Japanese startup JPYC has launched the primary stablecoin pegged to the yen, backed by home financial savings and Japanese authorities bonds.

JPYC Is The First Yen-Backed Stablecoin In The World

JPYC introduced on Monday the launch of its yen-backed stablecoin, additionally known as “JPYC.” A stablecoin is a cryptocurrency pegged to a fiat foreign money, and at current, the sector is closely dominated by tokens tied to the US Greenback, with USDT and USDC alone accounting for almost all of the market.

Japan is now additionally dipping into the area with this new stablecoin. In line with JPYC, the token will probably be backed 1:1 by home deposits and Japanese authorities bonds (JGBs). Customers should purchase or promote the asset by way of JPYC EX, the Japanese startup’s official platform. The corporate is providing zero charge on issuance and redemption for now, as an alternative turning to the curiosity from the JGBs as a supply of revenue.

The token is initially changing into obtainable on Ethereum, Avalanche, and Polygon, with help for extra blockchains deliberate. In line with Reuters, JPY is aiming to problem 10 trillion yen price of the stablecoin over the following three years. On the present price, this goal is equal to about $65.5 billion.

USDC, the second-largest fiat-tied token within the sector, has a market cap of about $76.3 billion proper now. Thus, if JPYC meets its bold goal, it may doubtlessly rival the USD-ruled stablecoin market. The JPYC launch isn’t the one stable-related improvement that has occurred in Japan lately. As reported by Bitcoinist, three Japanese megabanks are planning to problem a yen-backed token by the tip of 2025.

The banks in query are Mitsubishi UFJ Monetary Group (MUFG) Financial institution, Sumitomo Mitsui Banking Corp., and Mizuho Financial institution. Collectively, they serve over 300,000 purchasers.

Institutional curiosity in cryptocurrencies has been rising within the East Asian nation lately as the federal government is contemplating a regulatory rule change that might permit banks to carry Bitcoin and different digital property for funding functions, and register themselves as “crypto trade operators,” changing into capable of supply buying and selling companies to clients.

Whereas Japan has been transferring in a crypto-positive path, China has remained cautious, providing impediments to stablecoin plans in Hong Kong, in keeping with Monetary Instances.

The Chinese language metropolis launched its stablecoin laws earlier within the 12 months and obtained enquiries from a number of tech giants for an issuer license. Mainland regulators, nonetheless, have urged the businesses to halt their plans, elevating issues in regards to the progress of currencies managed by the personal sector.

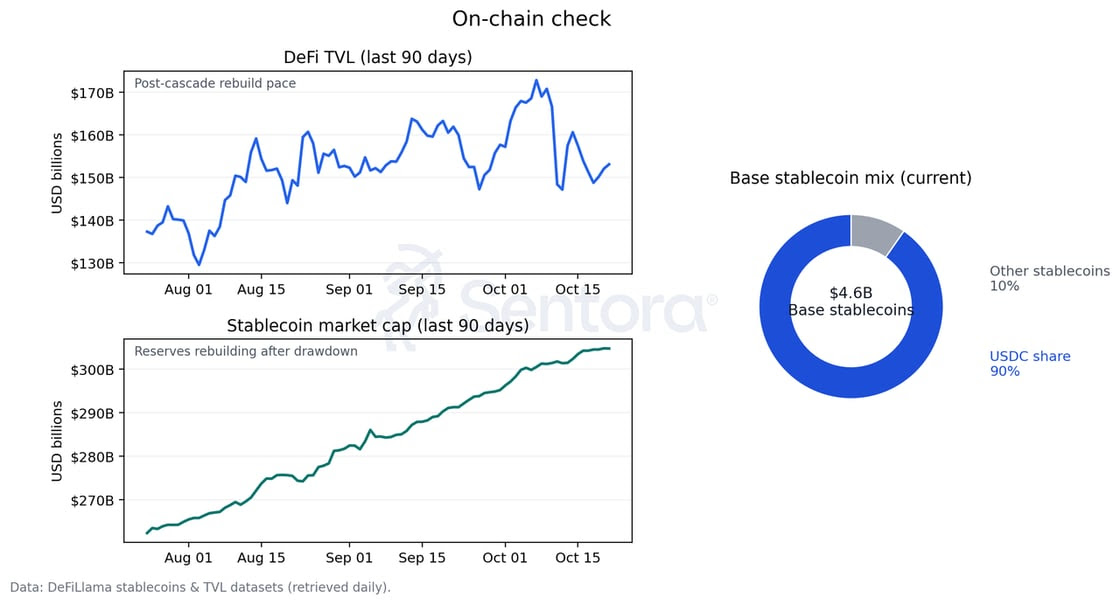

Globally, digital property pegged to fiat currencies have continued to take pleasure in capital inflows lately regardless of Bitcoin and altcoins dealing with volatility. Because the chart shared by institutional DeFi options supplier Sentora reveals, the sector has seen its market cap break a report of $308 billion.

The development out there cap of stables | Supply: Sentora on X

Bitcoin Value

On the time of writing, Bitcoin is buying and selling round $115,200, up almost 4% over the past week.

The worth of the coin appears to have been going up | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Sentora.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.