Be part of Our Telegram channel to remain updated on breaking information protection

The XRP value has jumped 9% previously week and 1.4% within the final 24 hours to commerce at $2.65 as of 4 a.m. on a 3% improve in buying and selling quantity to $4.69 billion.

That improve comes as the chances of a Fed fee lower on Wednesday soared to 97.8%, in line with the CME Group’s FedWatch gauge.

🇺🇲 97.8% likelihood for 25 BPS fee lower at tomorrow’s #FOMC 🔥

What di you assume will occur after that? pic.twitter.com/D7tgj97mIN

— Crypto Seth (@seth_fin) October 28, 2025

The speed choice looms amid a authorities shutdown that has delayed key jobs and inflation experiences, leaving Fed Chair Jerome Powell and policymakers “flying blind,” utilizing non-public knowledge and market alerts as an alternative of official authorities statistics.

Regardless of these challenges, sluggish job progress, rising unemployment, and inflation caught at 3% have satisfied most economists {that a} fee lower is the precise transfer.

A lower would convey the federal funds fee right down to a spread of three.75%-4% from 4.00%-4.25%. That is seen as constructive for crypto as decrease rates of interest assist generate extra liquidity that always pushes funds into riskier belongings like crypto.

XRP Coin Value Drives Consideration

Coin value exercise for XRP has been sizzling as merchants place for a Fed transfer. Within the final seven days, XRP surged about 9% and hit highs of $2.66, buying and selling a decent vary as enthusiasm for financial easing spreads throughout crypto exchanges.

A number of giant inflows have been recorded, with new consumers showing each time the value dips towards $2.60.

October has introduced bullish forecasts, with market consultants seeing XRP’s value probably climbing to $3.25 or larger if shopping for momentum holds. Technical evaluation by Changelly initiatives XRP could commerce between $2.87 and $3.25 this month, representing a doable 12–30% improve from present ranges.

These targets are lifted by the expectation of extra “simple cash” coming into markets after the Fed assembly.

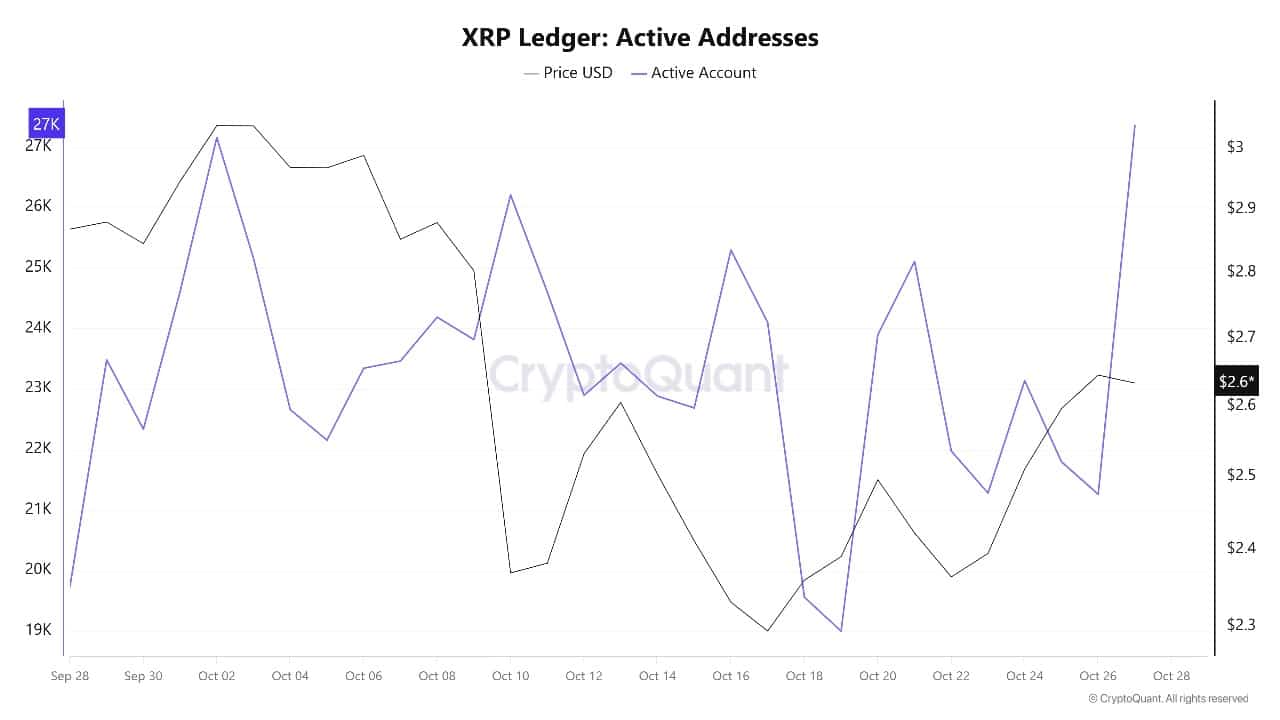

On-chain alerts additionally assist the bullish outlook for coin costs. Lively pockets addresses and massive transaction volumes are rising. This means that an rising variety of merchants, buyers, and even establishments are shifting into XRP forward of the Fed’s choice.

XRP Lively Addresses Supply: CryptoQuant

XRP Value Prediction: XRP Technical Evaluation

XRP’s value motion has caught consideration on charts with sturdy assist and resistance proven at key shifting averages. The most recent day by day chart offers a transparent technical view.

The value is now buying and selling at $2.6524, slightly below the 50-day Easy Shifting Common (SMA) at $2.7651 and above the 200-day SMA at $2.6116. This set-up alerts an enhancing pattern, with the coin bouncing off main assist.

XRPUSDT Evaluation Supply: Tradingview

The closest resistance sits at $2.77 (the 50-day SMA). If XRP can surge previous this stage, the value could goal the subsequent resistance close to $3.00. A key psychological and technical zone the place sellers have appeared earlier than.

Assist is robust at $2.61 (200-day SMA). A drop under this might set off extra promoting right down to $2.50 and $2.30, however consumers are defending these ranges tightly.

Technical indicators additionally level to extra upside. RSI stands at 53.10, exhibiting stable momentum however not an overbought market. The MACD is barely bullish, with a worth of 0.0439 and the sign line at -0.0470, indicating consumers are gaining power however have room to develop.

The ADX is at 39.30, which implies the pattern is strengthening, and excessive volatility may spark breakout strikes quickly.

If XRP value closes above $2.77 within the coming classes, it may rapidly advance to $3.00 after which $3.33, particularly if the Fed’s fee lower triggers one other wave of shopping for.

A rejection at resistance would possibly see XRP fall towards assist, however so long as it stays above $2.61, the general pattern seems to be constructive.

Massive institutional cash may very well be coming in, and any information on spot XRP ETFs or main partnerships would possibly add gasoline to the rally. For now, merchants are watching the Fed’s transfer, with most anticipating the speed lower to drive extra features in XRP’s coin value this week.

If present momentum holds and the Fed delivers the anticipated lower, XRP may break essential resistance and preserve climbing by early November. However as all the time, holding an in depth eye on key assist ranges, particularly close to $2.61, is essential for managing danger.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection