- A whale pockets purchased $8.37M price of SOL close to resistance, signaling long-term confidence.

- SOL trades round $192 with sturdy momentum however combined indicators.

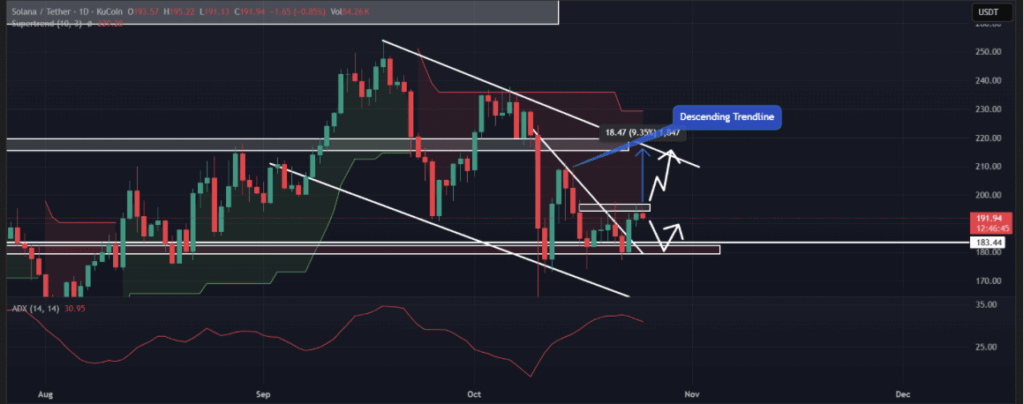

- Breaking above $196 might spark a ten% rally, whereas rejection may push it again to $180.

Solana has been on a little bit of a tear currently, climbing round 10% in just some days. The rally has introduced it proper as much as a make-or-break stage — one that might resolve whether or not SOL retains pushing larger or slips again once more. What’s catching everybody’s consideration although, is a large whale quietly scooping up hundreds of thousands price of SOL proper at this key zone.

Whale Exercise Alerts Rising Confidence

In response to knowledge from Lookonchain, a crypto pockets recognized as Ax6Yh7 just lately purchased 44,000 SOL, price roughly $8.37 million, whereas the token hovered close to resistance. This isn’t a random purchase both — this similar whale has been steadily constructing a place for months. Since April 2025, they’ve gathered round 844,000 SOL, valued at roughly $149 million, via platforms like FalconX and Wintermute. Most of those tokens are staked, displaying clear confidence in Solana’s long-term potential reasonably than short-term hypothesis.

Large cash tends to maneuver early, and this type of accumulation usually precedes bigger value swings. It’s like they’re positioning forward of one thing. Nonetheless, merchants are break up — some see it as bullish conviction, whereas others assume it’s simply whales utilizing the hype to check resistance once more.

Worth Motion and Resistance Watch

As of now, SOL trades round $192, up barely by 0.75% prior to now 24 hours. Regardless of the value uptick, buying and selling quantity has really dropped by about 22%, sitting close to $5.1 billion. That reveals retail curiosity is likely to be cooling off a bit whilst whales purchase in. The actual take a look at now sits on the $196 resistance stage — one which’s rejected Solana a number of occasions earlier than.

On the charts, SOL has already damaged above a descending trendline, which is usually a bullish signal. However this similar resistance has traditionally triggered sharp sell-offs at any time when value reached it. If historical past repeats, SOL might slip again towards the $180 zone once more. Nevertheless, if the bulls handle to punch via and shut above $196, it might spark a ten% rally towards $218 fairly rapidly.

Indicators and Market Sentiment

Technical alerts are combined. The Common Directional Index (ADX) is sitting round 31, which reveals sturdy momentum behind the present transfer. But, the Supertrend indicator continues to be bearish, hovering above the value and flashing purple — which means the broader development hasn’t flipped bullish simply but.

In the meantime, derivatives knowledge paints a cautious image. In response to CoinGlass, merchants are leaning closely on quick positions, hinting that many anticipate a rejection at this stage. The foremost liquidation zones sit close to $189.80 beneath and $195.80 above, with about $65 million in longs versus $84 million in shorts. If costs squeeze upward, these shorts might get caught off guard — presumably fueling a fast breakout rally.

For now, all eyes are on $196. Break it cleanly, and Solana might mild up once more. Fail to carry, and historical past may simply repeat itself.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.