Be a part of Our Telegram channel to remain updated on breaking information protection

Solana affords traders “two methods to win,” giving it “explosive” progress potential because it expands within the stablecoin and tokenization markets, mentioned Bitwise CIO Matt Hougan.

Hougan mentioned in a put up on X that Solana can win from the anticipated progress of the stablecoin and tokenization sectors, in addition to from capturing a bigger market share of these sectors.

He mentioned Solana’s edge lies in its quick, user-friendly know-how and increasing ecosystem, citing Western Union’s choice this week to launch its stablecoin, USDPT, on Solana as proof of rising momentum within the community’s stablecoin infrastructure.

”I believe individuals dramatically underestimate how a lot and the way shortly these applied sciences will remake markets,” he mentioned. ”It’s simple for me to think about this market rising by 10x or extra.”

Ethereum Leads The Market, However Solana Is Gaining Floor

Ethereum at present leads the stablecoin and tokenization infrastructure market by a snug margin when taking a look at every blockchain’s respective Complete Worth Locked (TVL) and stablecoin market share metrics.

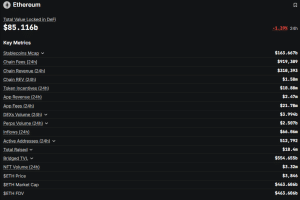

Ethereum on-chain metrics (Supply: DefiLlama)

Knowledge from DefiLlama reveals Ethereum’s TVL at present stands at round $85.116 billion, whereas the chain additionally hosts $163.667 billion value of the stablecoin provide at present in circulation.

In the meantime, Solana’s TVL stands at $11.386 billion and it hosts $16.945 billion of the stablecoin markets.

Hougan sees Solana as a high challenger and likes its odds “of successful a bigger share” of the stablecoin and tokenization infrastructure market.

“It affords quick, user-friendly know-how, backed by an incredible group with a ship-fast perspective,” he mentioned. “It’s a more recent asset and is enjoying catch-up towards its friends in successful institutional mandates, nevertheless it’s gaining floor.”

First Spot SOL ETFs Commerce In The US This Week

Hougan’s prediction comes after Bitwise launched the primary US spot SOL ETF (exchange-traded fund) this week.

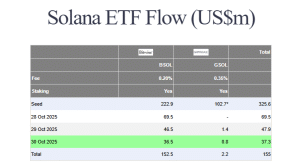

On its first day of buying and selling, the Bitwise Solana Staking ETF (BSOL) recorded $69.5 million inflows and $56 million in buying and selling exercise. In line with Bloomberg ETF analyst Eric Balchunas, this was the best quantity of debut buying and selling exercise of any of the 850 ETFs launched this 12 months.

$BSOL‘s $56m is the MOST of any launch this 12 months.. Greater than $XRPR, $SSK, Ives and $BMNU. And what’s superb is it seeded with $220m. It may have invested seed on Day One, which might have resulted in $280m-ish, could be much more than $ETHA‘s debut. Robust begin both approach.

— Eric Balchunas (@EricBalchunas) October 28, 2025

Previous to its launch, traders had put $220 million into the ETF as nicely. In line with Balchunas, had the fund invested this seed capital on the primary day it will have posted volumes of round $280 million. This could have been increased buying and selling volumes than BlackRock’s US spot Ethereum ETF (ETHA).

Inflows for the funding product continued within the days that adopted. After its first day of buying and selling, BSOL noticed $46.5 million inflows on Oct. 29 and $36.5 million on Oct. 30, based on information from Farside Buyers.

US spot SOL ETF flows (Supply: Farside Buyers)

BSOL was additionally in a position to outperform the Grayscale Solana Belief (GSOL) product, which debuted a day after BSOL.

The US spot SOL ETF market may quickly develop into extra aggressive as extra funds enter the house.

In line with Grayscale govt Zach Pandl, spot SOL merchandise may see the identical success that related funding merchandise for Bitcoin and Ethereum loved. The manager believes that spot Solana ETFs may swallow up a minimum of 5% of SOL’s complete provide inside the subsequent 12 months or two.

That will equate to greater than $5 billion value of SOL tokens at present costs.

The current launch of the US spot SOL ETFs has not had the specified influence on the value of Solana, which has retraced amid a broader crypto market correction in current days. Knowledge from CoinMarketCap reveals SOL slid greater than 2% prior to now 24 hours to commerce at $186.56 as of seven:22 a.m. EST.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection