Be part of Our Telegram channel to remain updated on breaking information protection

JPYC, a fintech agency based mostly in Tokyo, has launched Japan’s first yen-backed stablecoin in addition to a platform to concern the brand new token.

The stablecoin, with the ticker “JPYC,” went dwell in the present day and is backed 1:1 by financial institution deposits and authorities bonds. It additionally has a 1:1 change price with the yen, in response to an announcement by the corporate. The stablecoin’s issuer mentioned that it’s going to not cost a transaction charge, and can as a substitute generate income from curiosity on its holdings of the Japanese authorities bonds.

Companies Present Curiosity In Integrating With JPYC Stablecoin

Talking at a current press convention, JPYC President Noriyoshi Okabe mentioned that his firm’s stablecoin is a “main milestone within the historical past of the Japanese forex,” in accordance to a report from Enterprise Insider Japan.

ついに、日本円建初のステーブルコインJPYCが!

JPYCの発行償還が開始されました。https://t.co/X3gLEVRFs7【開発者向け】

コントラクトアドレスは契約前準備書面をご覧ください。https://t.co/hHpY0HIyCW— 岡部典孝 JPYC代表取締役 (@noritaka_okabe) October 27, 2025

He added that the stablecoin has attracted curiosity from seven firms which can be planning to combine with the token.

Fintech Software program agency Densan System is creating cost techniques for retail shops and e-commerce platforms incorporating the recently-launched stablecoin. In the meantime, Asteria plans so as to add performance for the token to its enterprise information integration software program, which is utilized by greater than 10K firms. HashPort, the crypto pockets, additionally plans on supporting JPYC transactions.

JPYC Can Flow into Globally

The JPYC stablecoin will have the ability to flow into globally, which is a stage of flexibility that tokens in different Asian areas don’t have. Each the Korean gained and the Taiwan greenback are onshore currencies by native legislation. Conversely, Japan’s yen is freely convertible and can be utilized offshore.

That’s following reforms within the Nineteen Eighties that dismantled Japan’s postwar capital controls.

Seoul’s present coverage for the gained preserves financial management. It additionally leaves little room for a worldwide stablecoin to perform, on condition that such a token could be restricted to whitelisted Korean customers and largely home settlements.

Taiwan is in an analogous state of affairs. Whereas its greenback is technically convertible, it isn’t used offshore. What’s extra, Taipei’s stablecoin framework that was launched in June mandates full onshore reserves and central financial institution reporting. That is to forestall cross-border leakage.

JPYC Accompanied By A Platform Launch

Alongside the JPYC stablecoin, the token’s issuer has additionally launched JPYC EX. This can be a devoted platform that may facilitate the issuance and redemption of the token.

That platform will probably be ruled by strict id and transaction verification underneath the Act on Prevention of Switch of Prison Proceeds.

Customers are in a position to deposit Japanese yen into an account through a financial institution switch to obtain JPYC to a registered pockets handle. They will additionally obtain a refund in yen to a withdrawal account.

US Stablecoins Nonetheless Dominate The Market

JPYC’s launch comes amid a stablecoin increase. A current report confirmed that stablecoin cost settlements have grown roughly 70% prior to now six months, from round $6 billion in February this yr to $10 billion by August.

A portion of that development comes after US President Donald Trump signed the GENIUS Act into legislation in July. This act gave the business some much-needed regulatory readability, and has established a framework for stablecoin corporations seeking to concern their tokens within the US to comply with.

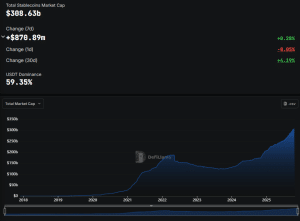

Stablecoins pegged to the US greenback nonetheless dominate the market, which has a capitalization of greater than $308 billion, in response to information from DefiLlama.

Stablecoin market cap (Supply: DefiLlama)

The largest stablecoins by market cap are Tether’s USDT and Circle’s USD Coin (USDC), which have respective capitalizations of greater than $183.15 billion and $75.81 billion.

After USDT and USDC, the next-biggest stablecoins are Ethena’s USDe and Sky Greenback, with their complete capitalizations standing at over $10.36 billion and $5.31 billion, respectively.

In the meantime, tokens pegged to the Japanese yen at the moment have a mixed capitalization of round $7.82 million, the DefiLlama information reveals.

Nonetheless, yen-backed stablecoins may quickly take up extra market share as JPYC says its plan is to concern 10 trillion yen, roughly $65.4 billion, of its token inside three years. The corporate additionally plans to develop the variety of blockchains that assist the token in addition to enter into collaborations with extra companies.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection