Briefly

- AI computing firm CoreWeave was set to purchase Bitcoin miner Core Scientific in a $9 billion all-stock deal.

- However Core Scientific shareholders rejected the proposed transaction on Thursday.

- Shares of CoreWeave dipped on the information; Core Scientific’s inventory rose.

Bitcoin miner Core Scientific shareholders have rejected a proposed $9 billion merger with AI computing firm CoreWeave, Core Scientific introduced on Friday, ending the possibly large transaction within the high-power computing house.

Core Scientific shareholders voted in opposition to the all-stock deal at a Thursday assembly.

“Core Scientific, a pacesetter in digital infrastructure for high-density colocation providers and digital asset mining, at present introduced that at a particular assembly of Core Scientific stockholders held earlier at present, the Firm didn’t obtain the requisite variety of votes to approve the beforehand introduced merger settlement with CoreWeave,” an announcement learn.

Shares of Nasdaq-listed CoreWeave, which focuses on AI cloud-computing, was buying and selling practically 4% decrease Thursday, in line with Yahoo Finance. Core Scientific inventory rose 0.3% greater.

Decrypt reached out to Core Scientific for remark. In a press release shared with Decrypt, CoreWeave co-founder and CEO Michael Intrator mentioned the agency revered the views of Core Scientific stockholders and “look[s] ahead to persevering with our business partnership.”

The deal, first introduced in July, would have given CoreWeave 1.3 gigawatts of gross energy throughout Core Scientific’s nationwide knowledge middle footprint, with the potential to develop progressively with one other 1 GW.

On the time, CoreWeave’s Intrator mentioned the deal would assist “improve our efficiency and experience as we proceed serving to clients unleash AI’s full potential.”

And Core Scientific President and CEO Adam Sullivan mentioned the deal would assist the miner “speed up the provision of world-class infrastructure for firms innovating with AI whereas delivering the best worth for our shareholders.”

However Core Scientific traders had qualms, believing the deal undervalued the Bitcoin miner.

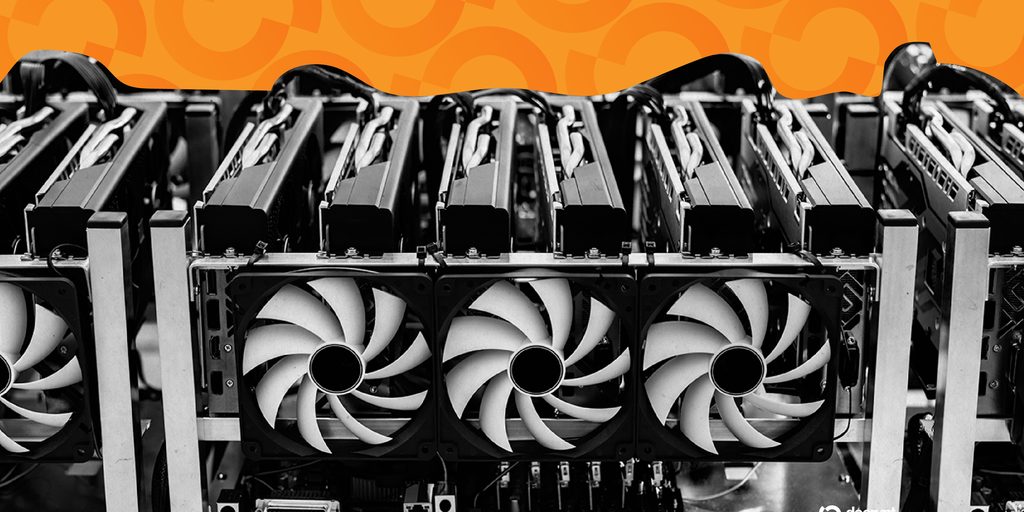

Mining Bitcoin has grown more and more tough and costly. The method has additionally generated smaller rewards since final yr’s halving lower the Bitcoin earned from 6.250 to three.125. These tendencies have damage profitability, whilst Bitcoin’s worth has risen, prompting miners to search for new income sources.

Miners have usually needed to promote cash or department into totally different industries—like high-performance computing for synthetic intelligence—to cowl operational prices.

However branching out into AI knowledge facilities is tough, requiring extra advanced heating, air flow, and air con programs than these for Bitcoin mining, specialists have advised Decrypt.

Day by day Debrief E-newsletter

Begin on daily basis with the highest information tales proper now, plus authentic options, a podcast, movies and extra.