High Tales This Week

Bybit halts new person onboarding in Japan, citing ‘rising’ laws

Bybit, the world’s second-largest crypto change by buying and selling quantity, has introduced it’ll pause new person registrations in Japan beginning Oct. 31, because it adapts to new laws from the nation’s Monetary Providers Company.

The corporate stated the transfer is a part of its “proactive strategy” to align with Japan’s rising regulatory framework for digital belongings, based on a Wednesday announcement.

“It has at all times been Bybit’s dedication to function responsibly and in compliance with native legal guidelines and regulatory expectations,” the change stated.

Present Japanese clients is not going to be affected for now, with all present providers remaining operational. Bybit stated it’ll share additional updates as discussions with regulators progress.

Nigerian fintech plans African stablecoin cost system with Polygon: Report

Flutterwave, Nigeria’s largest fintech firm, is creating a cross-border cost platform powered by stablecoins, highlighting the rising function of blockchain expertise in streamlining funds throughout Africa.

The corporate is partnering with Polygon Labs to launch the service throughout its 34-country community, Bloomberg reported Thursday. Polygon’s blockchain infrastructure, constructed to offer scalable, quicker and cheaper transactions on Ethereum, will probably be used to reinforce settlement velocity and effectivity.

Flutterwave CEO Olugbenga Agboola stated the transfer might remodel the movement of funds throughout the continent, enabling companies and shoppers to bypass the excessive prices and delays that usually plague conventional cost programs.

“Stablecoin adoption will drive extra flows into Africa,” Agboola stated, including that the initiative “has the potential to 10x the volumes we’re presently doing.”

MEXC apologizes to ‘White Whale’ dealer over $3M freeze

About three months after pseudonymous crypto dealer the White Whale reported that the MEXC change had frozen about $3 million value of their holdings, a consultant publicly apologized and launched the funds.

In a Friday X submit, MEXC Chief Technique Officer Cecilia Hsueh stated the change “f***ed up” in dealing with a state of affairs with the crypto person. In July, MEXC froze $3.1 million of the person’s funds, allegedly as a result of change’s “threat management guidelines.”

“We apologize to [the White Whale], and his cash is already launched,” stated Hsueh. “He can declare it at any time. I tousled in speaking with him. I acquired emotional, and I shouldn’t have.”

Bitcoin’s 4-year cycle isn’t useless, anticipate a 70% drop subsequent downturn: VC

The value of Bitcoin will proceed to expertise cyclical booms and busts, leading to a drawdown of as much as 70% throughout the subsequent market downturn, based on Vineet Budki, CEO of enterprise agency Sigma Capital.

There will probably be a BTC retracement of 65% to 70% within the subsequent two years as a result of merchants don’t perceive the asset they’re holding, Budki advised Cointelegraph on the fifteenth International Blockchain Congress in Dubai, UAE. He stated:

“Bitcoin is not going to lose its utility if it comes all the way down to $70,000. The issue is that folks don’t know its utility, and when folks purchase belongings that they don’t know and perceive, they promote them first; that’s the place the promoting strain comes from.”

Poor UX is inflicting stablecoin ‘ticker fatigue’: ZachXBT

The variety of totally different stablecoin tickers and token requirements is fragmenting liquidity throughout the crypto ecosystem and burdening customers with a poor expertise that’s pricey, technical, and time-consuming, based on onchain sleuth ZachXBT.

Cross-chain bridging restrictions, gasoline and transaction charges that should be paid within the native token of the blockchain getting used, and an absence of common token help throughout exchanges are all obstacles customers face in transferring stablecoins throughout the crypto ecosystem, ZachXBT stated. He gave the next instance:

“Think about you obtain USDPT to your Solana handle however understand your pockets doesn’t have USDPT on the default token record. You additionally want gasoline, so that you bridge ETH from Ethereum and wait a number of minutes, and need to swap USDPT for USD on a centralized change.”

