- Solana’s $BSOL ETF led with $56 million in first-day buying and selling however noticed SOL value drop 3.6%.

- Hedera’s $HBR ETF had low quantity ($8M) but HBAR jumped 4.9%, signaling rising retail curiosity.

- Litecoin’s $LTCC ETF struggled with weak demand, reflecting fading hype for legacy crypto property.

The primary wave of U.S. altcoin ETFs lastly hit the market on October 27, increasing the crypto ETF scene past Bitcoin and Ethereum. However as an alternative of fireworks, the outcomes have been slightly uneven. Whereas Solana, Hedera, and Litecoinall noticed buying and selling debut underneath their new tickers — $BSOL, $HBR, and $LTCC — their market reactions couldn’t have been extra completely different.

Solana ETF Sees Big Demand, However Worth Stumbles

Solana’s $BSOL ETF from Bitwise completely crushed the first-day stats, clocking in round $56 million in buying and selling quantity, the largest of any ETF launch this 12 months. However regardless of all that focus, SOL’s value slipped 3.6%, falling again to roughly $191 after briefly touching $203.

Technical charts present the RSI at 45, which indicators impartial momentum — not likely bearish, however not thrilling both. Quite a lot of merchants imagine the drop was basic purchase the rumor, promote the information conduct. The hype main as much as the ETF most likely pushed the worth up, and now we’re simply seeing profit-taking kick in.

Hedera ETF Surprises with Small Quantity, Huge Worth Soar

On the flip aspect, Hedera’s $HBR ETF didn’t seize huge consideration volume-wise — nearly $8 million traded on day one — however the token itself popped practically 4.9%, touchdown round $0.193. Its RSI climbed to 53, exhibiting clear indicators of bullish strain.

That’s an attention-grabbing twist as a result of it means that retail merchants and smaller funds could be shifting towards lower-cap Layer-1s like Hedera, betting on potential staking rewards or future inflows. Mainly, though the ETF wasn’t as hyped as Solana’s, folks appear to be warming as much as HBAR’s long-term worth story.

