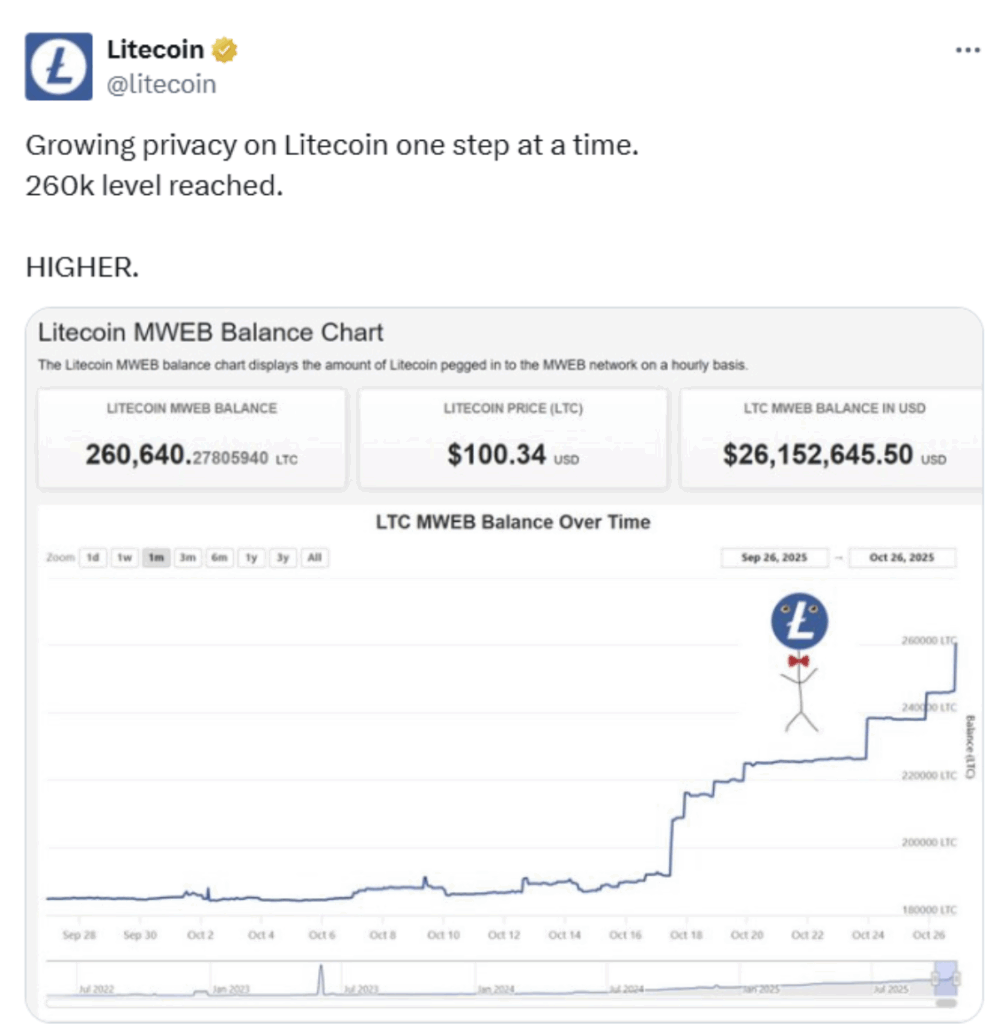

- MWEB privateness balances have surpassed 260K LTC, signaling regular on-chain development.

- Litecoin is forming a long-term bullish pennant sample across the $99 zone.

- ETF rumors add hypothesis as merchants look ahead to a breakout above key resistance.

Litecoin is quietly gaining consideration once more, not for hype or wild worth strikes, however for one thing extra natural — rising utilization. Extra holders are locking their cash into the community’s MWEB (MimbleWimble Extension Blocks) characteristic, a privateness improve that lets customers ship transactions with out publicly revealing the quantities. It’s not flashy, nevertheless it reveals persons are nonetheless utilizing Litecoin for what it was constructed for — on a regular basis funds with a contact of privateness.

MWEB Balances Preserve Rising

Over time, the stability of cash held in MWEB has climbed steadily, now sitting above 260,000 LTC — price roughly $26 million at present costs close to $100. The chart doesn’t present large spikes; it rises step by step, like individuals have been quietly including to their MWEB balances month after month.

This gradual, constant development says lots. It means holders are utilizing Litecoin for extra than simply buying and selling — they’re valuing its privateness and utility. Even throughout quieter stretches available in the market, when costs aren’t doing a lot, exercise inside MWEB has stayed robust. It’s virtually like a background heartbeat that retains the community alive, particularly for customers who wish to transfer or retailer cash with out drawing consideration.

Litecoin’s at all times been identified for low charges and ease, and MWEB provides one other layer — privateness. Collectively, these traits hold it related in a crypto world stuffed with complicated, costly, and typically dangerous options.

Value Chart Varieties Lengthy-Time period Bullish Pennant

In the meantime, the worth chart tells its personal story. Litecoin has been shifting inside what analysts name a bullish pennant — a long-term sample that varieties after a giant rally, adopted by consolidation in a tightening vary. The highest trendline slopes downward, the underside one slopes upward, and so they’re now assembly proper round $99.

In the event you zoom out, this sample stretches all the way in which again to 2017, when LTC rocketed from beneath $5 to over $400. Since then, it’s been years of sideways motion — over 1,200 buying and selling bars, in response to some analysts — however the construction is tightening. The idea is easy: as soon as worth breaks above the highest line with robust quantity, momentum may construct quick.

Merchants watching this setup say shopping for curiosity tends to reappear beneath $120, suggesting long-term believers are nonetheless quietly accumulating. If that breakout occurs, the following targets could be projected by including the peak of the earlier rally to the breakout level — a technique that’s guided many bullish predictions over time.

Will a Litecoin ETF Convey Extra Gas?

Including to the intrigue, there’s rising hypothesis a couple of potential Litecoin ETF. If accepted, it will let conventional buyers acquire publicity by way of regulated channels — no wallets, no non-public keys, only a ticker image.

The success of Bitcoin’s spot ETFs earlier this yr has reignited speak that Litecoin, as one of many oldest and most steady networks, could possibly be subsequent in line. Nonetheless, nothing official has been confirmed. For now, merchants are merely watching and ready.

With privateness use climbing, a large long-term sample nearing completion, and the faint buzz of ETF hypothesis within the background — Litecoin appears to be quietly gearing up for its subsequent chapter. Whether or not it breaks out or retains coiling, the items are falling into place for one thing large down the street.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.