Investor curiosity in spot Solana exchange-traded funds (ETFs) continues to develop, with the funds posting a fourth consecutive day of inflows amid a broader capital shift away from Bitcoin and Ethereum merchandise.

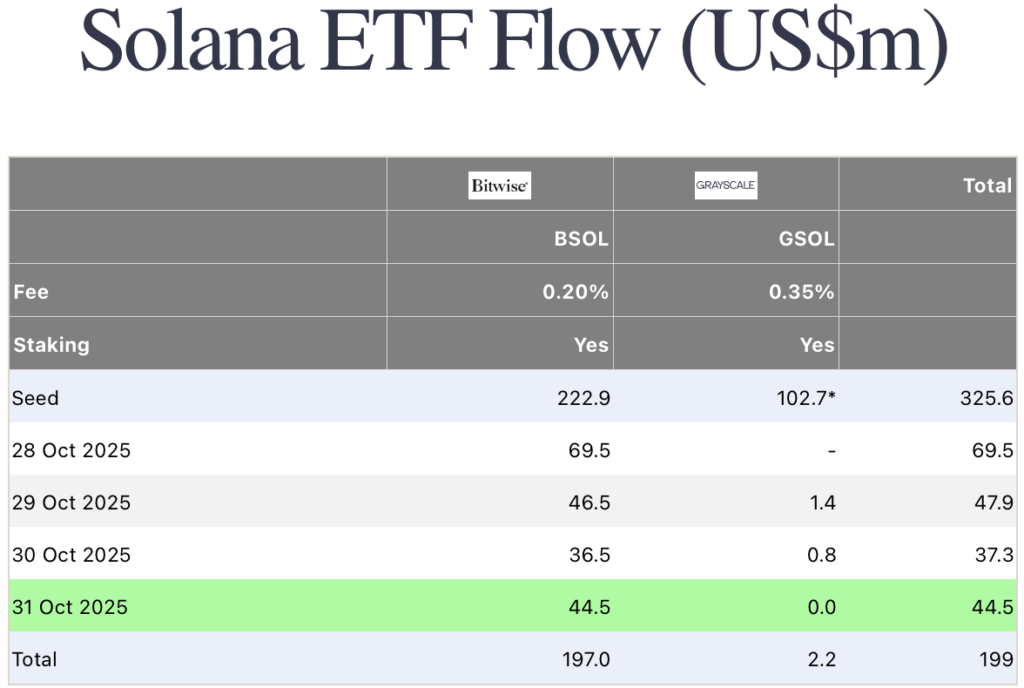

Information from Farside Buyers exhibits Solana ETFs attracted $44.48 million on Friday, pushing complete inflows to $199 million. The Bitwise Solana ETF (BSOL) led the cost, gaining practically 5% in a single day.

In the meantime, merchants continued taking income in Bitcoin ETFs, which noticed $191.6 million in outflows on Friday—marking their third straight day of losses after shedding practically $490 million on Thursday and $470 million the day earlier than. Ethereum ETFs additionally misplaced momentum, recording $98.2 million in outflows, bringing cumulative inflows all the way down to $14.37 billion.

Capital Rotates Towards Solana

Market analysts describe the inflows as a part of an ongoing “capital rotation” from main crypto property into newer narratives. Vincent Liu, Chief Funding Officer at Kronos Analysis, mentioned the shift underscores traders’ rising urge for food for yield alternatives and rising ecosystems.

“Solana ETFs are surging on recent catalysts and capital rotation, as Bitcoin and Ether see profit-taking after sturdy runs,” Liu famous. “The momentum may persist into subsequent week because the majors consolidate, barring any main macro shocks.”

New Merchandise Enhance Institutional Curiosity

The surge in curiosity follows the debut of the Bitwise Solana Staking ETF (BSOL) earlier this week. The fund launched with $222.8 million in property, giving traders entry to Solana’s staking yield—estimated round 7%—in a regulated format.

A number of different ETF issuers are increasing their choices as properly. Canary lately rolled out new funds targeted on Litecoin and Hedera, whereas Grayscale prepares to transform its Solana Belief into an ETF. In Asia, Hong Kong additionally authorized its first spot Solana ETF final week, signaling rising institutional urge for food for different crypto publicity.