Metaplanet Inc., certainly one of Japan’s most distinguished Bitcoin-holding corporations, is popping to Bitcoin-backed borrowing to fund an formidable $500 million share buyback after its inventory worth slipped under the value of its Bitcoin reserves.

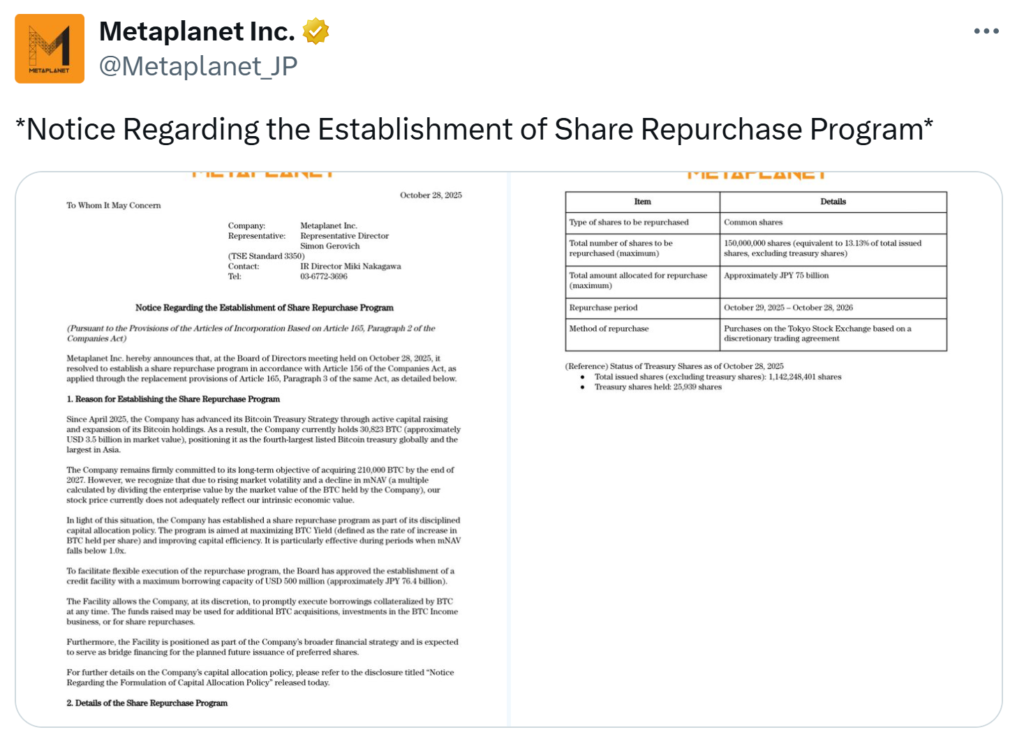

The Tokyo-listed agency introduced that its board authorised the repurchase of as much as 150 million shares – roughly 13% of its whole – to be carried out by the Tokyo Inventory Trade over the following two years. The transfer follows a pointy dip in Metaplanet’s market-based web asset worth (mNAV), which lately fell to 0.88 earlier than recovering barely.

To finance the buyback, Metaplanet secured a Bitcoin-collateralized credit score facility value half a billion {dollars}. The credit score line will give the agency flexibility to both repurchase shares or broaden its Bitcoin holdings, and will later function a bridge towards issuing most well-liked inventory.

Regardless of briefly pausing new Bitcoin purchases in the course of the mNAV decline, Metaplanet nonetheless holds over 30,000 BTC – valued at about $3.5 billion – and stays dedicated to its long-term goal of 210,000 BTC by 2027.

The corporate’s transfer comes amid rising volatility amongst Bitcoin treasury companies. A report by 10x Analysis famous that a number of such corporations have seen their valuations collapse after initially buying and selling nicely above their precise Bitcoin holdings, leaving many buyers within the purple.

Elsewhere, ETHZilla additionally introduced a $40 million buyback as its inventory trades at a steep low cost to its web asset worth, whereas S&P World Scores issued a speculative “B-” score to Michael Saylor’s Technique, citing excessive Bitcoin publicity and restricted diversification.