Be a part of Our Telegram channel to remain updated on breaking information protection

Coinbase has accused US banks of ignoring actuality by claiming stablecoins will drain deposits and constrain their capacity to lend, arguing that they develop the greenback’s international attain.

Coverage chief Faryar Shirzad stated on X that the majority stablecoin demand comes from exterior the US, boosting greenback dominance somewhat than competing with home lenders.

“The ‘stablecoins will destroy financial institution lending’ narrative ignores actuality,” Shirzad stated. “Treating stablecoins as a menace misreads the second: they strengthen the greenback’s international position and unlock aggressive benefits that the US shouldn’t constrain.”

US banks have repeatedly expressed issues that yield-bearing stablecoins will result in giant outflows from the standard monetary system, threatening lending that powers financial progress. They’re urging Congress to clamp down on providers that supply yields on stablecoins.

Considerations intensified after US President Donald Trump signed the GENIUS Act into legislation in July, offering regulatory readability over their standing and thus making them a extra imminent menace to conventional banks.

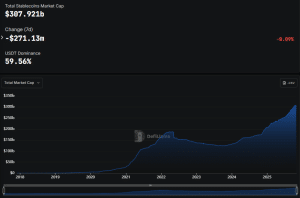

Their market capitalization has since surged to greater than $300 billion..

Stablecoin market cap (Supply: DefiLlama)

The GENIUS Act presently bans stablecoin issuers from providing yields to token holders instantly, however it doesn’t lengthen this prohibition to 3rd events or associates. As such, banking teams within the US are urging Congress to handle this “loophole,” particularly since a number of stablecoins presently provide significantly better yields than the typical financial savings account within the US.

Banks Have Extra Than Sufficient Liquidity For Lending

In his publish, Shirzad shared a snippet of a latest report printed by Coinbase Institute.

Coinbase stated within the report that banks presently maintain “huge reserves and protected belongings,” including that these establishments maintain $3 trillion in balances on the Federal Reserve and “further trillions” in Treasuries.

As such, the trade stated that banks have “extra liquidity” that’s greater than “what is required for present lending exercise.”

“If banks can take up such reserves with out impairing credit score provide, it’s inconsistent to assert that stablecoin progress poses a systemic menace,” Coinbase stated.

Competitors For Higher Funds Is A Characteristic, Not A Flaw

Coinbase additionally argued in its report that competitors within the funds area might be useful for customers, and that banks ought to somewhat participate within the competitors as an alternative of attempting to outright stall stablecoin progress.

“If stablecoins ever did appeal to substantial balances from US depositors, it could imply that they had succeeded in providing sooner, cheaper, and extra programmable funds,” Coinbase stated, including that may be a “success” and never a threat.

The agency drew parallels between banks’ issues with stablecoins and worries across the rise of cash market funds (MMFs) within the Eighties.

“When MMFs provided market yields and near-instant entry, customers shifted deposits away from low-rate accounts,” the trade stated. As an alternative of destabilizing the monetary system, MMFs “grew to become a everlasting and precious a part of the monetary ecosystem,” it stated.

“Stablecoins signify an analogous form of aggressive stress,” Coinbase stated. The agency stated the typical rate of interest paid by US financial savings accounts is 0.5%, even whereas short-term Treasury yields provide roughly 5%. This, in accordance with Coinbase, “displays inertia, frictions, and lack of options.”

Stablecoins are doing for funds what cash market funds did for financial savings: forcing innovation via competitors. Sooner, cheaper, programmable transactions aren’t a menace—they’re overdue progress. Credit score is not vanishing, it is evolving and rising into non-public credit score, fintech,…

— Faryar Shirzad 🛡️ (@faryarshirzad) October 29, 2025

Like MMFs, stablecoins problem incumbents ”not by rising threat however by providing a greater deal to customers and companies,” it stated.

Some TradFi Companies Have Began Shifting In On Stablecoins

TradFi corporations are also shifting into the stablecoin market. Funds big Visa has just lately introduced that it’ll add help for 4 stablecoins throughout 4 blockchains to its present providing, citing robust progress for its stablecoin merchandise previously 12 months.

Citi and a number of other main banks have additionally began exploring stablecoins, whereas studies counsel that Mastercard is in superior talks to amass the stablecoin infrastructure agency Zero Hash.

Legacy agency Western Union additionally introduced earlier this week that it’ll deploy its personal stablecoin on the Solana blockchain via Anchorage Digital.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection