- Ethereum’s TVL grew 16x since 2020, hitting $379B in 2025.

- Institutional tokenization might 10x that quantity once more, driving ETH’s worth increased.

- The Fusaka improve will push Ethereum’s pace to 12,000 TPS, unlocking large on-chain potential.

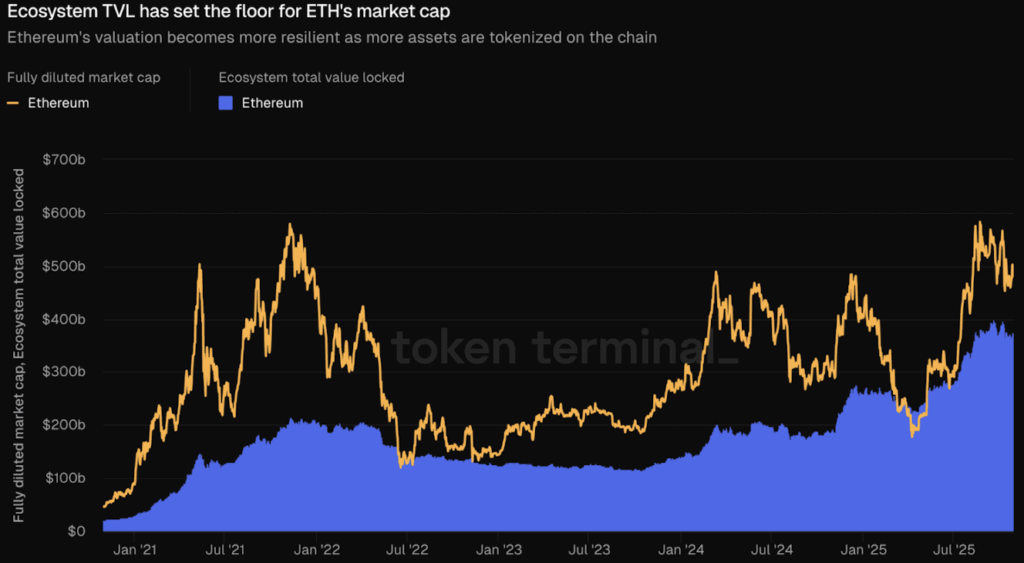

Ethereum’s rise because the spine of decentralized finance retains gaining steam. In simply 5 years, its complete worth locked (TVL) exploded from about $24 billion in 2020 to roughly $379 billion in 2025. That’s a sixteenfold surge—insane development that speaks volumes about how mature and deeply built-in Ethereum has grow to be inside world crypto markets. Alongside that, Ethereum’s market cap soared from $47 billion to round $502 billion, exhibiting an 11x climb as investor confidence piled up behind ETH.

Token Terminal’s information, Ethereum’s TVL has quietly served as a stabilizer by means of tough patches just like the brutal 2022 bear market and even the April 2025 correction. Every main dip didn’t simply get better—it bounced again stronger, setting increased lows for each TVL and ETH’s valuation. That sample type of alerts how buyers now see Ethereum much less like a speculative asset and extra like digital infrastructure. The community’s three principal drivers of TVL—stablecoins, lending, and staking—make up the majority of its basis. Stablecoins led by Tether dominate with $189 billion, lending protocols resembling Aave chip in round $82 billion, and liquid staking techniques like Lido and EigenLayer stack up one other $73 billion.

Institutional Tokenization May Multiply Ethereum’s TVL

Regardless of how big these figures sound, it’s actually simply the beginning. Massive monetary gamers have barely dipped their toes into on-chain finance. BlackRock, sitting on $13.5 trillion in property, has solely about $2.9 billion tokenized on Ethereum. Constancy, with $6.4 trillion, has simply $231 million deployed. If large-scale tokenization actually takes off—and it seems prefer it would possibly—the TVL on Ethereum might bounce 10x once more over the subsequent few years. That type of institutional capital flooding in might reignite the correlation between Ethereum’s market cap and its TVL, pushing ETH’s truthful valuation to new heights we’ve in all probability by no means seen earlier than.

The Fusaka Improve Is About To Redefine Ethereum’s Velocity

Subsequent up is Fusaka, Ethereum’s upcoming main improve, and it’s type of an enormous deal. The replace plans to ramp up throughput from the present 3,100 transactions per second to round 12,000. It’s bringing in PeerDAS (Peer Knowledge Availability Sampling) and higher blob dealing with to slash layer-2 rollup prices. In accordance with ETH researcher Leo Lanza, this enchancment triggers one thing just like the Jevons Paradox: the extra environment friendly Ethereum turns into, the extra individuals will truly use it. Mainly, quicker and cheaper transactions imply extra demand, not much less.

With DeFi, tokenization, and on-chain settlements turning into extra mainstream, these upcoming EIP-7691 and blob-related upgrades are setting Ethereum to increase its lead over each different chain. What we’re seeing isn’t simply community development—it’s the evolution of the subsequent world monetary layer, constructed totally on Ethereum rails.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.