Financial institution Negara Malaysia (BNM) has launched a three-year technique to discover how tokenization can modernize the nation’s monetary system, with a deal with sensible and compliant use instances relatively than speculative crypto belongings.

The initiative, run by way of BNM’s newly established Digital Asset Innovation Hub, will embody proof-of-concept initiatives and dwell pilots designed to check asset tokenization throughout sectors equivalent to small-business financing, Islamic monetary merchandise, inexperienced funding, and round the clock cross-border funds.

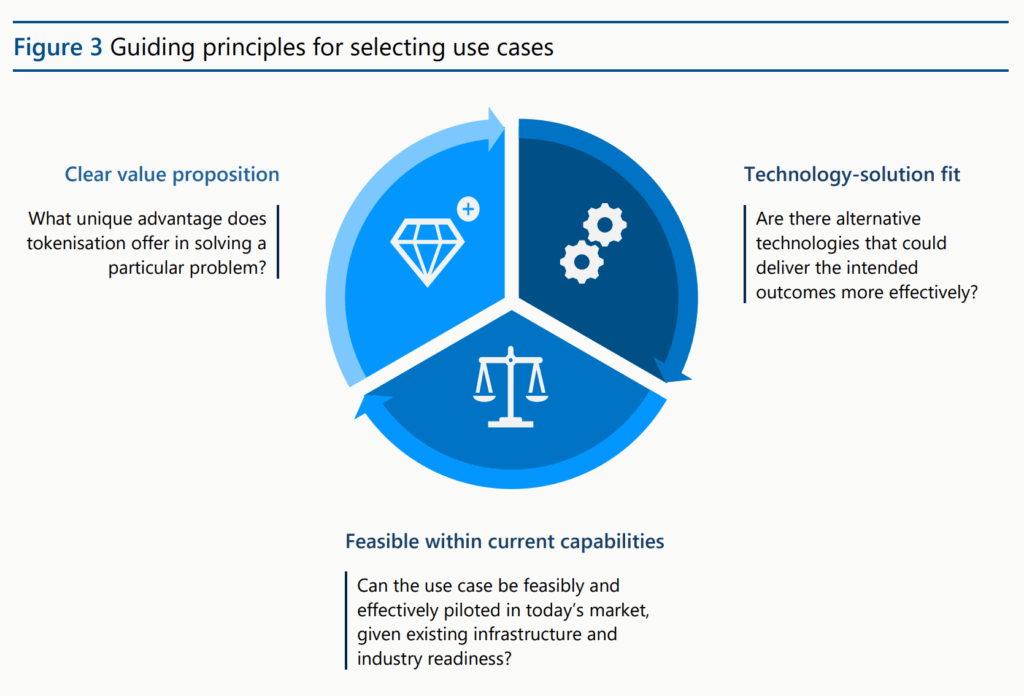

A devoted Asset Tokenization Trade Working Group, co-led by BNM and the Securities Fee, will coordinate efforts throughout the trade, serving to establish regulatory and authorized hurdles whereas defining greatest practices. The aim is to develop tokenized options that ship tangible financial advantages and function inside Malaysia’s present monetary and non secular frameworks.

BNM emphasised that its tokenization push will heart on real-world functions – equivalent to tokenized deposits, programmable funds, and liquidity administration – relatively than cryptocurrencies.

The central financial institution can even look at MYR-denominated stablecoins and tokenized deposits to make sure digital settlement effectivity whereas preserving the “singleness of cash.” Integration with wholesale central financial institution digital forex techniques can be on the desk.

By launching this roadmap, Malaysia joins a rising group of Asian regulators – together with these in Singapore and Hong Kong – testing how blockchain know-how can strengthen monetary infrastructure. Public suggestions on the plan is open till March 2026.

The announcement follows the Securities Fee’s July proposal to simplify the method for itemizing cryptocurrencies on regulated exchanges, signaling Malaysia’s rising openness to innovation within the digital asset area.