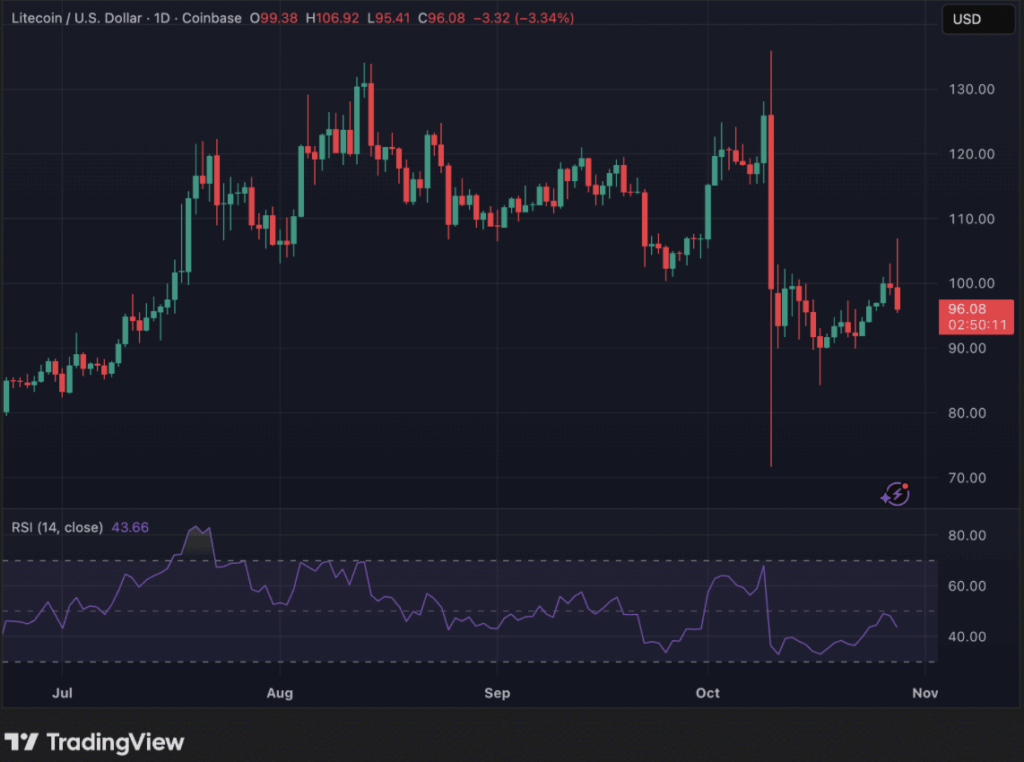

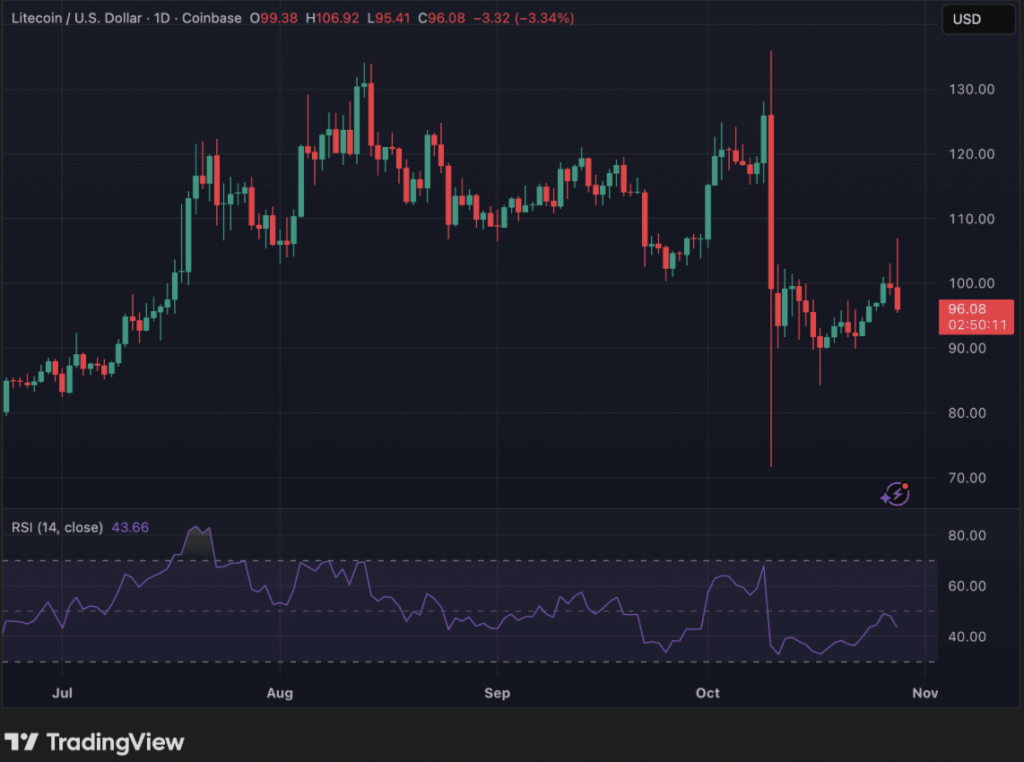

Litecoin ETF Struggles to Entice Curiosity

Then there’s Litecoin — which didn’t have the very best day. The $LTCC ETF barely hit $1 million in first-day quantity, and LTC’s value dropped 3.3% to round $96. Technicals weren’t trying too brilliant both, with an RSI close to 43, hinting at weak shopping for curiosity.

It’s type of the identical story we’ve been listening to for months: Litecoin feels extra like an old-school asset moderately than a cutting-edge crypto. Except quantity picks up, this ETF would possibly solely attraction to area of interest buyers or these nostalgic for crypto’s early days.

What the Market’s Response Actually Means

All in all, the launch of those altcoin ETFs confirmed that not each itemizing sparks a rally. Buyers aren’t throwing cash blindly at new merchandise anymore — they’re being selective, selecting tasks with stable fundamentals, development potential, or staking yields.

Nonetheless, the truth that three non-BTC, non-ETH spot ETFs launched efficiently on U.S. markets is a giant step ahead. It indicators that the crypto ETF house is evolving — changing into extra mature, extra various, and possibly rather less emotional.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.