Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value edged down 1.5% previously 24 hours to commerce at $113,980 as of three:48 a.m. EST on buying and selling quantity that dropped 7% to $54.8 billion.

The autumn got here as S&P World Scores slapped a junk score on Michael Saylor’s Bitcoin treasury agency Technique due to its ”speculative” publicity to BTC.

The B- credit standing positioned the agency six notches beneath funding grade.

“We view Technique’s excessive bitcoin focus, slim enterprise focus, weak risk-adjusted capitalization, and low U.S. greenback liquidity as weaknesses,” the company stated.

However the score marks the primary time a Bitcoin-focused treasury firm has obtained an official S&P score, a big milestone for the crypto business’s rising overlap with conventional finance.

S&P Score ‘Hilarious’

Some analysts took challenge with the score. Adam Livingston, an analyst with 56k followers on X, known as it “hilarious.”

Everyone, please learn this because it pertains to Technique’s credit standing.

It is hilarious

S&P World: “we’re prone to proceed to view capital as a weak spot, as a result of Technique’s bitcoin holdings are prone to develop materially”

So mainly “the extra Bitcoin they purchase, the weaker… pic.twitter.com/vC4khB4sog

— Adam Livingston (@AdamBLiv) October 27, 2025

VanEck’s Matthew Sigel stated the B- score locations Technique in high-yield territory, implying a couple of 15% default danger over 5 years.

🚨Technique Inc Assigned ‘B-‘ Issuer Credit score Score; Outlook Steady at S&P

That’s high-yield territory. In a position to service debt for now, however susceptible to shocks.

S&P information: B issuers carry ~15% 5-yr default danger. https://t.co/ingZu6DRmH pic.twitter.com/RrHOWYmzVG

— matthew sigel, recovering CFA (@matthew_sigel) October 27, 2025

Regardless of the company’s score, Technique’s inventory (MSTR) rose nearly 2.3% yesterday to commerce at $295.63.

In the meantime, Technique added one other 390 BTC to its hoard at a price of about $43.4 million on Monday. The agency now holds 640,808 BTC.

