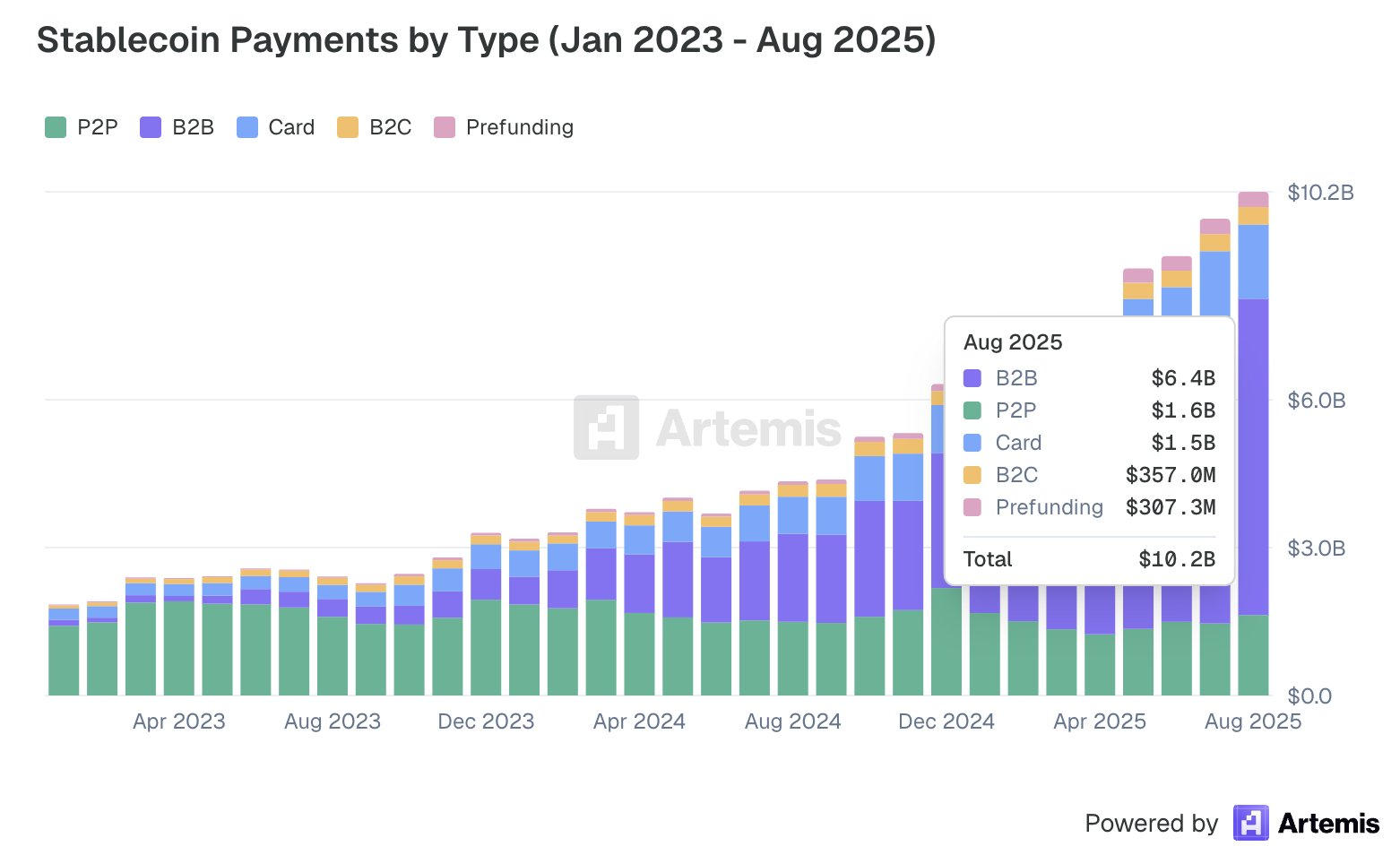

Stablecoin settlement volumes have expanded sharply this 12 months, climbing 70% from $6 billion in February to greater than $10 billion by August 2025.

In line with a report from Artemis, the surge displays how digital {dollars} are leaving the buying and selling area and coming into mainstream commerce, with business-to-business transfers rising because the dominant development driver.

Sponsored

B2B Transactions Energy Stablecoins Fee Development

Artemis’ figures present that company utilization of stablecoins now accounts for practically two-thirds of complete funds.

In line with the agency, month-to-month B2B quantity has greater than doubled since February, rising 113% to about $6.4 billion. The enlargement lifted the cumulative worth of stablecoin funds since 2023 to over $136 billion, representing that on-chain cash is now not a distinct segment settlement software.

In the meantime, client channels are following the identical trajectory of development.