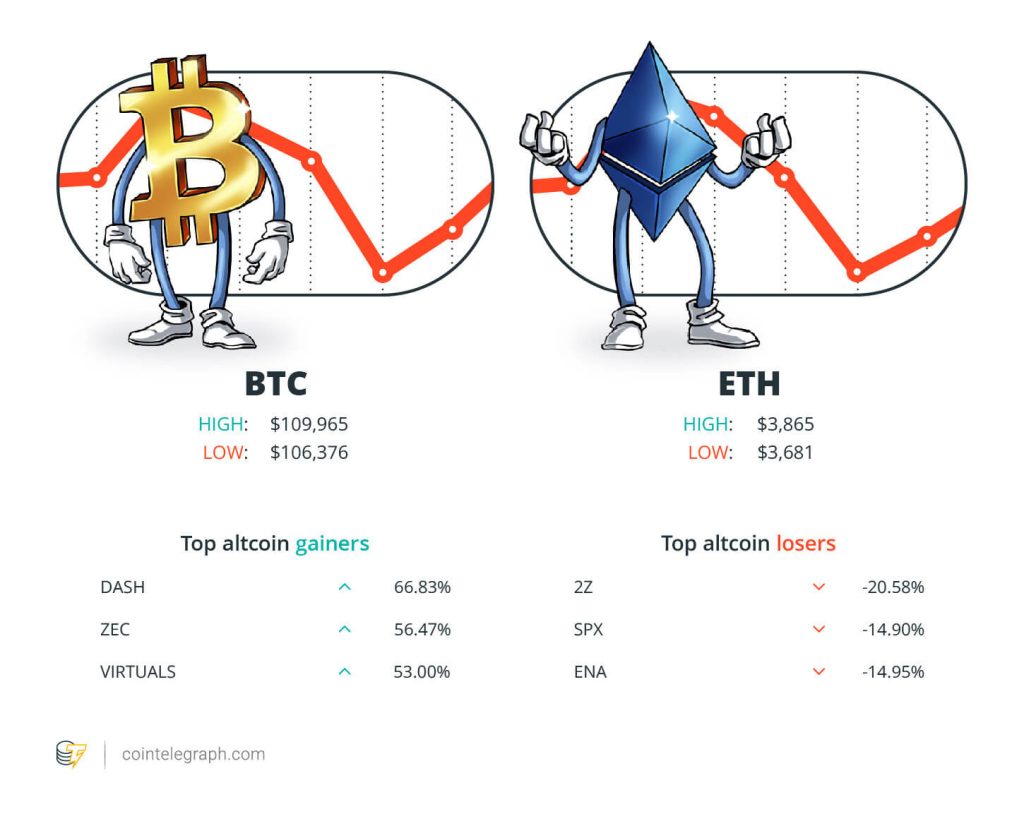

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $109,965, Ether (ETH) at $3,865 and XRP at $2.50. The full market cap is at $3.71 trillion, based on CoinMarketCap.

Learn additionally

Options

Aligned Incentives: Accelerating Passive Crypto Adoption

Options

Is the Metaverse actually turning out like ‘Snow Crash’?

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Sprint (DASH) at 66.83%, Zcash (ZEC) at 56.47% and Virtuals Protocol (VIRTUALS) at 53.00%.

The highest three altcoin losers of the week are DoubleZero (2Z) at 20.58%, SPX6900 (SPX) at 14.90% and Ethena (ENA) at 14.95%. For more information on crypto costs, be sure to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“For the final 20 years. We’ve been progressively shedding our digital freedoms.”

Pavel Durov, Telegram founder

“Usually, we don’t have any plans to pursue M&A [merger and acquisition] exercise, even when it might look to be doubtlessly accretive.”

Michael Saylor, Technique chairman

“I used to be a bit distracted as a result of I used to be monitoring the predictions market about what Coinbase will say of their subsequent earnings name, and I simply need to add right here, the phrases Bitcoin, Ethereum, blockchain, staking, and Web3, be sure we get these in earlier than the tip of the decision.”

Brian Armstrong, Coinbase CEO

“General, we stay reasonably risk-on and see a reputable path for Bitcoin to interrupt its all-time excessive earlier than year-end.”

Matt Mena, 21Shares market analyst

“Most stablecoin demand comes from outdoors the US, increasing greenback dominance globally, not competing along with your native financial institution.”

Faryar Shirzad, Coinbase chief coverage officer

“Altcoin ETF inflows are the inevitable subsequent step after Bitcoin and Ethereum ETFs proved institutional demand.”

