The “Uptober” state of affairs didn’t play out for Bitcoin. US President Donald Trump’s commerce struggle with China, in addition to issues relating to a possible liquidity disaster within the monetary markets, created important promoting strain on crypto costs.

Nonetheless, consultants consider “Moonvember” might make up for what “Uptober” missed.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page.

November has traditionally been Bitcoin’s finest month, with a median return of 42.5%. Final November, Donald Trump’s re-election triggered an enormous bull run, which noticed the most important cryptocurrency surge by over 60% to $108k.

Bitcoin value predictions from prime analysts point out one other bullish November this 12 months, which might see BTC reclaim $120k and even hit a brand new all-time excessive.

Moreover, BTC-themed altcoins like Bitcoin Hyper are additionally in excessive demand amongst whales which might be trying to find multi-bagger performs.

Bitcoin Value Prediction: Right here’s Why BTC Will Hit $120,000 In November

In response to Coinglass information, the Deribit name choice with a $120,000 strike value expiring on November 28 exhibits one of many highest ranges of open curiosity and buying and selling quantity.

For the uninitiated, a name choice offers merchants the correct to purchase Bitcoin at a particular strike value by a set expiry date, permitting them to revenue if the worth rises. This means that merchants are closely positioning for a possible Bitcoin rally towards that stage within the coming weeks.

Three core elements are driving smart-money conviction that Bitcoin might publish sturdy positive aspects this month.

US Fed’s Dovish Pivot

The US Federal Reserve has turned dovish and is predicted to play a key position in Bitcoin’s rally this month.

The central financial institution minimize its goal fee by one other 25 bps, whereas additionally pausing its quantitative tightening. Collectively, these measures are anticipated to decrease the borrowing prices for establishments and buyers, which is all the time bullish for threat belongings like crypto.

The Fed additionally continues to inject liquidity into the monetary markets, over $50 billion in simply this week.

As soon as the US authorities shutdown is over, spending from the Treasury Common Account (TGA) can also be anticipated to offer recent capital to the monetary markets.

The broader macroeconomic outlook, which continues to play a key position within the crypto market, is lastly turning bullish, and Bitcoin is predicted to learn from it significantly.

Whales Proceed To Purchase The Bitcoin Dip

Whales proceed to be bullish on Bitcoin.

In response to Coinglass information, name choices proceed to dominate Bitcoin’s derivatives market, signalling a transparent bullish bias amongst merchants. Calls account for over 60% of whole open curiosity (240,013 BTC vs. 154,329 BTC in places), displaying that almost all of positions are betting on increased costs.

Equally, prime Binance merchants stay firmly bullish on Bitcoin, with the long-to-short ratio at 2.03 by accounts and 1.85 by positions, indicating a transparent choice for upside publicity.

Now, the OG Bitcoin whale is again to purchasing. Technique co-founder Michael Saylor has hinted that the highest Bitcoin treasury firm will proceed to build up in November.

BTC’s Technical Evaluation Suggests The Backside Is Close to

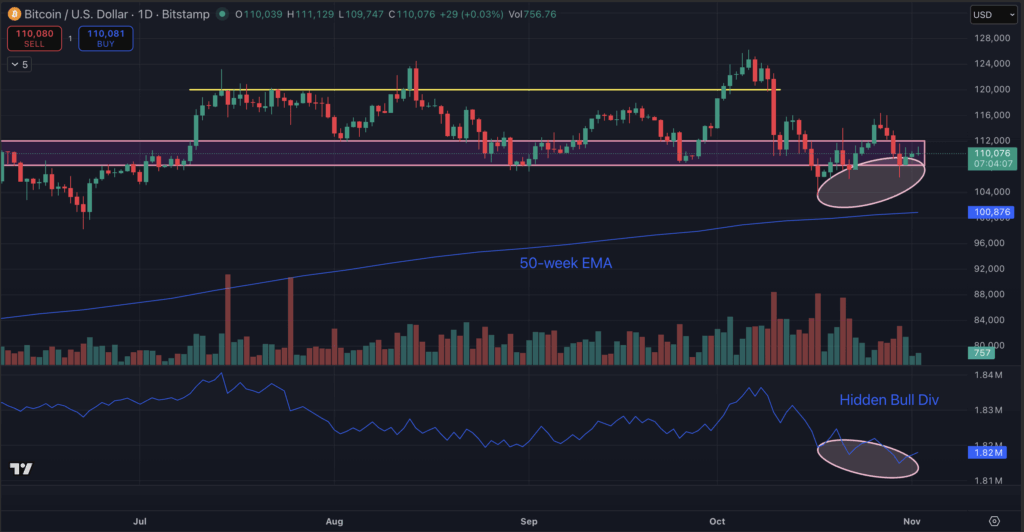

The Bitcoin value chart means that the most important cryptocurrency is on the cusp of a bullish reversal.

BTC has fashioned a hidden bullish divergence with its on-balance quantity (OBV), which signifies rising shopping for strain.

Notably, buyers must be open to the potential for a correction to its 50-week Easy Shifting Common, which is at present at $100k. A profitable retest right here could be a wonderful shopping for alternative for sidelined buyers.

Quite the opposite, a weekly shut above $112,000 might invalidate all bearish eventualities and pave the best way for a rally to new highs.

Bitcoin Hyper Tipped As The Subsequent 10x Crypto

Bitcoin’s rally is very bullish for BTC-themed altcoins, particularly since they present a powerful correlation.

As an example, BTC’s layer-2 coin Stacks (STX) was one of many prime performers of final November’s bull run. In a span of a month, its market cap surged from $2.2 billion to $4.1 billion.

A 12 months earlier than that, STX’s valuation surged from $900 million in the beginning of November to over $2.3 billion in January.

This 12 months, a brand new BTC layer-2 coin is within the highlight. Bitcoin Hyper (HYPER) has caught the eye of the whales. Behind a string of six-figure buys, it has already raised almost $26 million in presale funding.

Powered by the Solana Digital Machine and zero-knowledge structure, Bitcoin Hyper is designed to make Bitcoin scalable, environment friendly and programmable. In reality, consultants consider it might emerge because the hub for brand new DeFi apps, cost protocols and even meme cash that wish to enter the BTC ecosystem.

Contemplating that the highest layer-2 cash have a tendency to succeed in multibillion-dollar valuations, it’s no shock that many early HYPER consumers are eyeing as much as 100x returns.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t chargeable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss brought on or alleged to be brought on by or in reference to use of or reliance on any content material, items or providers talked about.