- $120 million drained from Balancer in a multi-chain exploit, with $99.5M stolen on Ethereum alone.

- Attackers looted belongings together with stETH, rETH, and Balancer V2 tokens, transferring funds right into a pockets labeled Balancer Exploiter 2.

- Balancer confirmed the breach and urged customers to keep away from phishing hyperlinks and withdraw funds till additional discover.

The DeFi world simply took one other heavy hit. Balancer, one in every of Ethereum’s oldest and most trusted DeFi protocols, was drained in an enormous exploit that noticed attackers stroll away with almost $120 million value of digital belongings.

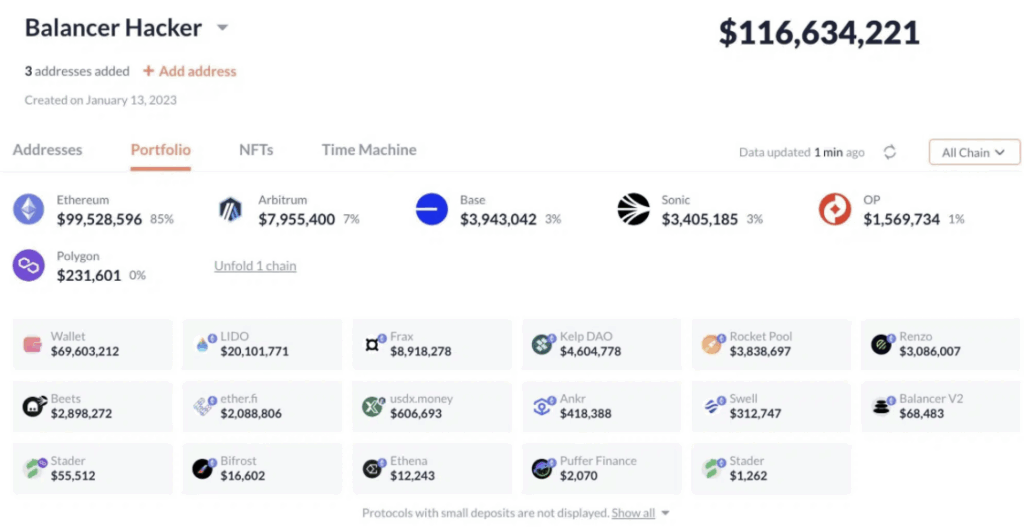

Blockchain safety platforms like Lookonchain and PeckShieldAlert had been among the many first to flag the breach. Lookonchain reported that roughly $116.6 million was stolen from Balancer’s vaults, whereas PeckShield’s estimates put the whole nearer to $128.6 million. Both method, it’s one of many largest crypto heists of 2025 to this point.

What the Attackers Took

Based on Lookonchain’s evaluation, a lot of the stolen funds — about $99.5 million, or roughly 85% of the whole — got here immediately from Ethereum’s mainnet. The remaining was unfold throughout different networks: Arbitrum ($7.9M), Base ($3.9M), Sonic ($3.4M), OP Mainnet ($1.5M), and Polygon ($231K).

The attackers didn’t simply steal one kind of asset. They looted a mixture of liquid tokens and staked derivatives, together with Lido’s stETH, Rocket Pool’s rETH, Frax, and Balancer V2 pool tokens.

Etherscan knowledge traced a number of giant transfers — amongst them 6,851 osETH, 6,587 WETH, and 4,259 wstETH — all funneled right into a pockets now labeled as “Balancer Exploiter 2.” As of the most recent replace, these funds stay untouched within the attacker’s addresses.

Balancer Confirms the Breach

In an official publish on X, the Balancer workforce confirmed that the exploit particularly focused its V2 swimming pools. Their engineers and safety companions are reportedly investigating the breach as a high precedence.

“We’re conscious of an exploit affecting Balancer V2 swimming pools,” the workforce stated, urging customers to remain alert and keep away from interacting with suspicious hyperlinks or feedback — a warning that comes as scammers attempt to capitalize on the confusion. Verified updates will observe as soon as the workforce completes its forensic assessment.

A Whale Wakes Up — $6M Pulled from Balancer

Because the chaos unfolded, one dormant whale pockets all of a sudden sprang to life after over three years of inactivity. The deal with withdrew $6.5 million value of belongings from Balancer in two separate transactions — $1.29M in WETH and $5.19M in GNO — seemingly a preemptive transfer to safe funds earlier than additional fallout.

Analysts warned that the scenario should still be creating, advising customers to withdraw their belongings from Balancer till the protocol confirms that the breach has been absolutely contained.

Not Balancer’s First Hack

Sadly, this isn’t new territory for Balancer. Again in 2020, the protocol misplaced $500,000 in an analogous assault. Extra just lately, in August 2023, a flash mortgage exploit drained over $2 million.

Nonetheless, this newest incident dwarfs all earlier ones. With almost $120 million gone, it marks one in every of Balancer’s worst safety breaches since its launch in March 2020 — and a sobering reminder that even established DeFi platforms stay weak.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.