• Gold faces a bearish correction however stays supported close to $4,000 per ounce.

• Technical merchants eye promote setups at $4,150 and purchase alternatives close to $3,980.

• Fed fee selections and international central financial institution strikes might spark renewed volatility — here’s what to observe subsequent.

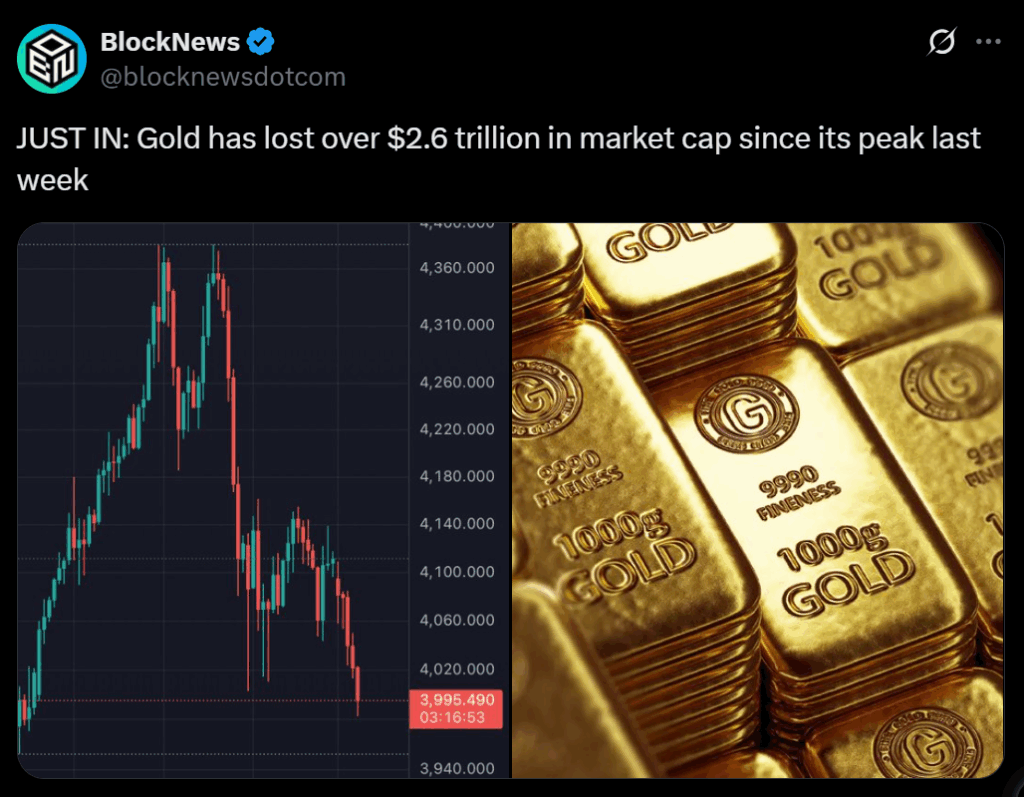

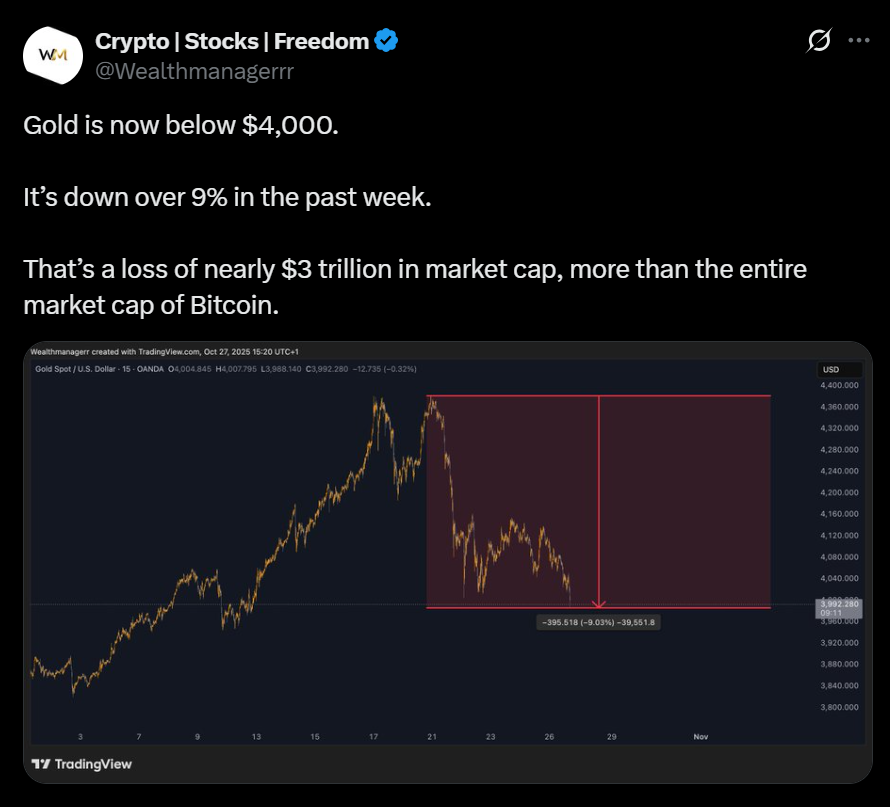

Gold continues to face a technical correction after retreating from its report highs earlier this month. The valuable metallic, which reached $4,382 per ounce in October, is now hovering across the essential $4,000 degree — a zone that has flipped from psychological resistance to key help. Analysts recommend that this worth section mirrors a well-recognized sample, with gold repeatedly testing its decrease pattern boundaries earlier than forming a brand new base. As we speak’s gold help ranges sit at $4,020, $3,975, and $3,920, whereas resistance lies close to $4,110, $4,180, and $4,240.

Key Buying and selling Indicators for the Day

Technical merchants are eyeing two clear setups. A promote place from $4,150 is advisable with a goal of $3,970 and a cease loss at $4,200. Conversely, a purchase setup emerges from $3,980, concentrating on $4,200 with a cease loss close to $3,910. The market’s present construction reveals consolidation close to $4,000, indicating indecision as buyers await readability from macroeconomic occasions — significantly the U.S. Federal Reserve’s coverage announcement and a extremely anticipated U.S.–China commerce assembly that would shift international sentiment.

Market Outlook: Coverage Strikes May Outline Gold’s Subsequent Pattern

Merchants anticipate that the Fed’s upcoming fee lower — coupled with softer inflation knowledge — could present short-term aid for gold. Nonetheless, sentiment stays combined. Whereas short-term merchants lean bearish following latest profit-taking, long-term buyers nonetheless keep a cautious bullish outlook. Analysts notice that the correction, although sharp, was probably exaggerated by nervous market contributors exiting positions forward of this week’s policy-heavy calendar.

Consolidation and Longer-Time period Assist

Regardless of near-term weak spot, specialists argue that gold is forming a wholesome shopping for base between $4,000 and $4,300. This consolidation vary might set the stage for one more rally as soon as macro uncertainty clears. With central banks throughout the globe signaling dovish tones, gold’s fundamentals — inflation hedging, geopolitical threat, and policy-driven liquidity — stay intact. Nonetheless, warning is suggested: merchants ought to monitor each the Fed’s tone and bond market reactions for indicators of renewed momentum.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.