The primary weekend of November lands with out fireworks however with lots to digest. Bitcoin trades at $110,513, regaining quick from October’s pink shut. Ethereum struggles to make it above $4,000. XRP begins the month at $2.51, retaining most of its late-summer surge alive.

Conventional equities are slowing down after heavy company earnings within the U.S., giving digital belongings their very own window to maneuver independently. The significance of macro can also be fading for every week — no Fed conferences, no new inflation knowledge till mid-month — which leaves the market to commerce on positioning, not headlines.

TL;DR:

- XRP enters its strongest historic month with an 81% common November achieve.

- Coinbase closes October with $1.8 billion income and over a dozen product rollouts.

- DonAlt flags Bitcoin’s first bearish sign because the $88,000 breakout.

XRP faces its favourite month: 81% common November achieve again in play

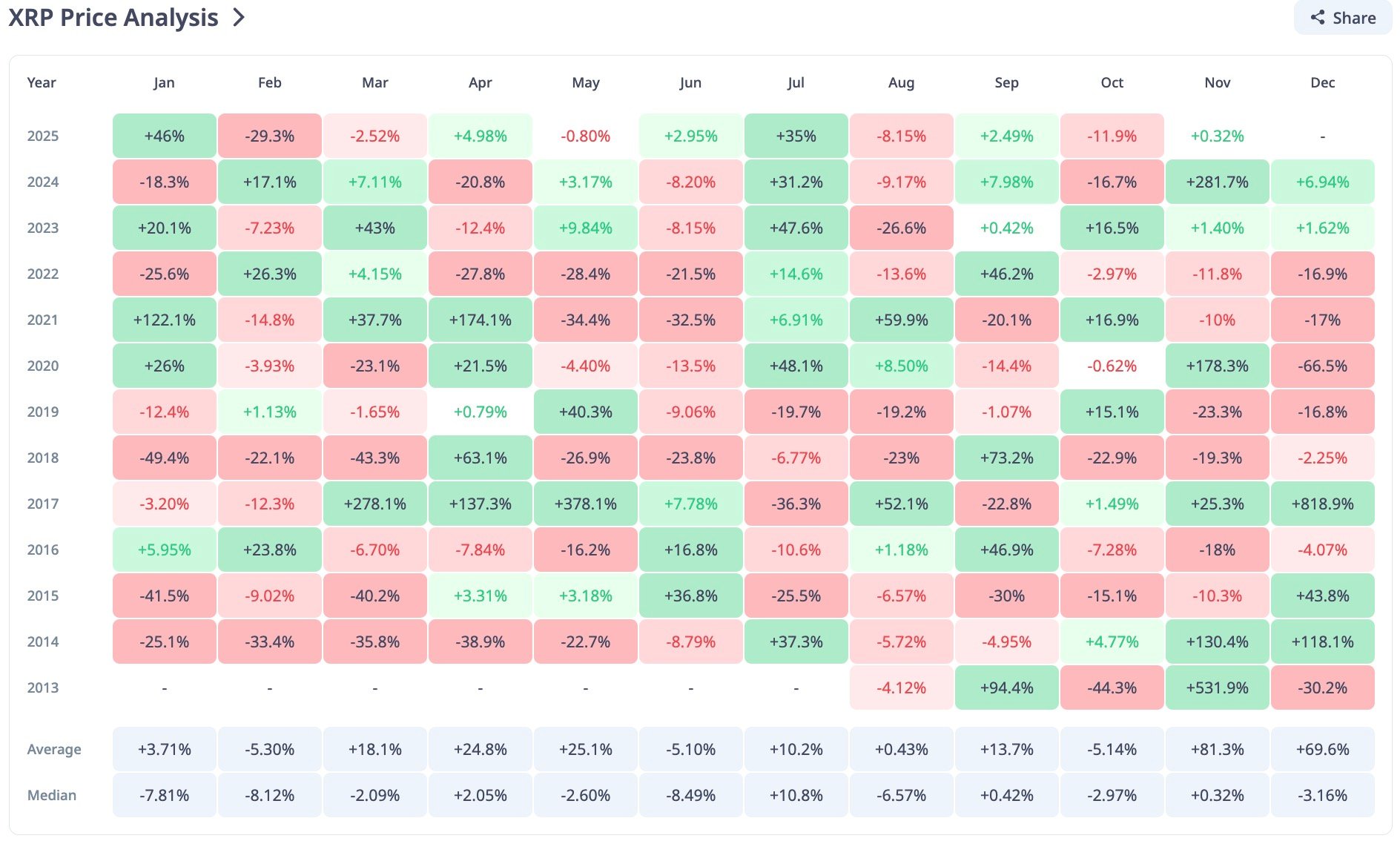

XRP’s calendar benefit just isn’t superstition — it’s within the numbers. CryptoRank’s month-to-month knowledge present November delivering a median 81% transfer for XRP throughout the previous 10 years, outpacing practically each different month. The median sits impartial due to flat years, however the outliers are large: 281% in 2024, 818% in 2017 and 130% in 2014.

