- DOGE trades round $0.1875 with robust help at $0.18 and regular accumulation.

- Whales offered 440M DOGE in 72 hours, however bigger wallets quietly added extra.

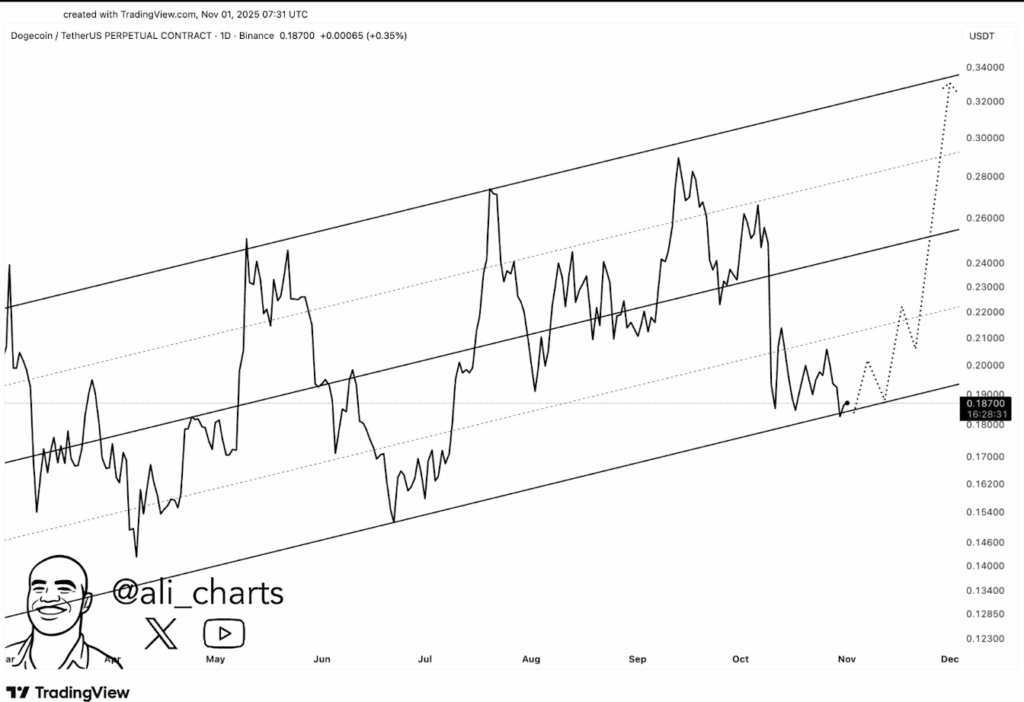

- Analysts see $0.26–$0.33 as potential targets if Dogecoin breaks above $0.20 resistance.

Dogecoin (DOGE) has been quietly holding its floor currently. The meme coin trades round $0.1875 with a every day buying and selling quantity hovering close to $1.66 billion. Its market cap sits at about $28.4 billion, giving it roughly 0.75% dominance within the crypto market. During the last 24 hours, it’s up a modest 0.53%, however that small acquire carries extra weight than it appears.

That little uptick reveals regular shopping for stress constructing close to the $0.18 zone—an space merchants are watching carefully. Analysts say if DOGE manages to carry this stage, it may mark the tip of its consolidation section and probably kick off the subsequent leg larger. A clear break above $0.18 would possibly open the trail towards $0.20, a psychological mark that usually flips market sentiment from impartial to bullish.

$0.18 — The Accumulation Zone to Watch

Crypto analyst Ali not too long ago posted that $0.18 stays the important thing “purchase the dip” stage for Dogecoin. Based on his chart, holding that zone may spark a rally towards $0.26 and even $0.33 if market situations flip supportive. It’s not nearly hype both—this stage matches historic accumulation areas the place previous rallies started.

Proper now, DOGE’s value motion seems calm, virtually suspiciously so, particularly when a lot of the market remains to be shaking off volatility. If it continues to carry regular right here, merchants is perhaps staring down one other accumulation section earlier than an even bigger breakout. The sentiment appears cautious however quietly optimistic, which is commonly how DOGE likes to set the stage earlier than stunning everybody.

Whales Offload — However It’s Not All Bearish

On the flip facet, on-chain information paints a combined image. Whale wallets—these holding between 10 million and 100 million DOGE—offered about 440 million tokens in simply three days, in line with Santiment. That’s one of many largest mid-tier whale sell-offs seen currently. These accounts held roughly 15.51% of the whole DOGE provide on October 29, however that dropped to fifteen.15% by the tip of the month.

That promoting stress helped gasoline DOGE’s 5.76% weekly dip and added to its 27% slide over the past month. Together with that, whale buying and selling exercise above $100,000 spiked to 119 transactions on October 30 earlier than plunging to only 15 by week’s finish—a transparent signal that many large gamers went from energetic distribution to taking a breather.

But it surely’s not all promoting. Bigger whales, these holding greater than 100 million DOGE, quietly elevated their share from 19.28% to 19.46% throughout the identical interval. Mid-level holders (100,000 to 10 million DOGE) remained regular, exhibiting neither panic nor euphoria.

Calm Earlier than the Subsequent Run?

Dogecoin’s present setup seems like a tug-of-war between fading sellers and gradual, quiet accumulation. The $0.18 help zone has turn into the battleground, and the way value reacts right here may outline the subsequent few weeks. If consumers proceed defending it—and bigger wallets hold scooping up dips—DOGE might be gearing up for a recent push again towards $0.20 and past.

Whereas volatility’s cooled for now, historical past reveals Dogecoin doesn’t keep quiet for lengthy. As soon as momentum flips, it tends to maneuver quick—and the subsequent wave would possibly already be forming simply beneath the floor.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.