Leon Waidmann, head of analysis at Web3 analytics agency On chain

High Prediction of The Week

Quantum risk to Bitcoin nonetheless years away, says Borderless Capital companion

Though nonetheless in its “infancy,” quantum computing might pose a risk to Bitcoin and different proof-of-work algorithms within the close to future, based on Amit Mehra, a companion at enterprise capital agency Borderless Capital.

When requested what developments Borderless Capital was following, Mehra, chatting with Cointelegraph on the fifteenth International Blockchain Congress in Dubai, stated the corporate was “diving deep into quantum compute” and how firms are creating quantum resistance expertise.

Mehra stated quantum computing will take till the tip of the last decade to develop. Nonetheless, he stated, folks are likely to underestimate the fast evolution of expertise:

“Given the latest developments which have occurred in chip expertise, in compute tech, and within the energy of doing compute in a decentralized approach, it [quantum computing] is unquestionably an issue. If not imminent […] within the very close to future.”

High FUD of The Week

New Hampshire Senate stalls crypto mining deregulation invoice after break up vote

A vote from the New Hampshire Senate Commerce Committee on a invoice aimed toward deregulating crypto mining within the US state was break up on Thursday, after senators reported public suggestions on the invoice had surged because it was final debated.

After being deadlocked twice, as soon as on advancing the invoice and once more on rejecting it, the committee finally voted 4–2 to ship the measure for additional overview in interim examine, as first reported by the New Hampshire Bulletin.

Learn additionally

Options

Crypto followers are obsessive about longevity and biohacking: Right here’s why

Options

China’s Digital Yuan Is an Financial Cyberweapon, and the US Is Disarming

Home Invoice 639 would forestall municipalities from creating restrictions on crypto mining, corresponding to guidelines round electrical energy use or noise, in addition to prohibit state and native authorities from levying taxes distinctive to digital belongings.

Australian police crack coded pockets, seize $5.9M in crypto

Australian police cracked a coded cryptocurrency pockets backup containing 9 million Australian {dollars} ($5.9 million).

Australian Federal Police (AFP) Commissioner Krissy Barrett described the hassle as “miraculous work” throughout a Wednesday speech, crediting an information scientist who has turn into identified inside the company as a “crypto protected cracker.”

Throughout an investigation right into a purported “well-connected alleged legal” who stockpiled cryptocurrency by promoting “a tech-type product to alleged criminals,” the AFP got here throughout password-protected notes on his cell phone. Upon additional examination, regulation enforcement additionally recognized a picture containing random numbers and phrases, Barrett stated.

Barrett stated the numbers had been divided into six teams with over 50 mixtures, and the AFP digital forensics group “decided it could possibly be associated to a crypto pockets.” The suspect allegedly refused handy over the keys to his crypto pockets, an act that carries a 10-year penalty in Australia.

Banks’ concern over stablecoins ‘ignores actuality’: Coinbase

Issues that crypto stablecoins will hurt US banks by cannibalizing banking deposits are ill-placed and don’t think about the real-world makes use of of the tokens, based on Coinbase researchers.

“The ‘stablecoins will destroy financial institution lending’ narrative ignores actuality,” Coinbase coverage chief Faryar Shirzad stated on Wednesday. “Most stablecoin demand comes from outdoors the US, increasing greenback dominance globally, not competing along with your native financial institution.”

Shirzad shared a market notice that stated the arguments over stablecoins impression on financial institution deposits and lending “echo acquainted worries from earlier improvements like cash market funds. But they fail to account for the way and the place stablecoins are literally used.”

High Journal Tales of The Week

Grokipedia: ‘Far proper speaking factors’ or much-needed antidote to Wikipedia?

Elon Musk’s experiment to reshape on-line fact, Grokipedia, is touted as a extra impartial and complete rival to Wikipedia, however is it?

China formally hates stablecoins, DBS trades Bitcoin choices: Asia Categorical

DBS pronounces Bitcoin and Ethereum choices commerce with Goldman Sachs, China’s central financial institution boss offers thumbs all the way down to stablecoins.

Solana vs Ethereum ETFs, Fb’s affect on Bitwise: Hunter Horsley

Working as a product supervisor at Fb taught Hunter Horsley what to not do with Bitwise.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.