Bitcoin is at present displaying weak spot, having dipped under its $110,000 help stage amid post-FOMC promoting. However whereas this has elevated worry and uncertainty amongst buyers, it doesn’t diminish the truth that the market is in a very fascinating place.

On one hand, there’s the looming conclusion of the most recent four-year market cycle, alongside doubtlessly exhausted institutional BTC demand. However, the macroeconomic surroundings and regulatory panorama recommend extra progress might be forward – and that’s what some consultants are paying shut consideration to.

So, what’s the actual story? Will Bitcoin soar to new heights within the coming months – and doubtlessly even into 2026 – or is that this the beginning of a bear market? On this article, we’ll dive into a brand new Bitcoin worth prediction to determine a solution.

Apparently, at the same time as Bitcoin and prime altcoins have confronted headwinds since mid-October, demand for Bitcoin Hyper (HYPER), a brand new Bitcoin Layer 2 blockchain with its token nonetheless in presale, has continued to surge. May this be the crypto that defies the present market circumstances and delivers substantial good points?

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

The Bitcoin Bear and Bull Case

Let’s begin by clarifying that the “bear case” doesn’t indicate quick draw back for Bitcoin; reasonably, it’s a mid- to long-term situation. The short-term outlook (till the tip of 2025) is mostly seen as optimistic for the market-leading asset, given latest rate of interest cuts, the Fed’s dedication to finish quantitative tightening, and the US-China commerce settlement.

All these indicators recommend that November and December might even see elevated liquidity, doubtlessly resulting in a restoration of October’s losses and a transfer into recent highs. Nonetheless, within the bear case, there are two major dangers to observe after December: the conclusion of the four-year cycle and a full pivot to institutional profit-taking.

The four-year cycle that Bitcoin has adopted since its inception suggests the market peak will happen in This autumn 2025, whereas Farside Traders‘ knowledge reveals that ETF outflows have considerably exceeded inflows over the previous two weeks. Moreover, Bitcoin treasury purchases have slowed, indicating that main establishments and companies could also be holding again on recent investments in the interim.

So, what’s the bullish case? Merely put, it’s the convergence of macroeconomic tailwinds and a positive regulatory surroundings. As talked about, the Fed simply minimize rates of interest, and ING Chief Worldwide Economist James Knightley predicts additional 75 basis-point cuts by early subsequent 12 months, which is able to increase liquidity and make threat property like BTC extra enticing.

Furthermore, the crypto advocate Michael Selig has simply been appointed as the brand new CFTC chair, which may assist usher in additional Bitcoin-friendly laws, resulting in a resurgence in institutional adoption.

The analyst Crypto Maxi suggests this paves the best way for “an prolonged institutional supercycle aligned to US politics.”

He’s not alone in predicting a “supercycle”; in mid-August, Bernstein analysts forecasted that Bitcoin may rally into 2026 and attain $200,000.

Ultimate Verdict: Bitcoin Value Prediction

Bitcoin’s supercycle thesis hangs on macroeconomic tendencies and the way institutional gamers reply. If institutional curiosity rekindles, BTC may break the four-year cycle and attain $200,000 subsequent 12 months.

However even when BTC follows historic patterns and ends the bull market late in 2025, the present macroeconomic and regulatory surroundings means that additional good points will come first. Relating to Bitcoin’s potential progress, Technique CEO Michael Saylor appeared on CNBC this week and forecasted an increase to $150,000 by year-end.

Though Bitcoin has confronted struggles in latest weeks, with institutional outflows and widespread liquidations, the near-term outlook leans optimistic, and mid- to long-term good points are definitely not not possible. Nonetheless, by means of October, sensible cash has been shifting into Bitcoin Hyper (HYPER) whereas BTC has been declining. Let’s discover what this challenge is all about.

Why Are Merchants Rotating Into Bitcoin Hyper?

If Bitcoin reaches $150,000 by the tip of 2025, it will symbolize a 36% rise from its present worth. Many buyers are conscious that higher risk-adjusted alternatives lie elsewhere – and Bitcoin Hyper (HYPER) is proving itself as a well-liked different.

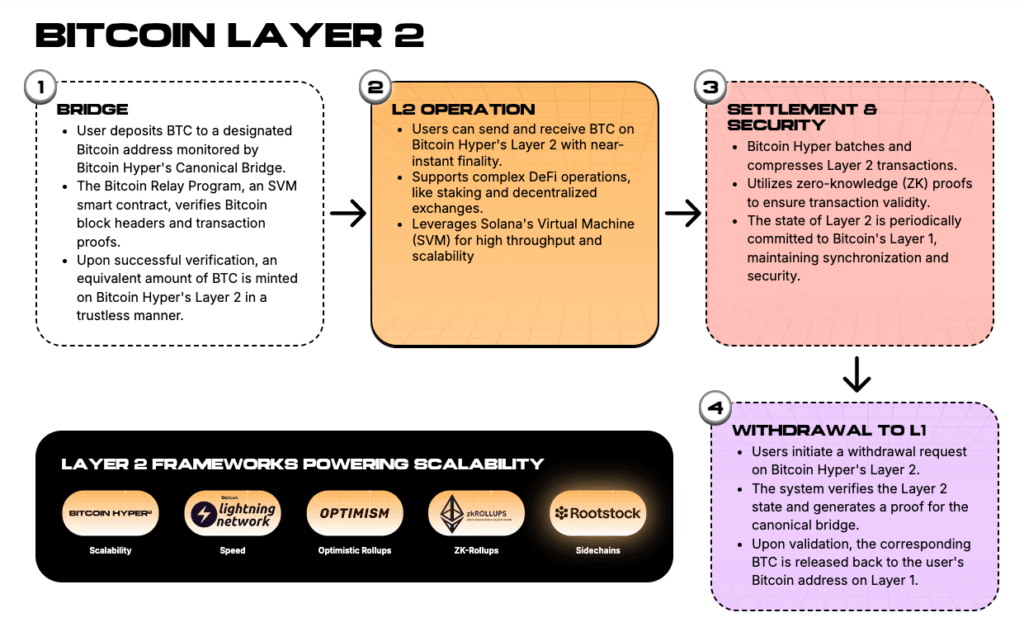

It’s growing a Bitcoin Layer 2 blockchain designed to considerably improve the Bitcoin Layer 1’s velocity and capabilities. It would run on the Solana Digital Machine, leveraging Solana’s quick efficiency and sensible contract help. For context, Solana can course of as much as 65,000 transactions per second, making it one of many world’s quickest blockchains.

If Bitcoin Hyper efficiently integrates this L2 growth into the Bitcoin ecosystem, HYPER might be greater than a short-term commerce – it’d even be a multi-cycle play. That’s as a result of profitable implementation would unlock alternatives in DeFi yields, RWAs, stablecoins, meme cash, and AI – all supported by Bitcoin’s safety and liquidity.

It’s no shock, then, that HYPER is attracting the eye of sensible cash merchants, with Borch Crypto just lately claiming it has 100x potential.

Thus far, the Bitcoin Hyper presale has raised $25.3 million, suggesting whales are shopping for it up, not simply speaking about it. HYPER is at present priced at $0.013195, and may be staked for dynamic APYs of as much as 46%.

Whereas Borch Crypto’s 100x goal would possibly take months or years to appreciate, the potential for main good points quickly after HYPER’s change debut means buyers are unfazed by the broader market circumstances and are scrambling to become involved.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any injury or loss precipitated or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.