• Zcash surged 45% this week, flipping Monero to grow to be the highest privateness cryptocurrency.

• Arthur Hayes’ $10,000 worth goal fueled retail FOMO and renewed institutional consideration.

• Whale wallets are trimming holdings, however retail participation continues to climb.

Whereas a lot of the crypto market continues to chill, Zcash (ZEC) has staged one of the crucial shocking rallies of the yr. The privacy-focused token surged 45% this week, hovering to an eight-year excessive of $388 and overtaking Monero (XMR) as probably the most helpful privateness cryptocurrency with a $6.2 billion market cap.

This transfer comes at a time when Bitcoin and different main property are consolidating after commerce talks between the U.S. and China didn’t ship a transparent deal. But, because the broader market hesitated, Zcash broke out — signaling renewed investor demand for privacy-oriented cash that prioritize anonymity and untraceable transactions.

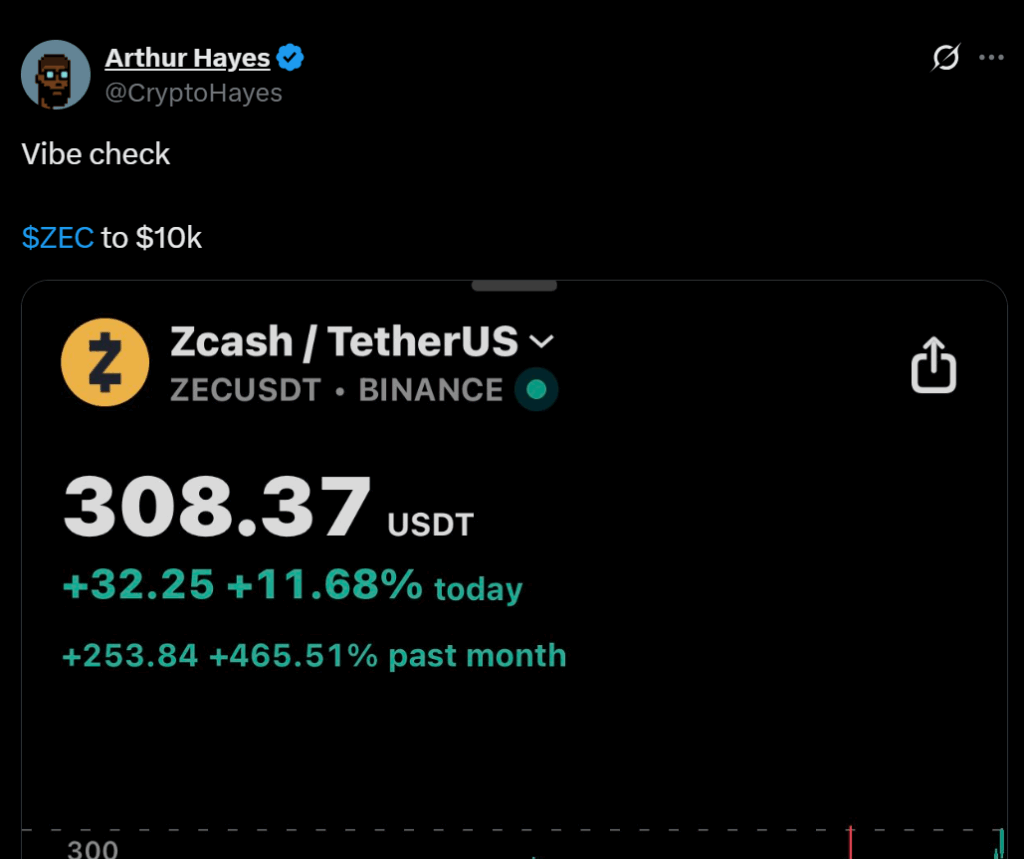

Hayes’ $10,000 Name Ignites ZEC Mania

The newest leg of Zcash’s rally could be traced again to BitMEX co-founder Arthur Hayes, who predicted that ZEC may rally to $10,000. His bullish name set off a wave of shopping for, propelling costs from round $272 to $355 inside hours. That form of momentum hasn’t been seen within the privateness sector in years.

