• BNB trades above $1,100 after breaching the $1,000 mark with sturdy market assist.

• Analysts predict a transfer towards $1,180 if momentum holds by way of November.

• CoinCodex forecasts $1,138 by month-end, with sentiment staying bullish total.

Binance Coin (BNB) has been probably the most constant gainers in current weeks, managing to break above the $1,000 mark for the primary time in months. The token, which powers the Binance ecosystem, has been holding agency regardless of volatility throughout the broader crypto market. As of press time, BNB is buying and selling close to $1,102, barely down 2% in 24 hours however nonetheless displaying sturdy structural assist above the important thing $1,100 zone.

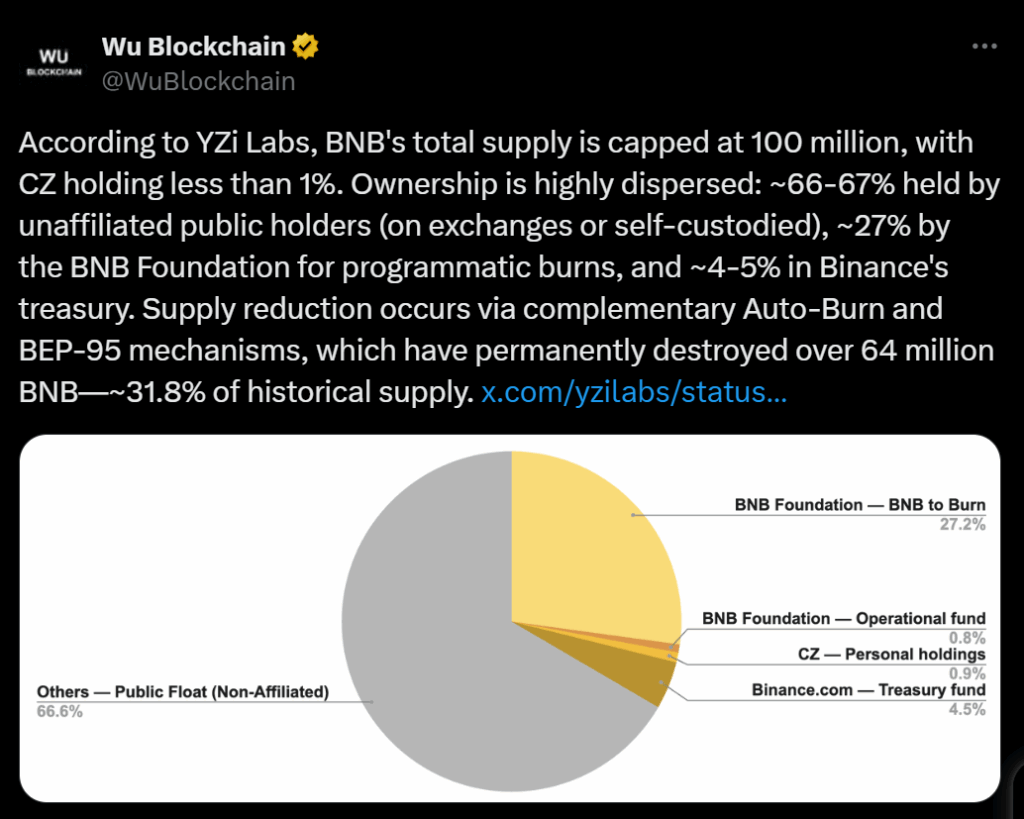

Market watchers say BNB’s resilience displays renewed investor confidence following Binance’s ongoing regulatory readability and community growth. Knowledge from Yzi Labs additionally revealed that BNB’s whole provide is capped at 100 million tokens, with Changpeng Zhao now proudly owning lower than 1%. Round two-thirds of provide is held by unaffiliated public holders, displaying a extremely decentralized possession base — a wholesome signal for long-term sustainability.

Analysts Predict a Push Towards $1,180

Technical analysts stay optimistic heading into November. Widespread dealer Satoshi Owl believes BNB may quickly retest increased resistance ranges if momentum holds:

“BNB is wanting strong brief time period. The worth is at the moment holding above $1,120 and is regularly gaining momentum. If it could break $1,145 with quantity, the subsequent cease might be $1,160–$1,180. Nonetheless looking ahead to a pullback if BTC wobbles, however the construction seems to be bullish for now.”

Such value conduct aligns with a sample seen after main Binance ecosystem developments — the place BNB usually consolidates briefly earlier than launching right into a contemporary leg increased.

November Outlook: Bullish however Cautious

Based on CoinCodex, BNB may climb to $1,138 by November 28, representing a modest however regular 2.1% achieve from present ranges. The platform’s technical indicators present a bullish market sentiment, whereas the Worry & Greed Index sits at 51 (impartial), hinting at cautious optimism. Over the previous month, BNB has recorded 15 inexperienced days out of 30, with 6.95% volatility, suggesting steady market participation.

If Bitcoin maintains its place above $110,000, analysts imagine Binance Coin may simply outperform in November — notably as investor focus returns to main change tokens.

Can BNB Maintain Its Power?

BNB’s long-term case stays anchored in utility. It powers Binance Good Chain (BSC) transactions, fuels change payment reductions, and performs a job in BNB Chain’s DeFi and Web3 tasks. With Binance’s world person base increasing and new integrations on the horizon, BNB’s place as a top-five crypto asset seems to be more and more safe.

Nonetheless, merchants warning that short-term corrections are attainable if broader market circumstances flip risk-off. For now, although, BNB stays one of many few large-cap cryptos flashing sustained bullish construction heading into the ultimate stretch of 2025.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.