Be a part of Our Telegram channel to remain updated on breaking information protection

Technique shares soared virtually 6% in after-hours buying and selling after the Bitcoin treasury agency’s third-quarter outcomes topped analyst forecasts and Michael Saylor mentioned it’s unlikely to purchase smaller rivals.

The corporate reported diluted earnings per share of $8.42 for the three months ended Sept. 30, above Wall Road’s estimate of $8.15.

Income reached $2.8 billion, rebounding from a $340.2 million loss a yr earlier however nicely beneath its file $10 billion revenue within the earlier quarter.

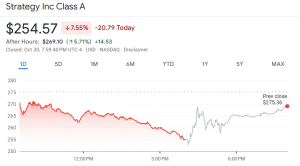

Regardless of the stronger outcomes, Technique’s inventory stays beneath strain, down greater than 20% up to now month and over 30% in six months as Bitcoin’s decline weighs on its $47.4 billion crypto holdings.

Technique (MSTR) closed the most recent buying and selling day down greater than 7%, in line with Google Finance.

Technique share value (Supply: Google Finance)

Saylor Says It’s Unlikely Technique Will Purchase Smaller Rivals

Companies together with Japan-based Metaplanet and main Ethereum treasury agency BitMine Immersion Applied sciences have suffered double-digit inventory value drops lately, and smaller digital asset treasury (DAT) corporations have struggled.

That’s prompted analysts to foretell that bigger DAT corporations might start shopping for up smaller rivals

However Saylor mentioned Technique has no quick plans for mergers or acquisitions, citing “a whole lot of uncertainty” amongst digital asset treasuries.

“We don’t have any plans to pursue M&A exercise, even when it will look to be doubtlessly accretive,” he mentioned. “An thought that appears good if you begin may not nonetheless be a good suggestion six months later.”

Saylor didn’t shut the door on acquisitions fully, saying “I don’t assume we’d ever say ‘we’d by no means, by no means, by no means, ever’.”

Value Declines Put Strain On Technique’s Bitcoin Treasury Efficiency

Technique is the most important company Bitcoin holder globally, with 640,808 BTC on its stability sheet. It began buying Bitcoin again in 2020, and has continued shopping for the main crypto at the same time as a few of its rivals decelerate or halt accumulation methods.

High 10 largest company BTC holders (Supply: Bitcoin Treasuries)

It purchased one other 390 BTC for round $43.4 million earlier this week at a mean buy value of $111,053.

Bitcon’s 4% slide up to now month and Technique’s inventory value decline have additionally put strain on Technique’s BTC treasury efficiency, with the corporate’s mNAV falling from its November peak of three.89x to 1.16x now, in accordance to SaylorTracker.

Regardless of the decreased mNAV, Technique reported that its Bitcoin yields have hit 26% to date this yr at a $13 billion acquire. The corporate additionally reaffirmed its full-year outlook of hitting a 30% BTC yield with a web earnings of $24 billion. That is primarily based on its estimation that the Bitcoin value will attain $150,000 by the top of the yr.

With Bitcoin buying and selling at $109,898.61 as of 1:50 a.m. EST, BTC’s value must climb round 36% to attain Technique’s year-end goal.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection