- ADA dropped over 5% in 24 hours, sliding towards key $0.59–$0.60 assist.

- Whales bought 100 million tokens in three days, triggering liquidations and panic promoting.

- Lengthy-term sentiment might enhance if Cardano ETF proposals achieve SEC approval.

Cardano has been bleeding out recently, dropping greater than 5% in simply the previous day and sliding to round $0.60. The autumn has triggered a transparent technical breakdown, leaving merchants eyeing $0.55 as the subsequent doable cease if the $0.60 assist fails to carry. From its native excessive of roughly $0.89 in early October, ADA’s downtrend has been relentless, with every restoration try fading out nearly as quickly because it started.

Whales Begin Dumping as Liquidations Spike

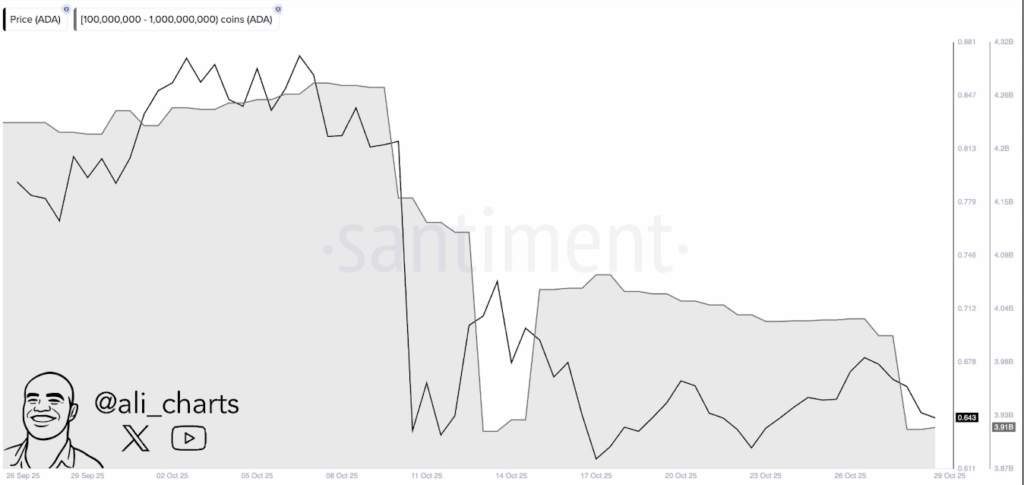

Proper now, ADA is hovering simply above $0.59—a degree that’s turn into a little bit of a battleground. In keeping with crypto analyst Ali Martinez, whales holding between 100 million and 1 billion ADA offloaded round 100 million tokens in solely three days. That’s an enormous quantity of promote strain for any market to soak up, and as traditional, it got here proper earlier than costs cracked decrease. Martinez noticed this sample when ADA was round $0.64, saying it hinted at waning momentum, which, effectively, appears spot-on now.

CoinGlass information additionally backs this bearish temper. Previously 24 hours, merchants noticed $4.36 million in complete liquidations, with the overwhelming majority—greater than $4 million—coming from lengthy positions. That imbalance reveals how overleveraged bullish merchants obtained caught off guard by the sudden drop. The consequence: ADA plunged to the $0.59–$0.60 zone, whereas danger urge for food throughout the altcoin market cooled off sharply. Some merchants may already be eyeing re-entries although, ready for sentiment to stabilize.

Technical Image: ADA Nonetheless Underneath Strain

Technical alerts don’t look nice both. Analyst Jesse Olson famous that “a downward sloping 200-week shifting common is just not bullish,” and his chart reveals ADA nonetheless buying and selling beneath it. Traditionally, that line acts like a wall till it flattens or begins curving upward. The Relative Power Index (RSI) sits close to 35, which means ADA is near oversold territory—so a small rebound is likely to be on the desk if sellers take a breather.

If the $0.59 assist provides means, ADA might tumble to $0.55, perhaps even $0.51, which might mark new lows for 2025. On the flip aspect, resistance lies at $0.65 and $0.70, whereas a clear breakout above $0.80 might flip the script solely and set off a push towards $1.70. For now, although, that assist zone round $0.59 will in all probability resolve whether or not this slide retains going or a short-term bounce lastly takes form in early November.

ETF Filings Provide a Glimmer of Lengthy-Time period Hope

Even with all of the short-term ache, there’s a touch of optimism on the horizon. ETF issuers REX Shares and Osprey Funds have filed with the SEC to incorporate ADA of their Prime 10 Crypto Index ETF. What’s fascinating is that this product wouldn’t simply observe value—it will additionally function staking, which means buyers might earn rewards alongside their publicity.

Whereas these filings haven’t but been authorized, they present that institutional curiosity in altcoins is rising past Bitcoin and Ethereum. If a Cardano ETF does go reside, it might sit alongside different current altcoin merchandise for Solana, Litecoin, and Hedera. Analysts consider such approval might enhance inflows and perhaps even double ADA’s value over time. For now, although, Cardano’s subsequent few weeks hinge on whether or not consumers can defend that fragile $0.59 degree—or if one other leg down remains to be forward.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.