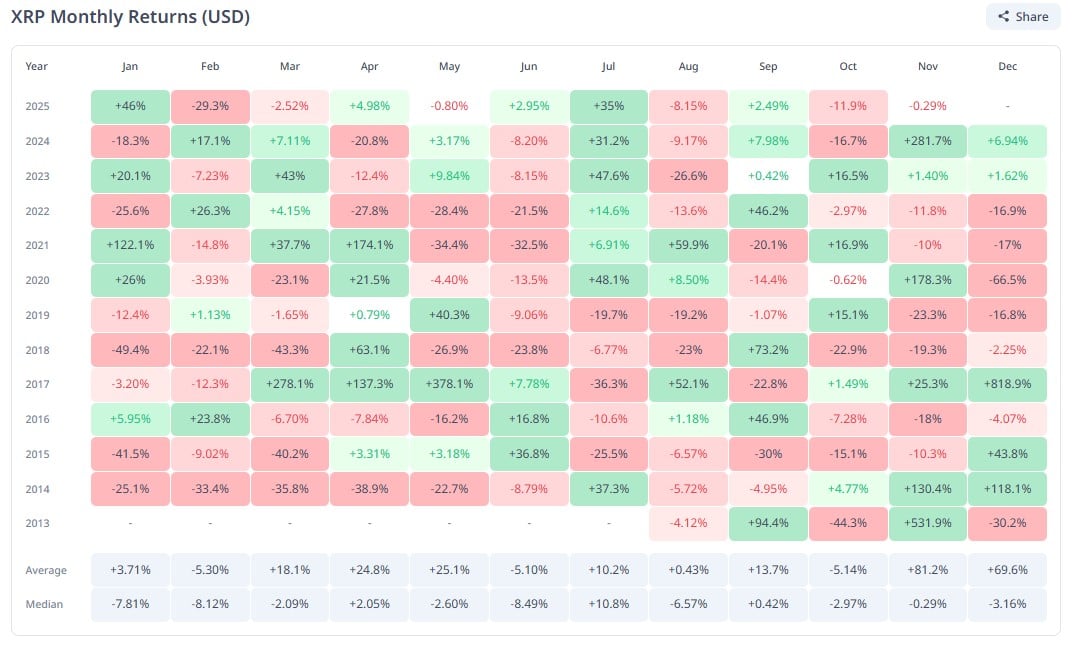

The final volatility within the cryptocurrency sector noticed XRP worth closing October within the crimson, down by 11%. The event didn’t come as a shock to market watchers, because it was not a traditionally bullish month for the coin. Nevertheless, November stands out because the month with the very best common month-to-month progress for the XRP worth.

Can XRP worth exceed $4.50 in November?

As per Cryptorank knowledge, XRP boasts a mean of 81.3% progress within the final 12 years. In 2024, XRP worth recorded 281.7% progress, the second-highest in a single month for the coin. The 2013 document of 531.9% stays unbeaten up to now.

If XRP replicates the performances of final yr and finishes inside its month-to-month common for November, the coin might change palms for $4.53.

Technically, XRP worth could be set for a bullish rally because the asset broke one of many most necessary resistances of the yr. Notably, its worth breached the 200-day exponential transferring common (EMA) after it pushed from its help zone of $2.45.

The leap alerts the opportunity of a large rally in November after it had consolidated for a number of weeks. Traditionally, the crossover of the 200-day EMA often precedes a worth surge for XRP. This growth means that the market circumstances seem bullish for the coin to proceed on an upward trajectory.

As of this writing, XRP worth was altering palms at $2.50, which represents a 0.38% improve within the final 24 hours. The coin earlier hit a peak of $2.55 earlier than dropping a couple of cents to market volatility.

XRP merchants are, nonetheless, nonetheless cautious, with buying and selling quantity down by 30.9% at $3.71 billion. The asset is prone to climb towards the crucial $3 degree if shopping for strain will increase for the coin.

Market sentiment strengthens amid ETF hypothesis

From all indications, curiosity in XRP might improve towards mid-November. Price mentioning is the truth that the neighborhood anticipates {that a} spot XRP exchange-traded fund (ETF) might go reside by Nov. 13.

This elevated optimism got here after Canary Funds filed an up to date S-1 Type with the Securities and Change Fee (SEC) for an XRP ETF. The submitting eliminated a delaying modification, which might see computerized approval after 20 days, besides that the SEC returns with further feedback.

In the meantime, a bullish transfer was noticed within the XRP market on Oct. 29 as a whale withdrew 4,000,000 XRP valued at over $10.5 million. The person proceeded to lock the asset in escrow, prompting debates concerning the intention and implications for the market.