- AVAX reclaims $20 help, rising over 5% with robust buying and selling quantity.

- Bullish construction types with greater highs and lows; targets $24–$27.

- Avalanche’s community metrics surge, reinforcing investor confidence and long-term upside potential.

Avalanche is lastly heating up once more. After weeks of uneven sideways motion, AVAX has began exhibiting indicators of power, reclaiming the $20 help and edging greater. Merchants are taking discover, and sentiment throughout the market appears to be shifting again in favor of this Layer-1 heavyweight.

On the time of writing, AVAX is buying and selling round $20.87, up greater than 5.6% prior to now 24 hours, in accordance with Courageous New Coin. That push comes with robust buying and selling exercise — over $558 million in every day quantity — and a market cap nearing $9 billion. The rebound from $19.8 has constructed a short-term uptrend that means early accumulation by consumers close to key zones of help.

AVAX Value Construction Flips Bullish

Technically, issues are wanting significantly better. After a number of rejections between $18.50 and $19.00, AVAX is lastly beginning to push greater. A clear breakout above $21.50 may open the door to $23–$24, the place earlier provide zones sit. On shorter timeframes, the chart has been printing a collection of greater lows, hinting that momentum is slowly shifting from consolidation to enlargement — if quantity retains up.

Analysts from Crypto Chiefs highlighted that AVAX has printed a greater low (HL) close to $19.8 and a greater excessive (HH)round $21.2 — traditional indicators of a bullish construction forming. If the $20 area continues to carry agency, worth targets line up with the $23.40–$24 vary, which may set off a stronger breakout towards $27 within the coming weeks. For now, that higher-low construction is the bulls’ greatest proof that the reversal is actual.

On-Chain Progress Provides Gasoline to the Rally

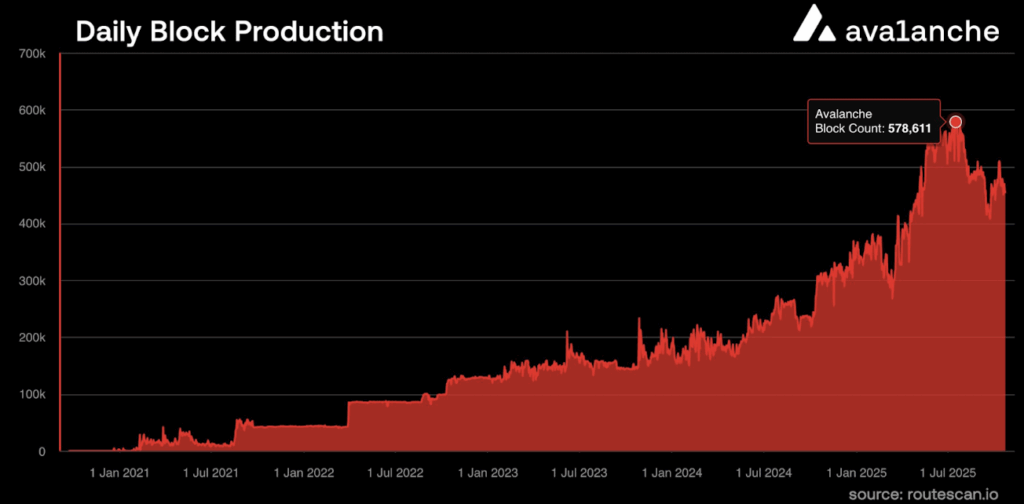

Avalanche’s fundamentals are backing the transfer too. On-chain knowledge exhibits the community’s efficiency has improved considerably, with block manufacturing doubling in comparison with final 12 months. Over 578,000 blocks are actually produced every day — an indication of robust validator exercise and scaling effectivity.

This uptick in community efficiency builds investor confidence. Extra on-chain exercise usually interprets to greater demand for the AVAX token, and it helps the concept this rally isn’t simply hypothesis. It’s additionally price noting that Avalanche’s DeFi ecosystem continues to develop, giving the token stronger long-term fundamentals to lean on.

Lengthy-Time period Chart Nonetheless Seems to be Constructive

Regardless of the latest dips, Avalanche’s larger image stays constructive. In response to analyst Sheldon The Sniper, the broader chart exhibits a gentle accumulation zone between $19.4 and $21.2, the place each dip has been absorbed rapidly by consumers. The descending trendline that’s capped costs since midyear has lastly been damaged — a possible shift towards full structural restoration.

Any pullback into the $19.5–$20 vary would nonetheless be wholesome and will even act as a springboard for the following leg greater. Analysts have their eyes on $24.14 as the primary massive resistance stage, adopted by $27–$30 if bullish momentum continues into This autumn 2025.

Closing Ideas: Avalanche’s Momentum Is Again

Between its bettering on-chain metrics, stable technical construction, and renewed market consideration, Avalanche seems to be prepared for its subsequent leg up. Holding above $19.5 retains the short-term bullish setup intact, whereas reclaiming $23–$24 would verify a full pattern reversal.

If community exercise continues to climb and quantity stays constant, AVAX may very well be gearing up for a robust breakout — one which may outline its This autumn efficiency and set the tone for 2025.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.