- Core Scientific shareholders rejected a $9B all-stock merger with CoreWeave in a uncommon 2025 vote.

- The corporate’s inventory rose 5%, buying and selling above the proposed merger value at $21.99.

- Each companies plan to maintain their industrial partnership alive regardless of the deal’s collapse.

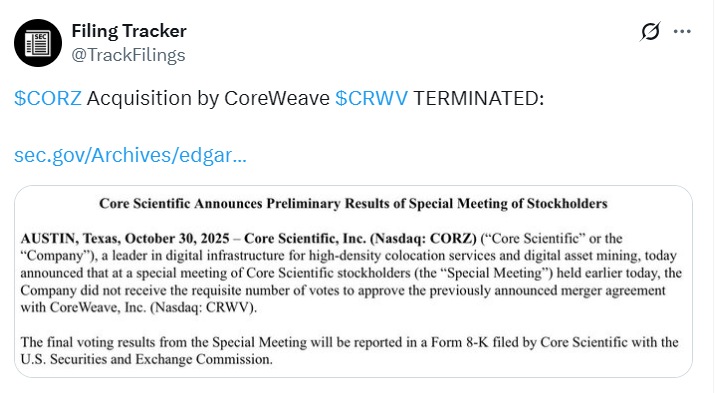

In a shocking twist, Core Scientific’s shareholders simply voted down an enormous $9 billion all-stock merger with CoreWeave, ending what might’ve been one of many largest blockchain–AI offers of 2025. The vote, held on October 30, marks a uncommon second of pushback in a 12 months filled with crypto mergers and SPAC offers. Much more fascinating — as a substitute of crashing, Core Scientific’s inventory truly jumped over 5% after the rejection, buying and selling round $21.99, larger than the proposed buyout value of $20.40 per share.

Shareholders Say No

The deal, first introduced in July, would’ve valued Core Scientific at roughly $9 billion, making it one of many largest cross-industry mergers in current reminiscence. However through the particular shareholder assembly, CoreWeave did not safe sufficient votes to push it via, based on filings with the SEC. Whereas disappointing for some, others noticed the transfer as an indication that buyers weren’t prepared at hand over management — particularly with Core Scientific’s inventory performing higher than anticipated in current months.

CEO Responds, Partnership Lives On

CoreWeave CEO Michael Intrator dealt with the defeat gracefully, saying the corporate respects the choice of Core Scientific shareholders and nonetheless plans to take care of its industrial partnership. “CoreWeave’s technique stays unchanged,” he added. So, whereas the merger’s useless, the collaboration between each firms — notably in knowledge middle operations and AI infrastructure — isn’t going wherever. It’s extra of a “goodbye” than a full breakup.

A Break from 2025’s Merger Craze

The rejection stands out in a 12 months that’s seen nonstop consolidation in crypto and tech. From CoinShares’ $1.2 billion merger with Vine Hill Capital to the Trump-backed American Bitcoin Company’s Nasdaq debut, most offers have flown via with out a lot resistance. However Core Scientific’s shareholders simply proved not each massive provide will get a sure — particularly when the corporate’s inventory is already outperforming the buyout phrases.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.