Card-based crypto funds have elevated by about 36%, whereas business-to-consumer transactions are up 32%. Prefunding, usually utilized by retailers to take care of instantaneous liquidity, additionally jumped 61% in the course of the reporting interval.

Sponsored

David Alexander, companion at enterprise agency Anagram, stated the numbers present how on-chain liquidity is being was spendable money in the actual world. For context, he famous crypto card funds now course of greater than $1.5 billion every month, up 50% year-to-date.

He identified that these mechanisms enable customers to earn yields on idle property by decentralized finance (DeFi) protocols after which spend these property in actual time.

This seamless circulation successfully converts blockchain-based liquidity into usable money, merging the yield alternatives of DeFi with the familiarity of conventional cost networks.

“One of many earliest use instances for stablecoins was easy peer-to-peer transfers. The enchantment was sending cash sooner and cheaper, and making fiat extra accessible, significantly for areas with restricted entry to conventional types of banking. However that’s the place the trail of onchain cash historically ended: customers couldn’t spend it offchain. Now, that very same cash has advanced into programmable capital: property that dwell onchain, earn yield, and performance as direct equivalents to conventional cost devices, usable anyplace on this planet,” Alexander stated.

Sponsored

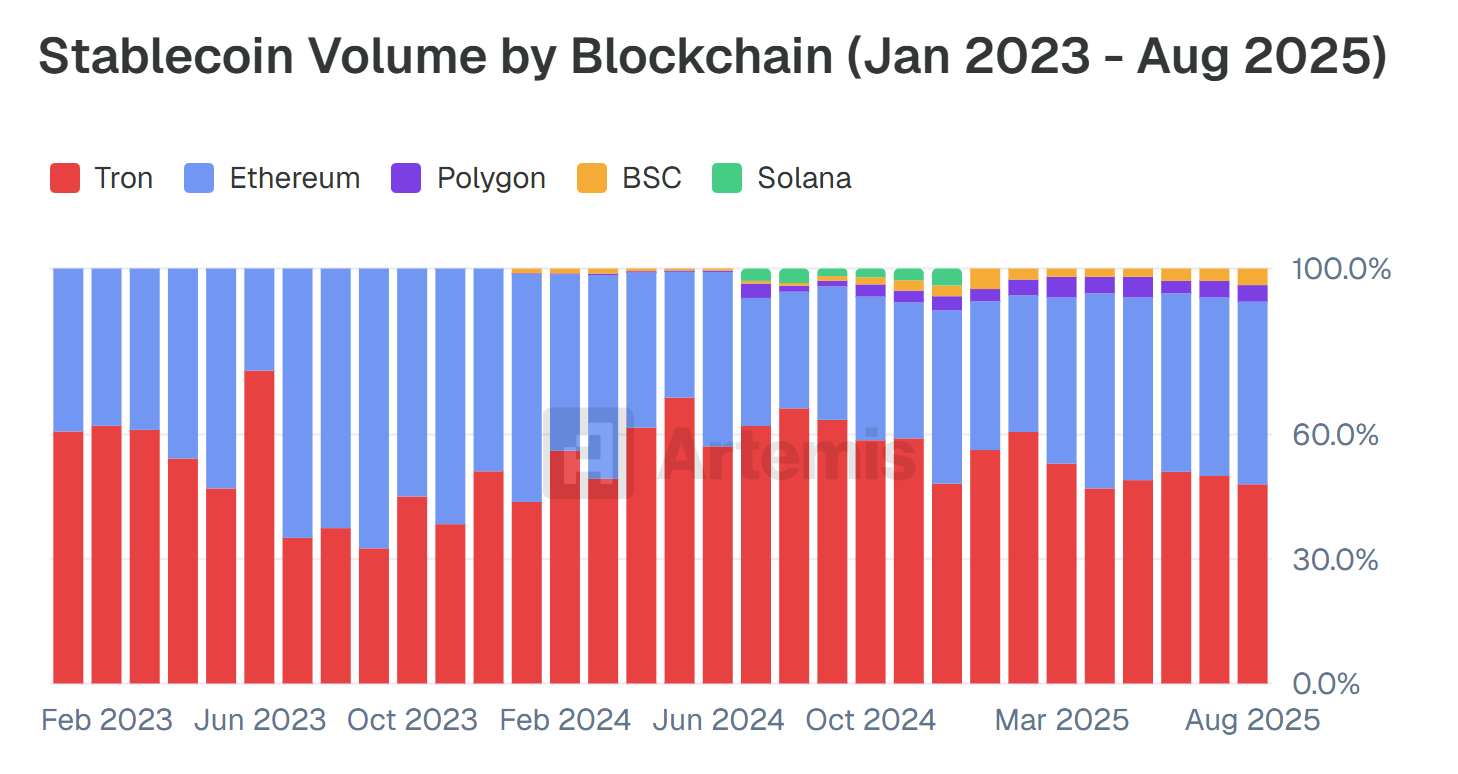

Tron’s Market Share Shrinks as Tether Consolidates Energy

Whereas the Tron community stays the biggest blockchain for stablecoin settlement, its lead is narrowing.