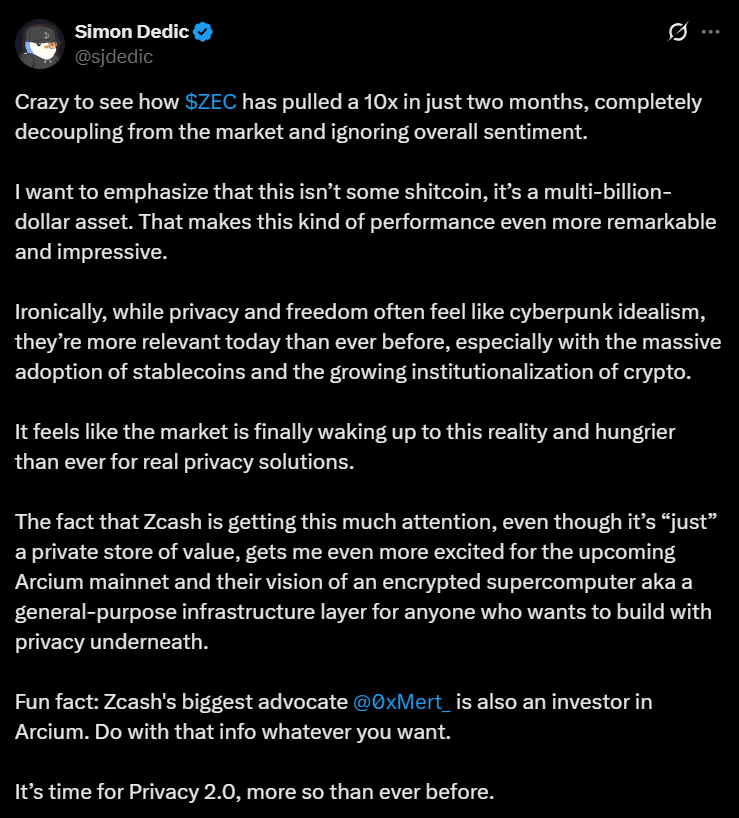

ZEC’s sharp rise mirrors the speculative surges that fueled earlier crypto bull cycles, however this time it’s backed by renewed consideration on information safety and monetary privateness, particularly as regulators tighten surveillance on blockchain transactions. As Moonrock Capital’s Simon Dedic famous, “It’s loopy to see how $ZEC has pulled a 10x in simply two months, utterly decoupling from the market… this isn’t some memecoin — it’s a multibillion-dollar asset.”

Whale Exercise and Retail Frenzy

Whilst retail traders flood in, whale wallets have began to take earnings. Knowledge from Nansen exhibits that enormous holders bought roughly $702,000 in ZEC tokens this week, even because the variety of distinctive Zcash wallets rose 63% to 1,968. The mix of recent inflows and selective whale promoting means that short-term volatility may stay excessive, however general sentiment nonetheless leans bullish.

For now, Zcash’s fundamentals — restricted provide, actual use case in privateness preservation, and rising on-chain exercise — are offering a basis that helps speculative enthusiasm. The token’s means to carry positive aspects whereas the remainder of the market stumbles has made it the clear chief within the privateness coin area.

Can Zcash Preserve Its Lead?

ZEC’s breakout above $350 has positioned it in uncharted territory not seen since 2018. If the momentum continues, merchants are waiting for a possible push towards $400–$420 resistance ranges, with Hayes’ $10,000 projection serving as a distant however psychological goal.

Nonetheless, with privateness cash typically dealing with regulatory headwinds, Zcash’s subsequent problem can be sustaining mainstream curiosity whereas navigating compliance pressures. Whether or not it is a short-term hype cycle or the beginning of an enduring comeback will depend upon how effectively Zcash can stability development with privateness in a extra regulated crypto panorama.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.