89 if momentum sticks round.

The one catch is that the neckline of the sample is sloping downward, an indication that sellers haven’t disappeared but. Nonetheless, ADA holding above $0.60 retains the setup legitimate. If it dips under that, although, the construction collapses and assist shifts all the way down to $0.50 — a degree that’s been examined a number of instances earlier than.

RSI Divergence Provides to Bullish Case

The Relative Energy Index (RSI) is quietly hinting at power too. Between October 11 and October 22, ADA’s value made a decrease low, however the RSI made the next low — a bullish divergence. That’s often an early signal that sellers are shedding steam whereas patrons start creeping again in.

When RSI divergence exhibits up on a each day chart, it usually results in a shift in development course — if value confirms it. For ADA, that affirmation lies proper on the $0.66 mark. Break that cleanly, and the bulls may lastly take the reins. But when resistance holds agency, Cardano may simply slide again towards $0.50 and keep trapped in its vary a bit longer.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.