Though Bitcoin has continued to face a collection of corrections fueling uncertainties throughout the market, whales have continued to more and more transfer the asset in giant portions.

On Wednesday, October 29, widespread crypto analyst Ali Martinez revealed a big surge in Bitcoin’s whale exercise over the week, as whales received’t relent on constantly accumulating the main cryptocurrency.

Over 6,311 giant BTC transfers in 1 week

In a latest X put up, the analyst shared on-chain information from Santiment displaying a notable surge in giant transactions, with over 6,311 Bitcoin whale transfers recorded this week.

Notably, every of the transfers concerned at the very least $1 million value of BTC, marking the best stage the Bitcoin whale exercise has reached in about two months.

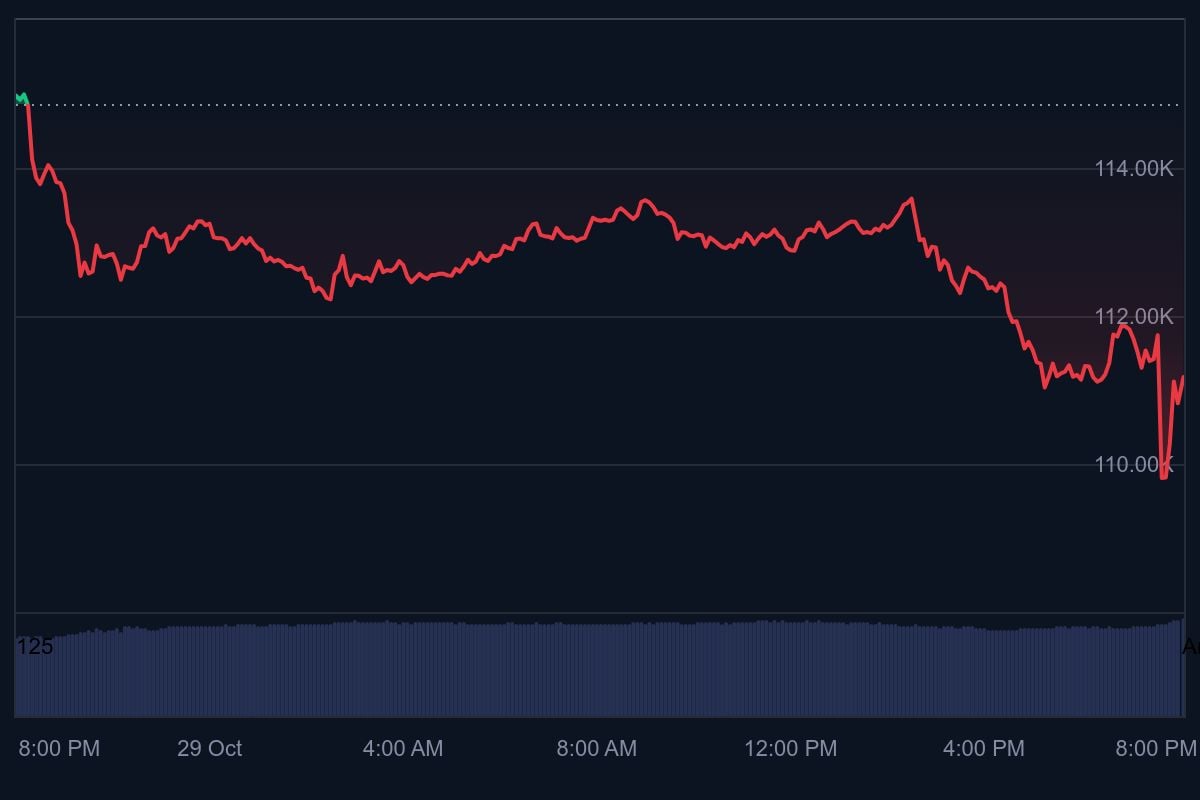

Whereas Bitcoin has simply retraced from its latest rally and raised hopes on the potential for a brand new ATH, the surge in Bitcoin whale transactions has come at a time when the asset is hovering across the $111K mark.

Whereas the spectacular whale actions coincide with constructive spot Bitcoin ETF inflows, it displays rising curiosity amongst establishments and high-profile buyers.

For the reason that broad crypto market is constantly confronted with rising uncertainties, it’s tough to determine the drive behind the rising whale actions. Nonetheless, will increase in giant transactions like this typically sign accumulation phases or main market strikes, as whales place themselves forward of volatility.

Nonetheless, Bitcoin has proven blended value actions over the past week, and it’s at present seeing its value plummet considerably. In response to information from CoinMarketCap, Bitcoin has declined by 3.34% over the past day, buying and selling at round $111,171 as of press time.

Apparently, the rising adoption of Bitcoin amongst giant establishments and governments as a strategic reserve device has contributed considerably to the rising on-chain exercise.

With large corporations like Technique, Metaplanet, and others relentlessly scooping up the asset regularly whatever the unstable market situations, it isn’t a shock that Bitcoin giant transaction counts have remained on the upside.

Nonetheless, market members imagine that this elevated on-chain exercise may point out rising confidence in Bitcoin’s long-term outlook, notably following robust ETF inflows and a rebound in market sentiment.