At right this moment’s $2.51, XRP remains to be up greater than 200% year-to-date, fueled by the early 2025 breakout that began from $0.80. Help stays at $1.80-1.60, a large however clear cushion constructed in the course of the summer time rally. The higher zone, $3.10-3.20, stays the identical ceiling that stopped the 2021 cycle and the place most long-term holders are ready to unload partial positions.

Dealer DonAlt, who caught the 700% XRP leg earlier within the cycle, mentioned he closed his place for about 300% revenue, including that technicals are nonetheless good, however he’s transferring on for now.

Nonetheless, XRP’s conduct suits its regular rhythm. 5 of the final eight Novembers have ended inexperienced for XRP. If the identical rhythm holds, the setup window is correct now.

Coinbase CEO Brian Armstrong guarantees “large month” to shut 2025

Brian Armstrong summed it up merely on X: “Huge month for us at Coinbase. Way more to return — excited to shut out 2025 with a bang.” For as soon as, the phrasing matched actuality. Coinbase simply wrapped certainly one of its busiest quarters since itemizing on Nasdaq, posting $1.8 billion in internet income and saying an aggressive set of product releases, partnerships and infrastructure strikes.

The October breakdown appeared much less like a recap and extra like an working report. Coinbase:

- Partnered with Citi to construct new world fee rails.

- Rolled out DeFi USDC lending for U.S. customers in eligible areas.

- Expanded DEX buying and selling to just about all customers besides New York.

- Utilized for a U.S. nationwide belief constitution through the OCC.

- Invested in CoinDCX, increasing to India and the Center East.

- Partnered with Samsung, including crypto capabilities to 75 million U.S. Galaxy gadgets.

COIN inventory ended October at $343.78, including practically 2% for the month and lengthening its multi-quarter rebound from 2023 lows. Key helps lie close to $240, whereas resistance seems simply above $350.

The inventory mirrors the final surroundings in crypto — not euphoric, however regular, and now pushed extra by actual exercise than by retail sentiment.

Bitcoin flashes first bearish sign since $88,000

For Bitcoin, November begins on a unique notice. DonAlt, the identical dealer behind this 12 months’s lengthy pattern name, posted that he’s seeing the primary bearish sign since $88,000, calling it time to “cool off a bit” until BTC reclaims his “pink field” close to $113,000.

The latest month-to-month candle helps his case — the chart exhibits a fade in momentum, smaller ranges and declining quantity after half a 12 months of just about straight upside.

BTC now trades at $110,513, up lower than 1% for the week. Help zones stay at $84,600 and deeper at $56,000, marking the 2 foremost liquidity cabinets from 2024.

Lengthy-term holders usually are not transferring cash, alternate balances are nonetheless low, however the short-term crowd is fading out. Traditionally, weak Novembers have preceded robust December runs as soon as leverage resets — 2016, 2020 and 2023 all match that very same sample. For now, the message is easy: respect the vary, don’t chase candles.

November outlook

The market’s composition going into the primary week of November appears balanced however nervous — XRP with historic upside, Bitcoin dropping warmth and Coinbase extending presence.

Quick-term watchpoints:

- XRP: breakout affirmation above $2.70, key assist at $1.80.

- BTC: maintain above $100,000 to protect pattern, however under $84,000 opens correction.

- ETH: mid-range at $3,200-3,400, breakout goal $3,600.

- COIN: energy above $350 might appeal to institutional flows again into crypto equities.

Macro catalysts stay mild this week — solely U.S. employment knowledge and early ETF circulate readings are scheduled. That often offers room for technicals to drive course.

Traditionally, the primary half of November units the tone for the whole quarter, and this 12 months that sample seems like that. No mania but, no worry both — only a market determining sentiment earlier than the subsequent resolution level.