The crypto market begins Wednesday beneath clear stress from macro catalysts as merchants place round in the present day’s FOMC resolution and Jerome Powell’s press convention. Complete capitalization is close to $3.82 trillion, with Bitcoin at $112,900 and Ethereum testing nerves round $4,000.

Liquidity stays skinny as U.S. yields stabilize into the Fed occasion, whereas a $15 trillion earnings cluster from Microsoft, Alphabet, Meta, Boeing and Caterpillar later in the present day will dictate danger urge for food, extending into Nasdaq futures and crypto correlations.

TL;DR

- XRP might repeat HBAR’s 25.7% ETF rally and shoot previous $4.

- Ethereum finalizes Fusaka testnet forward of Dec. 3 exhausting fork.

- Sequans strikes $111 million in Bitcoiin to Coinbase earlier than FOMC resolution.

- Massive Tech earnings and Powell press convention to dictate night volatility.

XRP: ETF math factors to $4.20

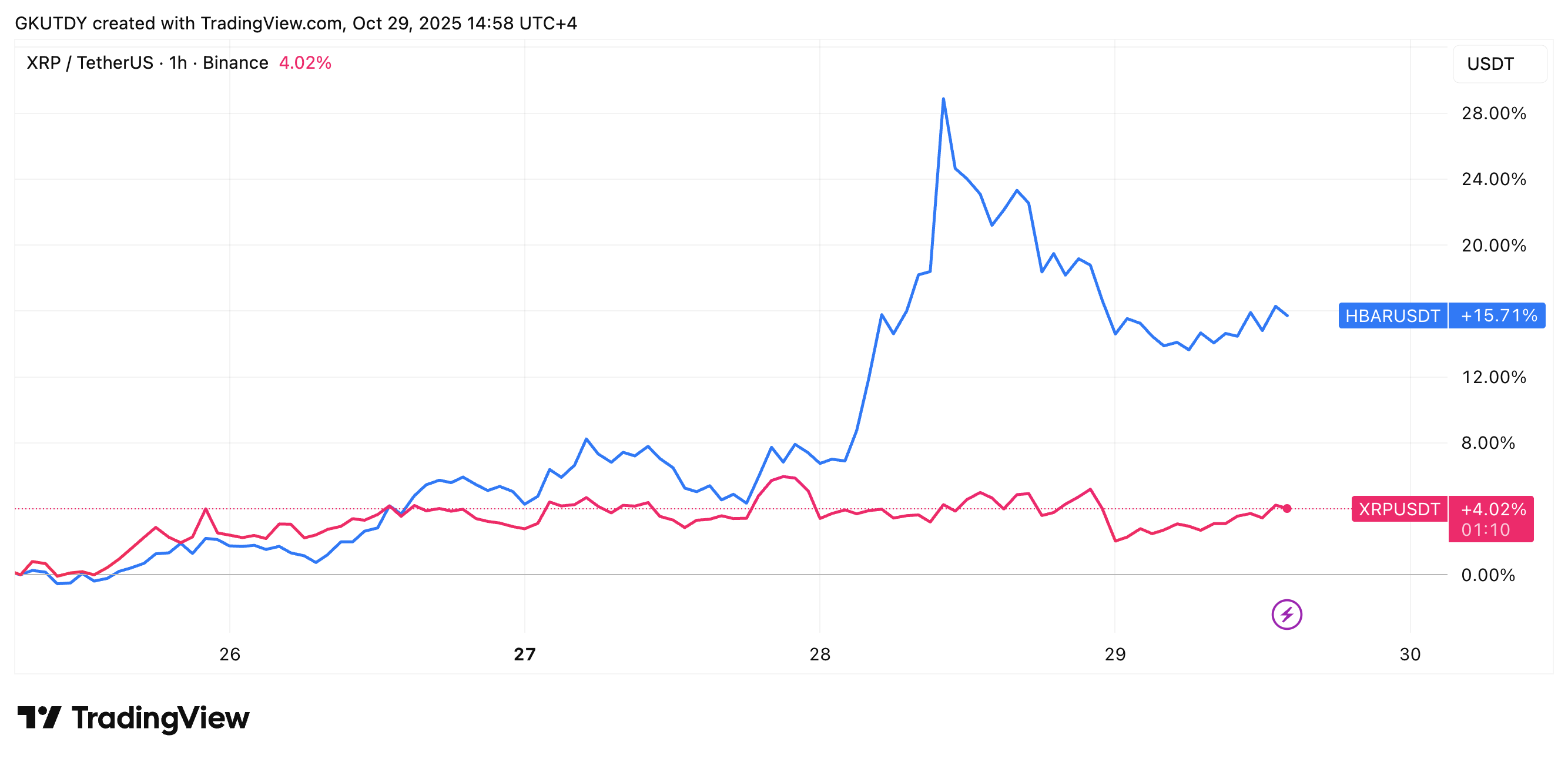

XRP trades close to $2.65, up a bit in a single day, however the true dialog comes from Hedera’s (HBAR) shock ETF approval rally as HBAR coin surged 25.7% in 24 hours, after Canary Capital’s spot ETF launch on the NYSE, shifting from $0.1775 to $0.2052 on 182% quantity development.

