- TAO has traded in a $295–$471 vary since June however is now approaching a key breakout stage.

- RSI and CMF readings affirm robust momentum and purchaser dominance.

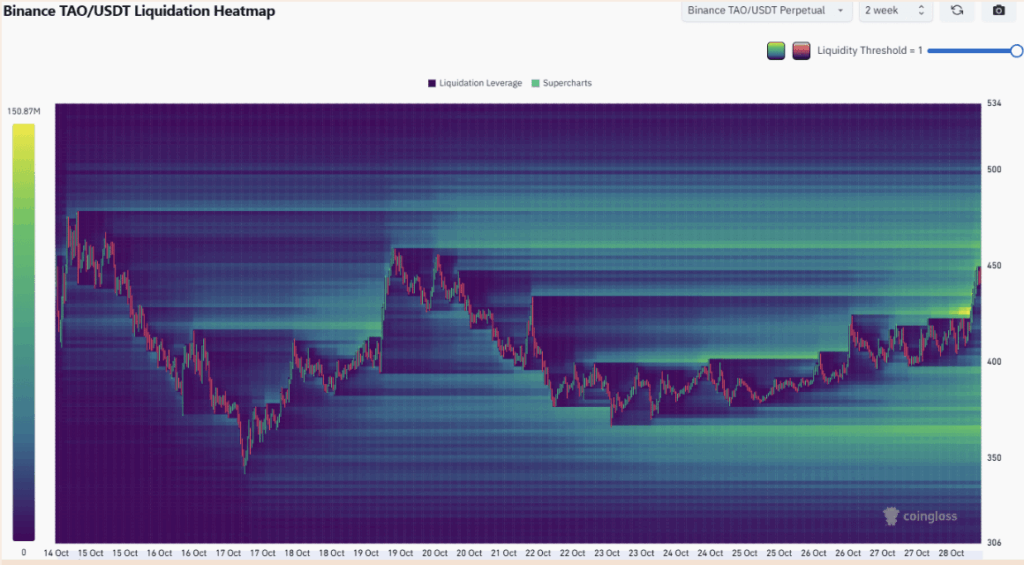

- Liquidity close to $480–$500 might set off volatility earlier than a decisive breakout or pullback.

Bittensor’s token, TAO, has been on an absolute tear recently, climbing near the highest of its six-month vary. Merchants are beginning to surprise — is that this the final leg earlier than a correction, or can the AI-focused coin lastly get away previous $500?

To this point, momentum appears to favor the bulls. TAO has proven robust resilience after October’s market-wide dip, holding its vary lows and bouncing exhausting, an indication of real demand build up behind the scenes.

TAO Holds the Vary, Eyes Breakout

Since June, TAO has been trapped in a sideways vary between $295 and $471, with a key mid-level help sitting round $383. When the market crashed on October 10, many altcoins noticed huge wicks on Binance — TAO included — dropping briefly to $140 earlier than shortly snapping again to shut the session close to $290. That restoration was no small feat and advised that robust arms had been ready on the backside.

Since then, TAO hasn’t seemed again. It’s rallied over 10% prior to now 24 hours with buying and selling quantity spiking almost 40%, signaling contemporary participation from each retail and institutional gamers. On the 1-day chart, indicators lean bullish: the RSI sits round 62, exhibiting agency momentum, and the Chaikin Cash Move (CMF) is above +0.05, confirming regular purchase strain.

From a technical perspective, the following logical targets lie on the mid-range resistance ($383) and the vary excessive close to $470–$480. If TAO can shut convincingly above that zone, the chart opens up room for a leg increased — possibly even towards $500 or past.

Liquidity Clusters Level to a Push Increased

Taking a look at CoinGlass’s liquidation heatmap, there’s a noticeable cluster of liquidations and open curiosity sitting within the $450–$480 vary. This space acts as a magnet for worth, which means TAO might very possible wick above these ranges to set off cease orders earlier than consolidating.

Beneath that, the following dense liquidity pocket seems round $395, which ought to function a powerful help if any pullback happens. The setup suggests a short push past the vary highs is probably the most possible short-term state of affairs, although bulls will nonetheless want heavy quantity to maintain a real breakout.

TAO’s Power vs. Bitcoin Hints at Extra Upside

TAO’s energy turns into even clearer when in comparison with Bitcoin. After the broader market correction, most altcoins took a success, however TAO/BTC truly broke increased, exhibiting a bullish construction break on October 12.

Whereas Bitcoin slid again to the $108k space, TAO merchants had been shopping for aggressively, pushing the pair upward. The subsequent main resistance on the TAO/BTC chart remains to be far-off, which means there’s room for TAO to proceed outperforming Bitcoin — a uncommon signal of confidence in a market that’s been shaky recently.

Ultimate Ideas: Rally Nonetheless Has Legs, However Watch $500 Intently

All indicators level towards continued momentum — robust spot quantity, bullish RSI, and clear liquidity targets above the present vary. Nonetheless, the $470–$500 zone is the place issues might get tough. That space has repeatedly rejected worth since summer time, and it’ll take vital shopping for quantity to flip it into new help.

If TAO breaks out cleanly, it might enter a brand new worth discovery section and probably purpose for $550+. But when rejection hits once more, anticipate a retest of $395–$400 earlier than any second try. Both manner, the token’s construction seems to be stable, and bulls are firmly in management — for now.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.