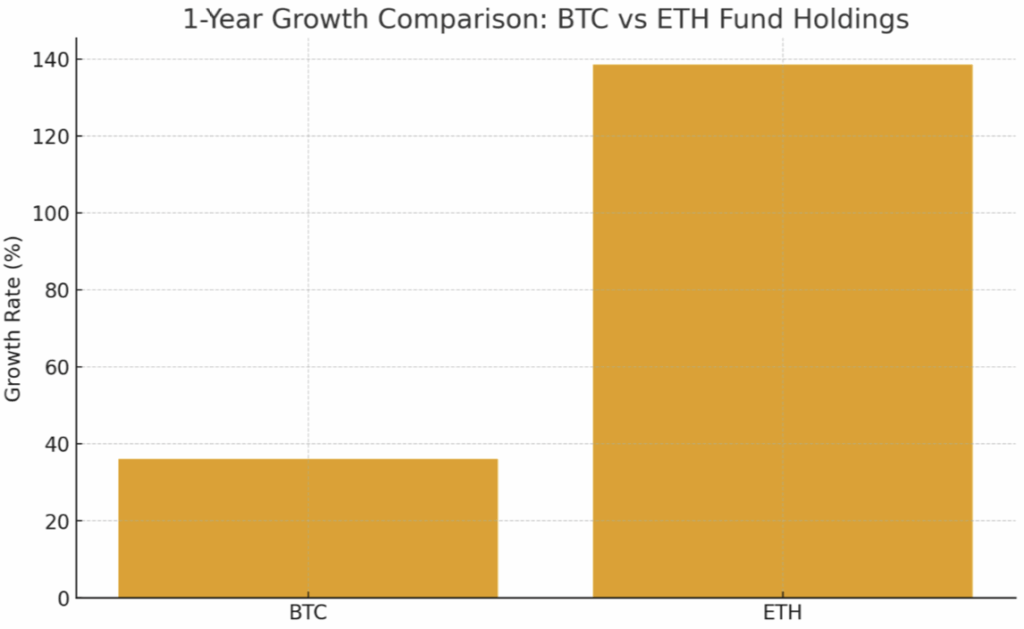

- Institutional Ethereum holdings surged 138% in a single yr, outpacing Bitcoin’s 36%.

- The ETH-to-BTC ratio in funds shifted from 3:1 to five:1, exhibiting long-term confidence.

- ETH should maintain above $4,100 for bulls to remain in management amid combined market sentiment.

Institutional cash appears to be shifting. Over the previous yr, Ethereum (ETH) has quietly develop into the star of big-money portfolios, rising almost 4 occasions sooner than Bitcoin (BTC) in institutional holdings. It’s not only a non permanent pattern anymore — it’s beginning to appear to be a strategic shift in how main traders view the 2 largest cryptocurrencies.

Ethereum’s Fast Progress Outpaces Bitcoin

Recent information from XWIN Analysis Japan paints a fairly clear image: establishments aren’t simply stacking Bitcoin anymore. Over the previous yr, Bitcoin fund holdings grew by round 36%, reaching roughly 1.3 million BTC. Spectacular, positive — however Ethereum blew previous that. Institutional ETH holdings jumped 138%, climbing to about 6.8 million cash.

Analysts imagine this acceleration is tied to the rollout of spot Ethereum ETFs and ETH’s increasing position in DeFi and broader digital ecosystems. Ethereum isn’t simply “Bitcoin’s sidekick” anymore — it’s being handled as a core asset in its personal proper.

The ratio of ETH-to-BTC held in institutional funds has shifted from 3:1 to five:1, exhibiting a transparent and lasting change in allocation. XWIN’s report famous that the sustainability of this divergence will rely upon ETF inflows, on-chain exercise, and general international liquidity situations within the months forward.

Including gasoline to the bullish case, some giant ETH traders have began shopping for once more after months of trimming their positions. Tom Lee of Bitmine, which manages one of many world’s largest Ethereum treasuries, stated he expects a possible year-end rally now that leveraged positions have cooled off.

Market Nonetheless Testing Key Ranges

Regardless of the bullish accumulation, Ethereum’s worth motion hasn’t mirrored that optimism simply but. On the time of writing, ETH was buying and selling round $4,114, down 1.8% up to now 24 hours. Analyst Daan Crypto Trades described this second as a “huge take a look at” for the bulls, noting that ETH wants to carry above $4,100 to maintain momentum alive.

Bitcoin, in the meantime, was priced at about $114,198, however its current breakout above $115K raised some eyebrows. Analyst TedPillows known as the transfer “a liquidity seize,” declaring that it got here with out significant institutional inflows or retail pleasure. On-chain researcher PelinayPA backed this up, noting that alternate fund motion is close to historic lows, an indication that market tops usually lurk close by.

Lengthy-Time period Outlook Nonetheless Robust

Even with short-term volatility, institutional participation in crypto stays huge. Bitcoin futures quantity on Binance alone hit $543 billion in October, proving that curiosity from each institutional and speculative merchants hasn’t pale.

The surge in institutional Ethereum holdings — particularly at a time when Bitcoin’s development has slowed — may set the stage for a brand new section out there. If present traits proceed, Ethereum may cement its place because the go-to institutional altcoin, sharing the highlight with Bitcoin relatively than standing in its shadow.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.