Ought to XRP mirror the identical 25.7% ETF carry, its value would soar from $2.62 towards $3.29, clearing the psychological $3 barrier and setting targets within the $3.50-$4.20 hall. With filings from Grayscale, Bitwise and 21Shares awaiting SEC assessment, merchants see HBAR’s approval as a dry run for the way institutional flows might distort XRP’s chart.

The $2.60 help band is unbroken, and indicators trace at potential retests of $2.80-$3, so the technical outlook aligns with XRP ETF speculations fueling fundamentals.

Nonetheless, a break beneath $2.58 would neutralize the bullish setup, however the uneven danger stays tilted upward given HBAR’s precedent.

Ethereum: Fusaka exhausting fork nears

Ethereum holds slightly below $4,000 after two brutal intraday reversals, ready for a catalyst past Fed rhetoric, and there’s one, as the important thing driver now’s the Fusaka exhausting fork, scheduled for mainnet activation round Dec. 3.

The Hoodi testnet has simply accomplished its ultimate trial run, following earlier deployments on Holesky and Sepolia. Fusaka introduces a number of upgrades central to Ethereum’s scaling roadmap:

- EIP-7594 (PeerDAS): Partial knowledge validation, slicing validator load by permitting blob-shard processing.

- EIP-7825 / EIP-7935: Gasoline-limit will increase and core effectivity boosts.

- Blob-package growth, node safety upgrades and infrastructure prep for L2 throughput.

This difficult fork cements Ethereum’s positioning because the foundational L2 settlement layer. With DeFi TVL grinding increased and every day gasoline utilization again to mid-2024 ranges, builders see Fusaka as the required replace to deal with the following scaling cycle with out bottlenecks.

Quick time period, ETH wants to carry $3,950 or danger unwinding towards $3,850, however the fork narrative limits draw back into 12 months’s finish.

Bitcoin: $111 million treasury sale raises purple flag

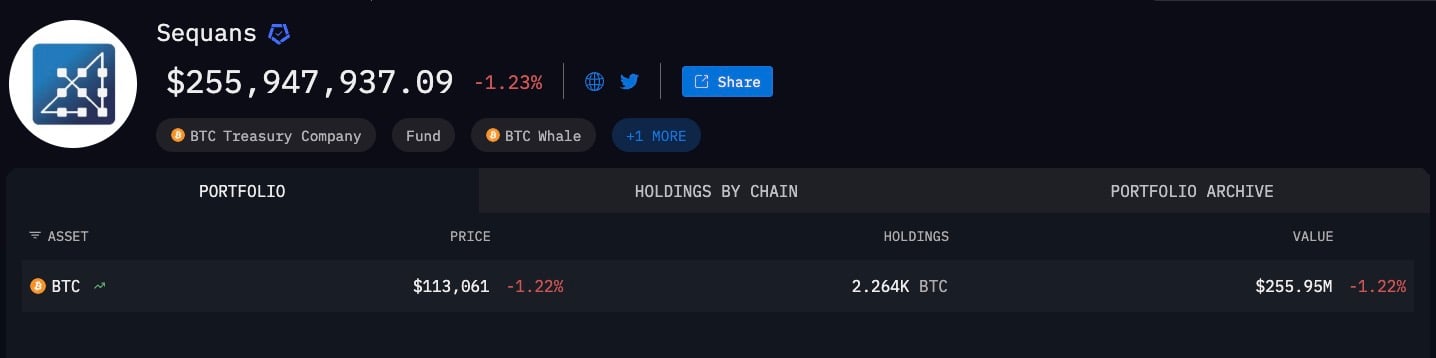

After dipping beneath $112,000 in Asian buying and selling, Bitcoin sits close to $112,900, with the highlight on Sequans Communications that simply moved 970 BTC, value about $111 million, to Coinbase.

That is its first main outbound transaction because the firm began constructing its 3,234 BTC treasury, at the moment valued at $255 million.

Sequans ranks twenty ninth on the worldwide checklist of public Bitcoin treasury holders, far behind giants like Technique (640,808 BTC) and Tesla (11,509 BTC), however its timing is worrying. In mild of upcoming FOMC, some interpret the sale as pre-emptive danger administration, others as balance-sheet optimization.

Both means, company flows of this magnitude add stress to an already fragile BTC spot e-book.

Rapid resistance for the Bitcoin value stands at $113,500, with stronger provide stacked close to $115,000. The vital draw back set off is $112,000, and dropping that zone reopens $110,800 as the following essential help.

Night outlook

The night is a collision of macro and micro. An FOMC assertion, Powell’s press convention and outcomes from Meta, Alphabet, Microsoft, Boeing and Caterpillar will hit danger belongings inside hours of one another.

- Bitcoin: Maintain $112,000 or danger deeper slide, reclaim $113,500 for aid.

- Ethereum: Defend $3,950, breakout of $4,050 results in $4,200 setup.

- XRP: ETF narrative retains $2.80-$3.00 open, HBAR precedent lights path to $4.

By the point Wall Avenue closes, merchants will know if Powell crushed danger urge for food or if ETF hopes and company earnings gave crypto the inexperienced mild. That is probably the most binary day of the week, and the market is sitting proper on the fault line.