Joe Bryan, a former derivatives dealer turned Bitcoin educator, has change into one of many extra considerate voices within the “onerous cash” debate. His central declare is straightforward: gold was as soon as the very best type of onerous cash humanity had, however Bitcoin has surpassed it.

We began 1000’s of years in the past with a type of cash that seemed like beads or jewellery, nonetheless it didn’t have the seven traits of good cash. He defines good cash by a set of traits akin to shortage, verifiability, portability, sturdiness, divisibility, and resistance to censorship.

Gold and Bitcoin each rating extremely on shortage and sturdiness, however gold fails badly with regards to portability and divisibility. An individual can transfer Bitcoin wherever on the planet in seconds. Gold, in contrast, is heavy, troublesome to move securely, and nearly inconceivable to divide or confirm immediately.

Bryan typically frames Bitcoin as the following logical step in financial evolution. Gold served its function for hundreds of years, anchoring financial stability beneath the gold customary. As soon as governments indifferent their currencies from gold, the world entered what he calls a “damaged cash” period, the place fiat currencies may be inflated with out restraint. Bitcoin, in his view, restores financial self-discipline whereas bettering on gold’s weaknesses.

Why Bitcoin Beats Gold

Bitcoin is “good cash” as a result of it combines the shortage of gold with the effectivity of digital know-how. Each Bitcoin may be verified immediately by anybody, whereas gold can not. It may be despatched globally with out intermediaries, and it can’t be debased by a government.

Gold’s bodily nature, as soon as its power, now makes it out of date in a digital financial system. Transporting giant portions of gold throughout borders requires value, danger, and belief in third events. Bitcoin eliminates all of that. Bryan calls it “self-sovereign cash,” as a result of holders management it instantly in their very own pockets somewhat than via banks or governments.

He additionally highlights an often-overlooked level: gold provide isn’t completely capped. New mining operations can improve world provide, when the gold value makes it worthwhile to mine gold you possibly can make sure that somebody will exit and achieve this, whereas Bitcoin’s whole issuance won’t ever exceed 21 million cash. This mounted provide, Bryan argues, offers Bitcoin absolute shortage, one thing no different asset has achieved in historical past.

Progress Ought to Be Deflationary

Bryan’s place isn’t solely financial however ethical. He views financial inflation as a mechanism that transfers wealth from savers to debtors and from the poor to the politically related. Bitcoin, in contrast, permits people to decide out of a system constructed on debt and financial manipulation.

Gold as soon as provided that very same escape, however the world modified. Bitcoin permits the identical resistance to inflation in a borderless, digital type. For Bryan, that makes it the ultimate stage in humanity’s seek for sound cash.

From Gold Bars to Non-public Keys

Bryan’s message is obvious: for those who consider within the ideas that when made gold helpful: shortage, freedom, and independence, then Bitcoin is the logical successor. However understanding that concept is simply step one.

Proudly owning Bitcoin responsibly means holding it in a pockets you management. Exchanges can fail, however non-public wallets put you answerable for your personal property. Self-custody ensures that your Bitcoin stays actually yours, protected by your personal keys somewhat than by a 3rd social gathering’s guarantees.

Holding Bitcoin in Your Personal Pockets

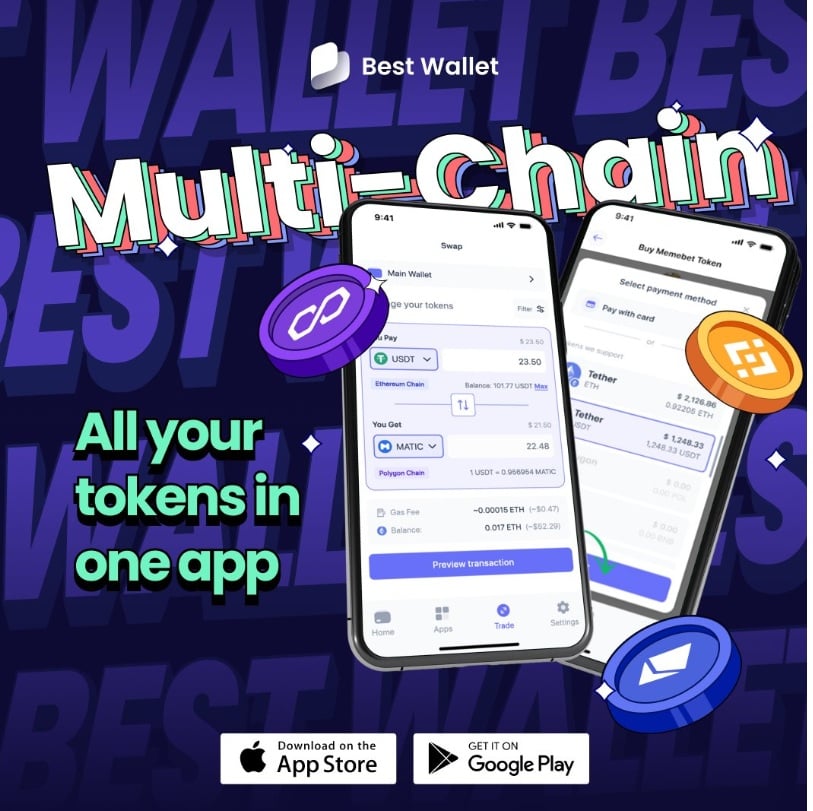

As traders reassess their funding technique and transfer into Bitcoin, they’re additionally taking additional care in how they retailer it, shifting towards self-custody options like Greatest Pockets that give them full management over their property.

There are numerous explanation why Greatest Pockets could possibly be the most suitable choice for all traders in 2025. First, it’s self-custodial, so customers are in full management of their Bitcoin and are, due to this fact, not weak to withdrawal delays, frozen accounts, or change hacks.

Additionally, it doesn’t require its customers to finish KYC to have interaction in both fundamental or superior buying and selling, which makes it a extra engaging choice than centralized exchanges. Not solely that, Greatest Pockets additionally lets customers join different wallets to it so as to handle totally different portfolios in a single place.

On the similar time, it options an intuitive, user-friendly cellular interface that anybody, together with rookies, can simply navigate. It additionally helps a wide range of blockchains, together with Bitcoin, Ethereum, Solana, Base, Polygon, and Binance Sensible Chain, which means that it may be used to retailer, purchase, and commerce all of the tokens operating on these networks.

The thought is to help over 60 blockchains in whole via a sequence of updates, increasing the platform’s performance and attain. When it comes to buying and selling options, Greatest Pockets ticks all the fitting bins, permitting customers to buy 1000’s of cryptocurrencies utilizing fiat and likewise swap them for each other seamlessly, whatever the chain they’re on.

The pockets even goes additional by letting customers to spend money on new cryptocurrencies with high-growth potential via its token launchpad. Latest additions to the lineup of options on the platform embrace gamified rewards, which grant customers factors for visiting the pockets’s app each day and BTC swaps, which permit customers to swap BTC for another supported crypto, and vice versa.

When paired with its Fireblocks-backed safety system, it’s straightforward why respected publications just like the New York Put up are rating it among the many finest choices to purchase Bitcoin safely in 2025.

Obtain Greatest Pockets

This text has been offered by one in all our business companions and doesn’t mirror Cryptonomist’s opinion. Please bear in mind our business companions could use affiliate packages to generate revenues via the hyperlinks on this text.