Bitcoin Value Rebounds Above Key Resistance Ranges Amid Bullish Restoration

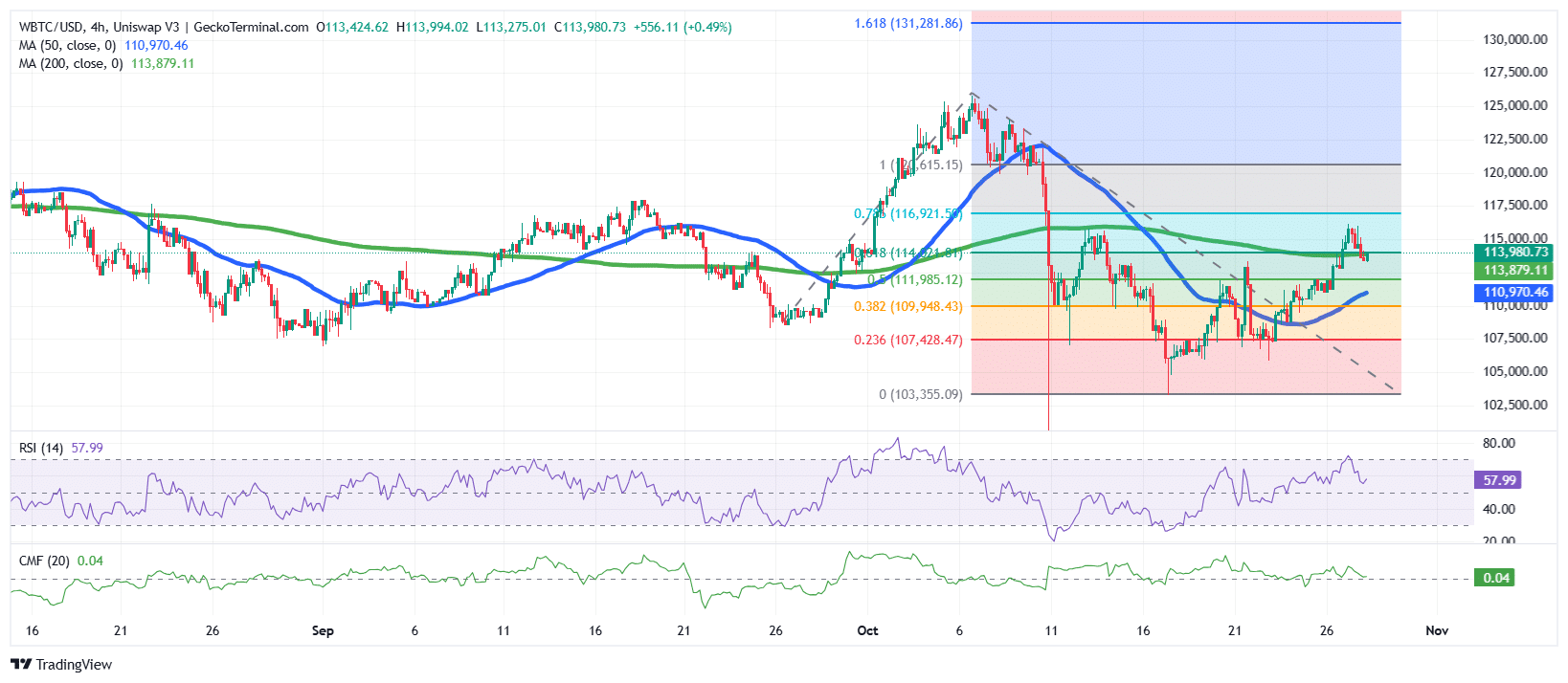

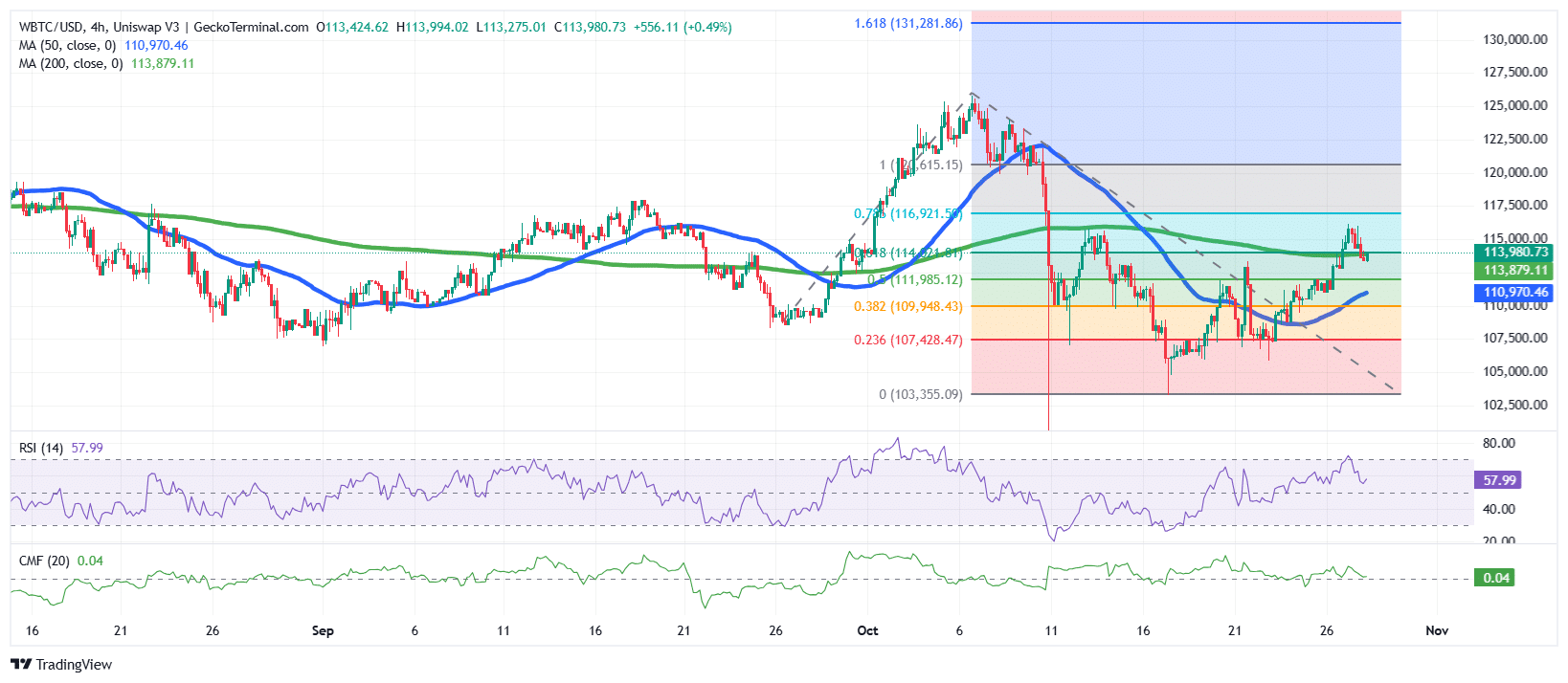

The BTC value has staged a powerful rebound over the previous week, indicating that the bulls are once more gaining momentum after a interval of consolidation and correction earlier in October.

Following the sharp decline from the native excessive close to $118,600, Bitcoin discovered help round $103,350, signaling the beginning of a brand new restoration section.

Since then, the BTC value has climbed steadily, breaking by a number of Fibonacci retracement ranges.

Presently, Bitcoin is buying and selling round $113,980, having moved above each the 50-day and 200-day Easy Shifting Averages (SMAs) on the 4-hour timeframe, a powerful sign that patrons are regaining management of the market.

The Relative Power Index (RSI) is at present above the 50-midline degree at 57.99. This studying indicators that bullish momentum stays dominant, however with sufficient room for additional upside earlier than approaching overbought situations.

Moreover, the Chaikin Cash Circulation (CMF) reveals a mildly optimistic studying of +0.04, which is a sign of regular capital influx and rising investor confidence. Sustained readings above +0.10 would affirm stronger accumulation.

BTC is testing the 0.618 Fib degree ($114,324), which aligns with the 200-day SMA, a traditionally vital confluence level. A profitable breakout above this space may speed up features towards the $116,900–$118,600 vary.

BTC Value Bulls Eye Costs Above $118,000

Primarily based on the continued restoration try, the BTC value seems poised to proceed towards the higher resistance band, supplied it maintains momentum above the 50-day and 200-day SMAs.

If bullish strain persists, the subsequent key resistance ranges lie at $116,900 (0.786 Fib) and $118,600 (latest swing excessive). A breakout past this zone may open the trail to the Fibonacci extension goal at $131,280, representing a possible 15% upside from present ranges.

Ali Martinez, a preferred crypto analyst on X, says the value of BTC may nonetheless soar so long as it holds a sustained uptrend line.

Bitcoin $BTC: Every little thing depends upon this trendline! pic.twitter.com/n492Yjxi6b

— Ali (@ali_charts) October 28, 2025

Conversely, if the BTC value fails to carry above $111,900 (Fib 0.5), a short-term pullback towards $110,000 and even $107,400 (Fib 0.236) may happen earlier than one other upward try.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection