- Egrag Crypto claims Cointelegraph headlines could precede XRP value drops.

- No arduous proof of insider exercise, however information reveals a visual sample.

- Group now pushing for transparency — and searching nearer at each bullish XRP article.

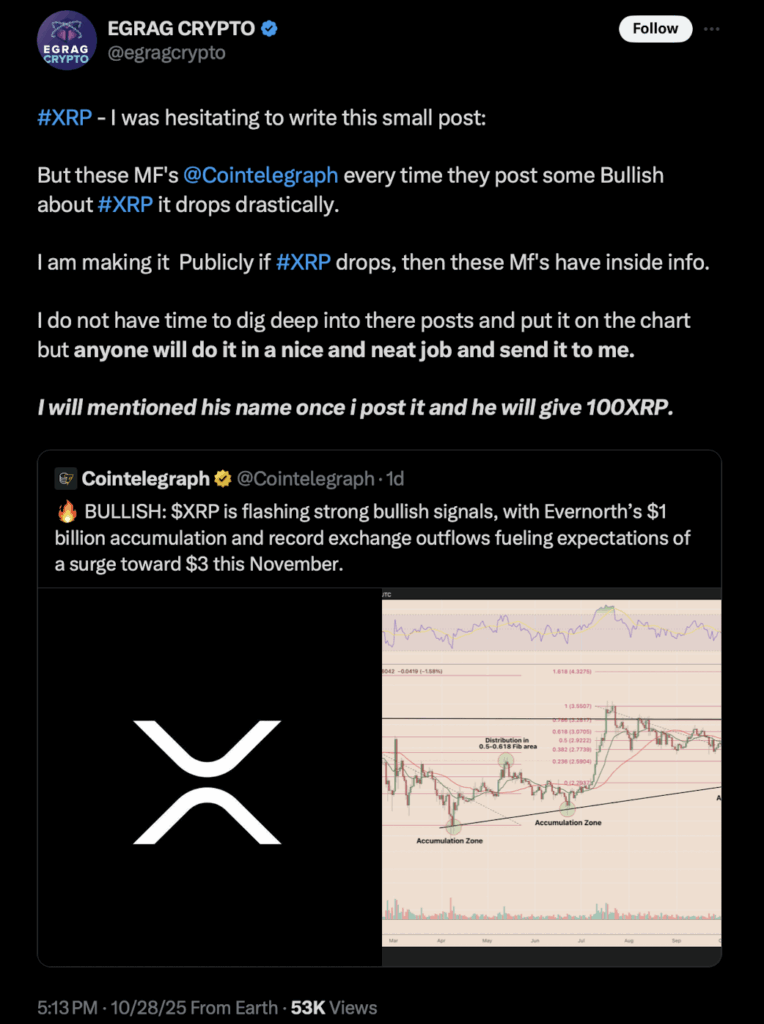

The XRP neighborhood is buzzing once more, because of a daring declare from analyst Egrag Crypto, who instructed that main media outlet Cointelegraph is likely to be influencing XRP’s value — and even buying and selling on insider information. His current publish on X implied that each time Cointelegraph publishes a bullish story about XRP, the token’s value “drops drastically” quickly after.

The remark was transient, but it surely hit a nerve. It touches a long-standing concern in crypto — that headlines and timing typically appear a bit of too handy for sure merchants.

Cointelegraph Headlines and the Value Drops

Egrag’s declare wasn’t pulled from skinny air. Over the previous few weeks, Cointelegraph launched a number of optimistic tales about XRP, highlighting robust sentiment and development throughout the Ripple ecosystem. However proper after a few of these posts went stay, XRP’s value tumbled sharply.

As an illustration, between October 24 and 27, 2025, XRP traded between $2.39 and $2.65. Notably, proper across the publication of considered one of Cointelegraph’s most bullish XRP items on October 25–26, the token noticed sudden intraday volatility and a short-term sell-off.

Now, does that show something? Not likely. But it surely’s a sample you possibly can really see — and it’s sufficient to get individuals asking questions.

Market Reflex or One thing Larger?

The crypto market reacts quick — typically too quick. A bullish headline can set off merchants who resolve it’s a very good time to take earnings. Bots monitoring main information feeds may also set off huge trades in seconds, creating what appears like manipulation when it’s actually automated response.

To show insider exercise, although, you’d want timestamps, order e book information, and possibly even pockets actions from giant holders proper earlier than and after these articles go stay. That sort of evaluation isn’t straightforward — and to date, there’s no precise proof that Cointelegraph or its workers did something shady.

Nonetheless, Egrag’s remark reignited an previous debate about transparency in crypto media and the way headlines can affect dealer psychology in ways in which may not be so innocent.

A Group Name for Transparency

As an alternative of letting the controversy fade, Egrag turned it right into a problem. He supplied 100 XRP to anybody who can produce an in depth chart displaying a constant correlation between Cointelegraph’s XRP tales and market reactions. It’s a small bounty, but it surely’s sparked curiosity amongst analysts and information geeks keen to check whether or not the idea holds up.

If the information reveals nothing however coincidence, superb. But when it reveals a recurring pattern — nicely, that may pressure some uncomfortable conversations about how crypto media operates and who actually advantages from market-moving information.

Headlines Nonetheless Transfer XRP — That’s Clear

On the finish of the day, Egrag’s accusation doesn’t show insider exercise, but it surely’s arduous to disregard how XRP’s value retains reacting to main headlines. Possibly it’s human psychology, possibly it’s algo buying and selling, or possibly it’s one thing deeper — we’ll see.

What’s sure is that each huge XRP story now comes with a bit of further rigidity. Merchants are watching extra intently than ever, ready to see whether or not the subsequent “bullish” headline seems to be a set off for an additional sudden drop.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.