• VeChain fell practically 20% this month to round $0.01 however retains key enterprise partnerships.

• Analysts see the decline as a shopping for alternative backed by sturdy fundamentals.

• Lengthy-term outlook stays bullish if market situations and adoption enhance — right here is why VET’s crash could also be a blessing in disguise.

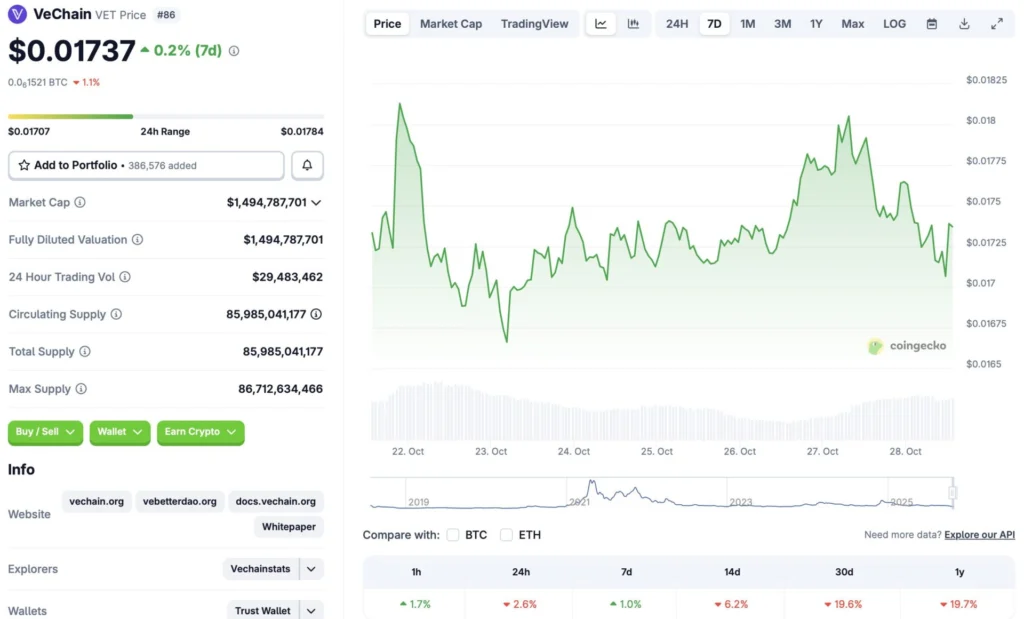

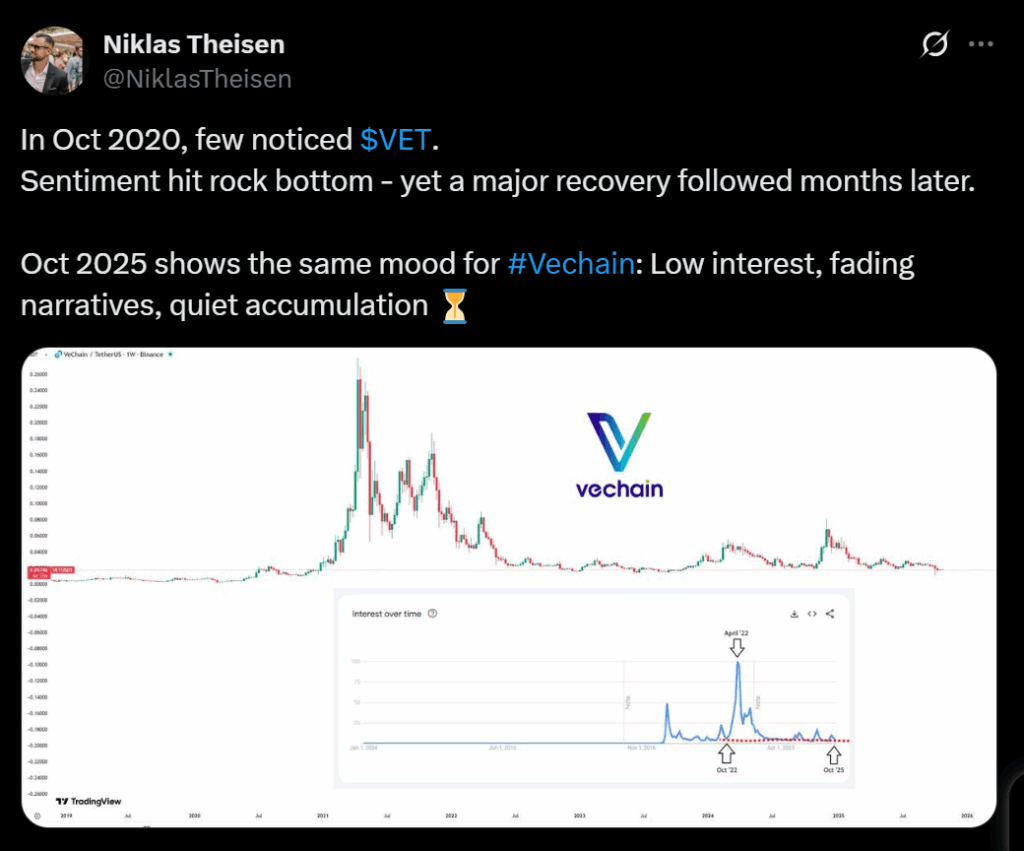

VeChain (VET) has been beneath stress amid the continuing market correction, dropping 2.6% in 24 hours and practically 20% over the previous month, in line with CoinGecko. The token now trades close to $0.01, marking a 93% fall from its all-time excessive of $0.281 set in April 2021. Regardless of the steep decline, VET did handle a modest 1% weekly acquire, hinting that accumulation could also be quietly going down amongst long-term traders.

Why the Value Crash Could Be a Blessing

Analysts argue that VeChain’s pullback may signify a strategic entry level for affected person traders. The undertaking’s deal with provide chain transparency, enterprise-grade blockchain options, and eco-friendly innovation offers it sturdy fundamentals in comparison with many speculative altcoins. Its expertise has already been adopted by Walmart China, BMW Group, LVMH, Bayer, and even the UFC, underscoring real-world use instances that might drive future demand as soon as macro situations enhance.

Fundamentals Stay Sturdy Regardless of Market Weak spot

VeChain’s infrastructure continues to develop by way of company integrations and sustainability partnerships. The undertaking’s dual-token mannequin, which separates governance (VET) from fuel charges (VTHO), stays a favourite amongst enterprise adopters in search of scalable blockchain instruments. Many analysts consider that after inflation pressures ease and danger urge for food returns to crypto markets, VeChain may emerge as a high contender within the subsequent development section — benefiting from each its utility and inexperienced expertise credentials.

Lengthy-Time period Outlook: Positioning for the Subsequent Cycle

If Bitcoin strikes towards its projected $1 million mark by 2030, analysts count on high-utility initiatives like VeChain to comply with the pattern. With its token value at multiyear lows, the present market section may provide uneven upside for long-term believers. Whereas short-term volatility could persist, VeChain’s ongoing partnerships and robust fundamentals make this dip look much less like a collapse — and extra like an early accumulation window.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.