- TIS, Japan’s largest funds processor ($2T yearly), is launching a blockchain platform with Ava Labs.

- The platform, constructed on Avalanche’s AvaCloud, will tokenize stablecoins and belongings below Japan’s Fee Act.

- AVAX kinds a bullish falling wedge — holding above $11 might ship it surging towards $30+.

Avalanche (AVAX) simply landed one in every of its greatest partnerships but — and it’s from Japan. TIS, one of many nation’s largest fee infrastructure suppliers dealing with over $2 trillion yearly, has teamed up with Ava Labs, the builders behind Avalanche, to launch a brand new blockchain-based funds platform. The Avalanche group is buzzing, seeing this as a much-needed enhance for the AVAX ecosystem, although the token slipped 1% during the last 24 hours.

Japan’s TIS Pushes for On-Chain Monetary Infrastructure

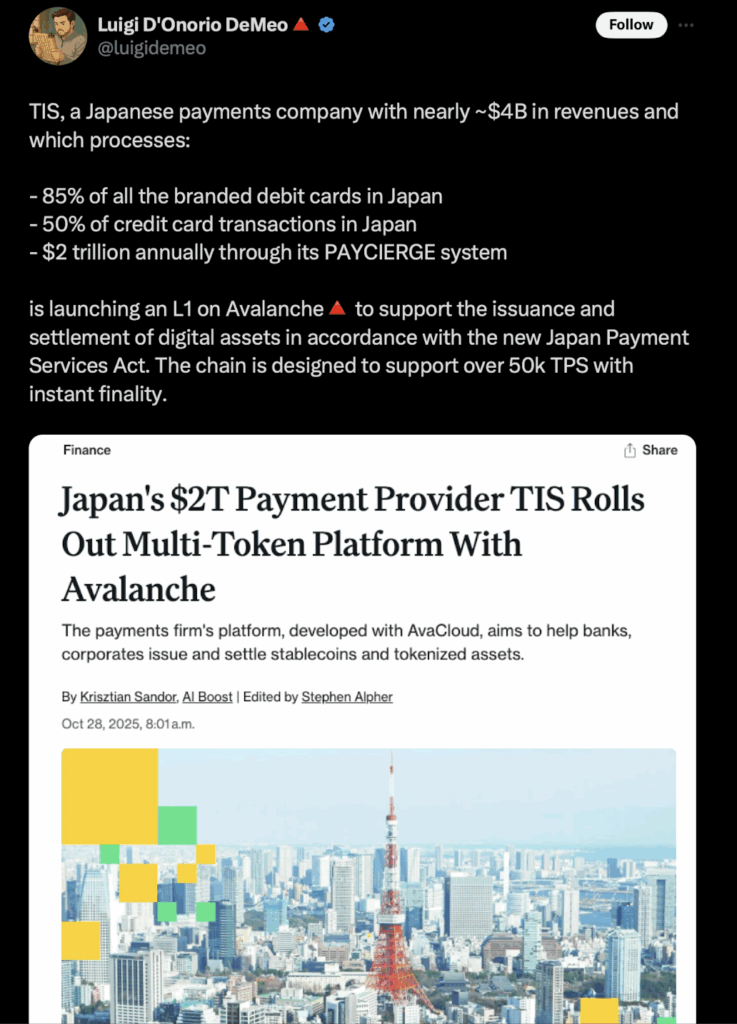

TIS is rolling out what it calls the “Multi-Token Platform”, constructed on AvaCloud, Avalanche’s enterprise blockchain suite. The platform is designed to assist Japanese monetary establishments concern, settle, and handle tokenized belongings — every thing from stablecoins to digital bonds — all below the Fee Companies Act.

TIS plans to collaborate with banks, companies, and even authorities businesses to scale this platform globally. The timing couldn’t be higher, as Japan’s urge for food for digital belongings is heating up. Simply this week, JPYC, the nation’s first regulated yen-pegged stablecoin, launched with backing from financial institution deposits and authorities bonds.

For context, TIS processes roughly ¥300 trillion ($2T) a 12 months by its PAYCIERGE community — a system that handles almost half of all Japan’s bank card transactions. If profitable, the brand new platform might reshape how establishments deal with funds, changing legacy methods with programmable blockchain rails.

Why This Partnership Issues for Avalanche

TIS isn’t simply any firm — it’s a publicly traded big with a market cap round $1.2 trillion yen (~$8 billion USD). Partnering with Ava Labs provides the Avalanche ecosystem a large institutional footprint in Asia. The deal will present TIS with a devoted Layer-1 blockchain, providing full management over privateness, governance, and efficiency, all powered by Avalanche’s community — able to processing over 50,000 transactions per second with near-instant finality.

AvaCloud CEO Nick Mussallem highlighted that this platform might help real-time settlements, embedded finance, and even central financial institution digital forex (CBDC) testing down the road. If it really works as meant, this might function the muse for Japan’s broader transfer towards on-chain monetary methods.

For the Avalanche group, this announcement looks like a breath of recent air. The ecosystem — as soon as seen as a high Layer-1 contender — has struggled to maintain tempo with faster-growing rivals like Solana, Base, and Ethereum. However a partnership of this scale might assist reignite investor curiosity and convey new liquidity into the community.

Avalanche’s TVL Slips, However Chart Patterns Look Bullish

Regardless of the massive information, AVAX value hasn’t reacted strongly but, hovering round $23.5 after a small 1% decline. Complete Worth Locked (TVL) on Avalanche dropped beneath $2 billion lately, displaying weaker ecosystem participation — a reminder that this community nonetheless has floor to get better.

Nonetheless, the technical outlook isn’t all dangerous. On the month-to-month chart, AVAX seems to be forming a falling wedge sample, a construction that usually precedes breakouts. So long as the worth stays above $11, the bullish setup stays legitimate. If momentum picks up, a breakout above $23.5 might set off an explosive rally towards $30–$32.

Momentum indicators are beginning to align too — the RSI lately broke out, and the MACD flipped bullish, each signaling the potential for a robust transfer forward. With the FOMC assembly anticipated to carry a 25bps charge lower, risk-on belongings like crypto might see renewed volatility — and AVAX is perhaps among the many greatest beneficiaries.

Closing Ideas: Can Avalanche Reclaim Its Spot Amongst Prime Layer-1s?

Avalanche’s new partnership with Japan’s $2T funds powerhouse TIS might mark a turning level for the community. If this blockchain platform proves profitable, it might assist AVAX reclaim misplaced floor and re-establish itself as a serious Layer-1 contender.

With international finance shifting towards tokenization and programmable settlement methods, Avalanche’s wager on institutional-grade infrastructure may lastly begin paying off. The charts counsel a breakout may very well be brewing — and the basics simply bought a critical improve.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.