In line with Artemis knowledge, Tron’s share dropped from 66% in late 2024 to 48% by August 2025, as newer, sooner networks like Base, Codex, Plasma, and Solana started capturing liquidity.

Sponsored

Dragonfly companion Omar Kanji stated this development marks the “starting of a structural rotation,” the place lower-cost and high-throughput alternate options progressively eat into Tron’s dominance.

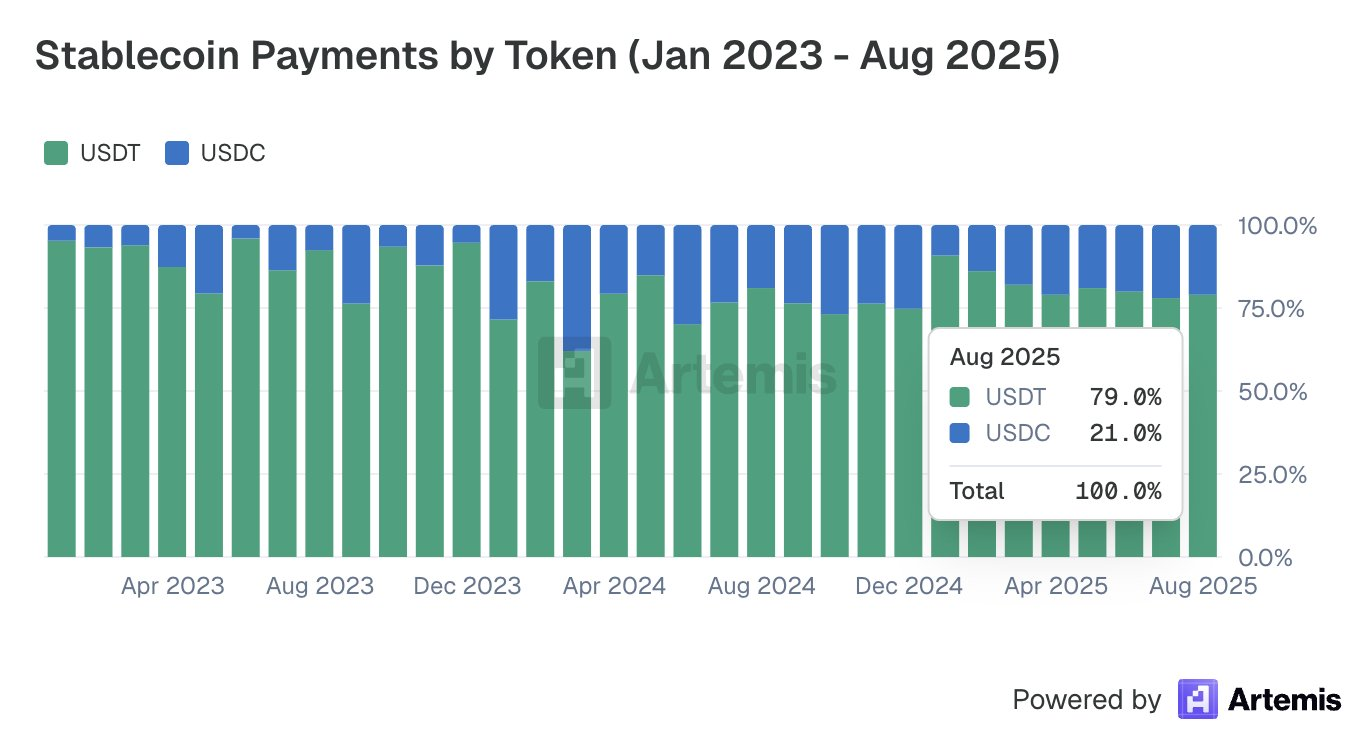

On the asset aspect, Tether’s USDT continues to dominate the stablecoin ecosystem with roughly 79% of all cost quantity, pushed by deep liquidity and unmatched accessibility throughout Africa and Latin America.

But Circle’s USDC is quietly increasing its footprint as its share rose from 14% to 21% since February.

Knowledge from DeFiLlama exhibits that USDT’s market capitalization stands at $183 billion, whereas USDC hovers close to $76 billion. Collectively, they anchor the over $300-billion community of digital {dollars} that now transfer with the velocity of code and the attain of worldwide finance.