The worldwide cryptocurrency market confirmed gentle positive factors right now, with the entire market capitalization rising 0.48% to $3.72 trillion.

Buying and selling exercise, nonetheless, slowed down notably, because the 24-hour buying and selling quantity dropped by over 30% to $93.68 billion. Regardless of the small uptick in costs, investor sentiment stays cautious – the Concern & Greed Index at present stands at 35, reflecting a state of “concern” amongst market contributors.

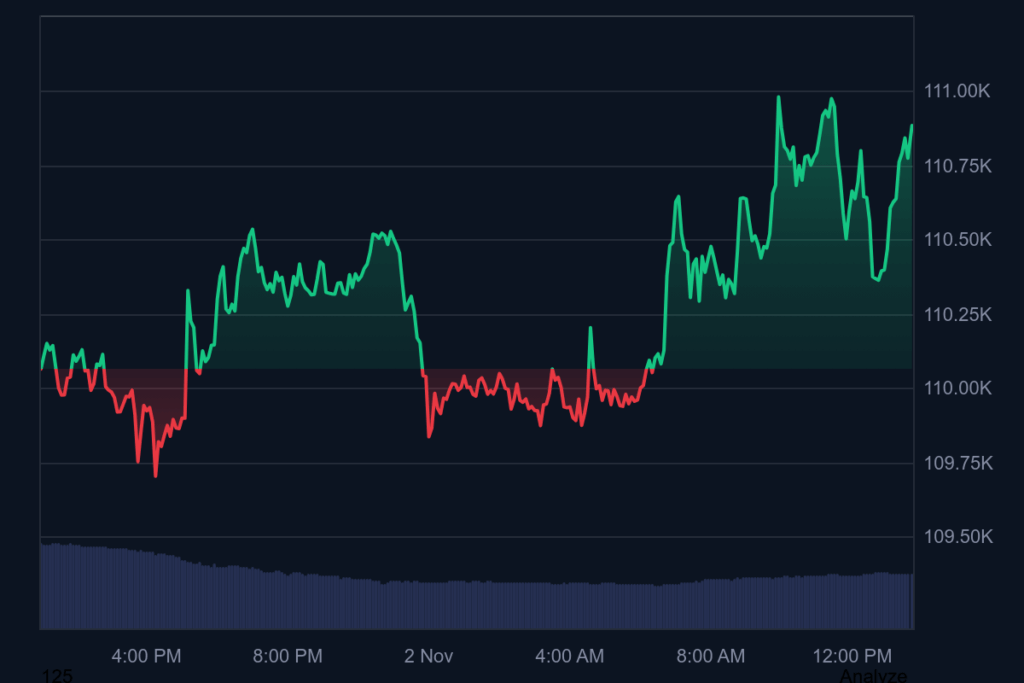

Bitcoin Leads with Modest Progress

Bitcoin (BTC) continues to dominate the market, buying and selling at $110,897, marking a 0.8% enhance previously 24 hours. The main digital asset maintains a market capitalization above $2.21 trillion, representing almost 60% of whole market dominance. Nonetheless, Bitcoin’s weekly efficiency is down 1.83%, signaling consolidation after current volatility.

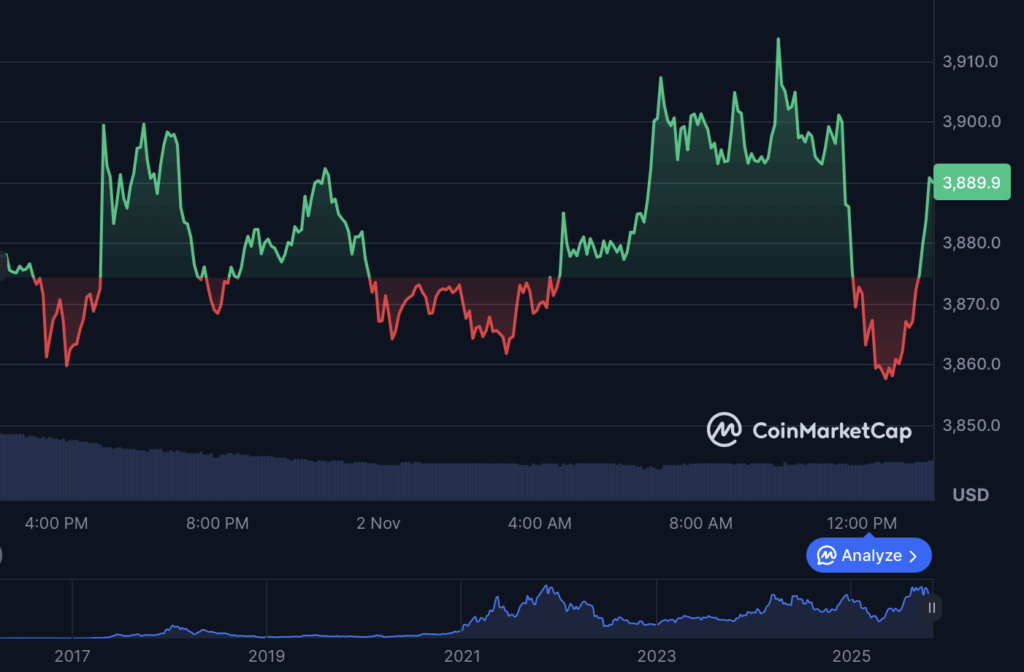

Ethereum Reveals Cautious Momentum

Ethereum (ETH) adopted an identical sample, gaining 0.53% in 24 hours to commerce at $3,892. The token’s weekly lack of 3.13% suggests merchants are hesitating to take aggressive positions forward of potential macroeconomic developments. Its market cap stays robust at almost $470 billion, protecting it firmly in second place behind Bitcoin.

Stablecoins Maintain Their Floor

Main stablecoins like Tether (USDT) and USD Coin (USDC) continued to carry out as anticipated, sustaining near-perfect pegs at $0.9998 and $1.00, respectively. These property stay very important for liquidity, contributing closely to general buying and selling quantity – with Tether alone posting $80 billion in 24-hour quantity.

Altcoins Below Gentle Stress

Altcoins displayed combined outcomes. XRP rose barely by 0.83%, buying and selling at $2.52, whereas BNB and Solana confirmed minor declines of 0.14% and 0.03% respectively. Dogecoin noticed the sharpest seven-day drop among the many high 10, falling 7.01%, although it stays a favourite amongst retail merchants. The Altcoin Season Index of 32/100 signifies that Bitcoin remains to be outperforming most different property.

Market Sentiment and Outlook

The broader crypto sentiment leans conservative as merchants weigh unsure financial indicators and regulatory developments. The Common Crypto RSI of 48.96 suggests a impartial market – neither overbought nor oversold. Analysts anticipate costs to stay range-bound until important catalysts emerge, akin to institutional inflows or new macroeconomic information.