- Vitalik Buterin insists Ethereum’s L2s inherit full base-layer safety from Ethereum.

- Anatoly Yakovenko argues L2s nonetheless face “basic” dangers just like cross-chain bridges.

- The controversy reignites ETH vs SOL rivalry as each blockchains present parallel market efficiency.

Ethereum’s layer-2 ecosystem, as soon as seen as the last word resolution to blockchain scaling, is all of a sudden beneath the microscope. A heated back-and-forth between Ethereum’s Vitalik Buterin and Solana’s Anatoly Yakovenko has sparked contemporary questions on whether or not these networks are as safe as folks suppose—or if the cracks are beginning to present.

Buterin Stands by Ethereum’s L2 Safety

Vitalik Buterin has lengthy been vocal about his confidence in Ethereum’s L2 mannequin. He argues that these networks inherit safety instantly from Ethereum’s base layer, that means they’re shielded from typical 51% assaults. In concept, L2s stay protected so long as Ethereum itself stays safe.

Nonetheless, Buterin did admit that issues come up when L2 validators function exterior Ethereum’s instant management. As soon as they begin dealing with off-chain capabilities independently, the road between inherited and exterior safety begins to blur. Nonetheless, he maintains that total, Ethereum’s rollup-based ecosystem—residence to over $35 billion in complete worth locked (TVL)—is essentially sound. And with greater than 1,000,000 validators securing the community, he sees little motive for panic.

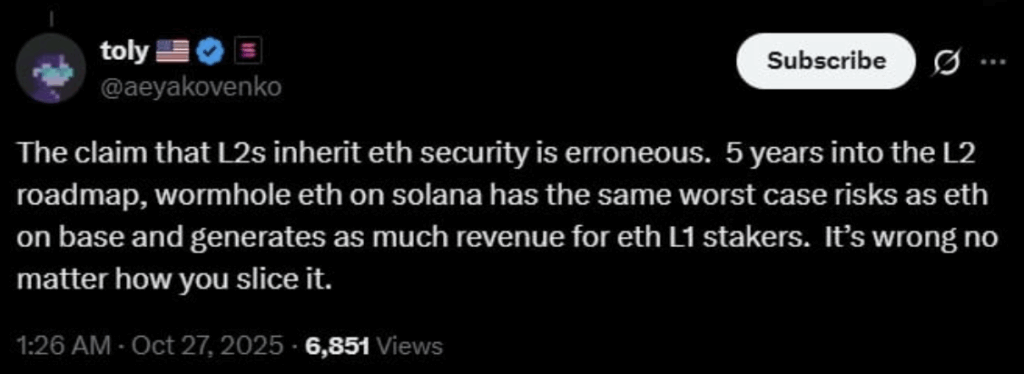

Yakovenko Pushes Again, Calling L2s Dangerous

Solana’s Anatoly Yakovenko wasn’t satisfied. He slammed Buterin’s view as “deceptive,” arguing that even after years of iteration, Ethereum’s L2s nonetheless face the identical vulnerabilities as cross-chain bridges like Wormhole. In his view, the safety dangers haven’t been solved—they’ve simply been repackaged.

Yakovenko pointed to a few principal weaknesses: overly complicated code that widens the assault floor, multi-sig custody setups that would transfer person funds with out direct consent, and off-chain processing that centralizes an excessive amount of management within the arms of some. He even floated an thought—flip Ethereum right into a “layer-2” for Solana utilizing a specialised bridge to repair interoperability and safety without delay. It was half a jab, half a problem, and it undoubtedly obtained folks speaking.

Ethereum Supporters Push Again

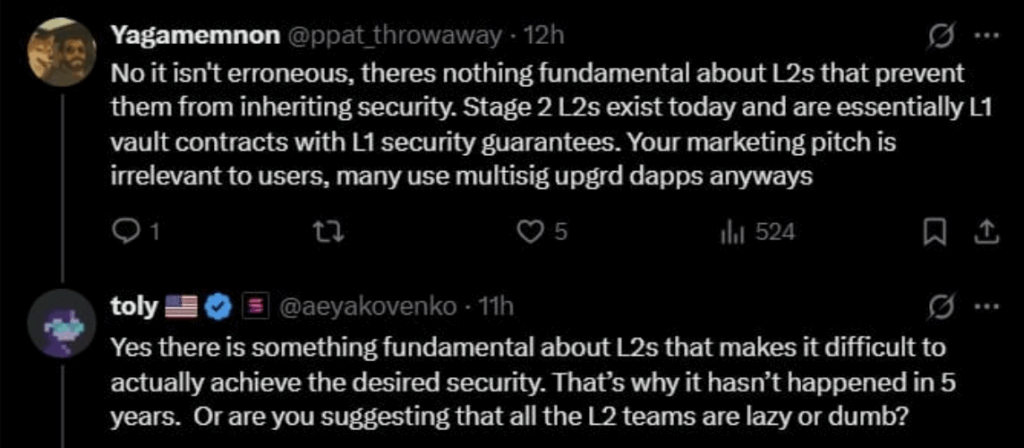

Not everybody agreed with Yakovenko’s take. A number of Ethereum builders fired again, saying there’s “nothing basic” stopping L2s from reaching full Ethereum-level safety. They argued that superior rollups—so-called Stage 2 L2s—already function like vault contracts absolutely protected by L1. Upgrades like fraud proofs and validity proofs, they mentioned, are closing the hole even sooner.

However Yakovenko didn’t again down. He doubled down on his declare that the hole is basic—a core design limitation that Ethereum nonetheless hasn’t solved after 5 years of making an attempt. His warning echoed throughout crypto Twitter, reigniting the age-old ETH vs SOL rivalry with a unique approach: decentralized scaling versus vertical integration.

ETH vs SOL: Neck and Neck Efficiency

Within the markets, each Ethereum and Solana have moved virtually in sync all through the previous 12 months. Ethereum’s up about 15.4% year-to-date, whereas Solana’s gained round 7.3%. Each noticed main rallies throughout mid-year, cooled off sharply in September, and have been slowly grinding larger since.

As of late October, Ethereum holds a slight edge, however the dialog round its layer-2 safety may affect investor sentiment transferring ahead. Whether or not Vitalik or Anatoly finally ends up being proper—solely time, and maybe a couple of exploits, will inform.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.